Open a free account

Use professional tools and the wisdom of the crowd

No management fees

At all. Even when you copy other traders and invest in portfolios

0% commission on stocks

No markup, ticketing fees or stamp duty, only bid/ask market spread

Invest in stocks commission-free. Buy in bulk or just a fraction, from as little as $10.

No Commission

- No management fees

- No rollover fees

- No ticket fees

- No additional broker fees

Ready to invest in the global stock market?

Join millions of TBanque users and Invest in the brands you love, wherever they are.

Zero-commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX charges on non-USD deposits and withdrawals. Your capital is at risk.

For clients of TBanque AUS Capital Limited AFSL 491139, only stocks traded on US stock exchanges are available to trade with no commission. Other stocks are offered as derivatives and bear commission. Offered through ARSN 637 489 466 and promoted by TBanque AUS Capital Limited CAR 001281634. For additional information, please see “other fees” and CFDs sections

When buying cryptoassets on TBanque, you gain ownership of those assets.

TBanque charges a single, simple and transparent fee of 1% for buying or selling crypto.

How it works

A fee of 1% is calculated for buying or selling cryptoassets on TBanque. This fee is included in the price we show when you open or close a position.

The 1% fee is added to the market price (Bid-Ask spread).

Where the prices come from

Crypto prices on TBanque are based on the Bid-Ask spread that comes from TBanqueX, a Distributed Ledger Technology (DLT) licensed trading platform affiliated with TBanque EU and TBanque AU.

TBanqueX maintains cryptoasset order books which are populated by liquidity providers and other crypto traders, and form the basis for the Bid-Ask spread. Learn more.

Click here to see an example

Understanding the fee

As soon as you open a new position, you will see a “loss” in the position. This is because the displayed Profit & Loss (“P/L”) includes the 1% buy fee you’ve just paid and the 1% sell fee you will pay when closing the position.

At TBanque, you can track the performance of your crypto investments and know that the buy and sell fees are already accounted for within the P/L information.

Important: When you close the position, the selling fee is adjusted to reflect the market price of the cryptoasset at that time.

Cryptoassets can be transferred from the TBanque platform to the TBanque Money crypto wallet*. Click here for more information about crypto transfer fees and limits.

Are you ready to invest in crypto?

Trust TBanque – offering cryptoassets since 2012.

Cryptoassets are highly volatile and unregulated in most EU countries, Australia and the UK. No consumer protection. Tax on profits may apply. Your capital is at risk.

Short selling orders on cryptocurrencies and leveraged trades are executed as CFDs that do not entail ownership of the assets and incur overnight fees, as detailed here.

Trades performed by Australian clients before September 12, 2021 were executed as CFDs and incur overnight fees.

*All trades performed by clients in France are executed as CFDs, with no ownership of the underlying assets.

CFDs are a popular way for trading different assets that allows greater flexibility – for example, leveraged trading and short selling.

CFD trading does not involve the acquisition of real assets, and incurs spreads and overnight fees.

Spreads

The spread is the difference between the Buy and Sell prices of a certain asset. Spreads are a common way in which trading platforms charge fees.

*Fees generated from the spread will be charged at the closing of a position. There may be instances when market conditions cause spreads to widen beyond the spreads displayed.

*Spreads indicate the lowest possible scenario. Spreads are variable and may fluctuate.

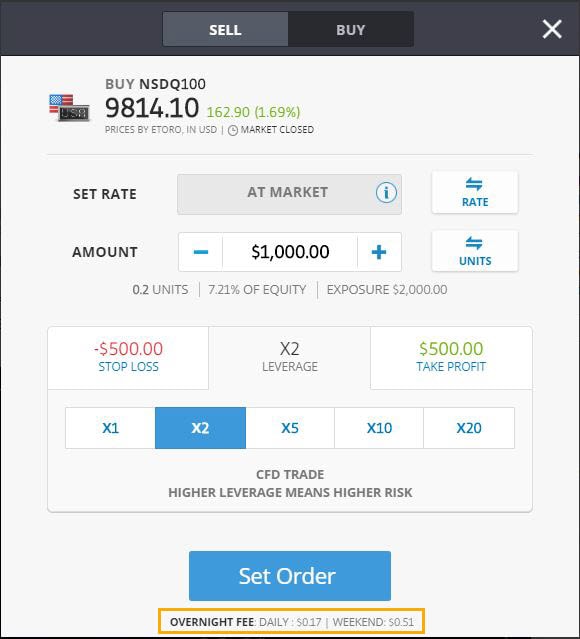

Overnight Fees*

CFD positions that stay open overnight incur a small fee, relative to the value of the position. These fees reflect the forces of supply and demand driving the financial markets, including to cover costs associated with your position.

Fees are in USD, per night, per unit

*Fees are subject to change at any given time and could change on a daily basis, without prior notice, depending on market conditions. We encourage you to visit this page periodically to stay updated on current fees.

To learn more about market opening hours and when overnight fees come into effect, please refer to the Market Hours and Events page.

Examples

Looking to trade CFDs?

TBanque’s vast offering, cutting edge and easy-to-use platform is the place for you.

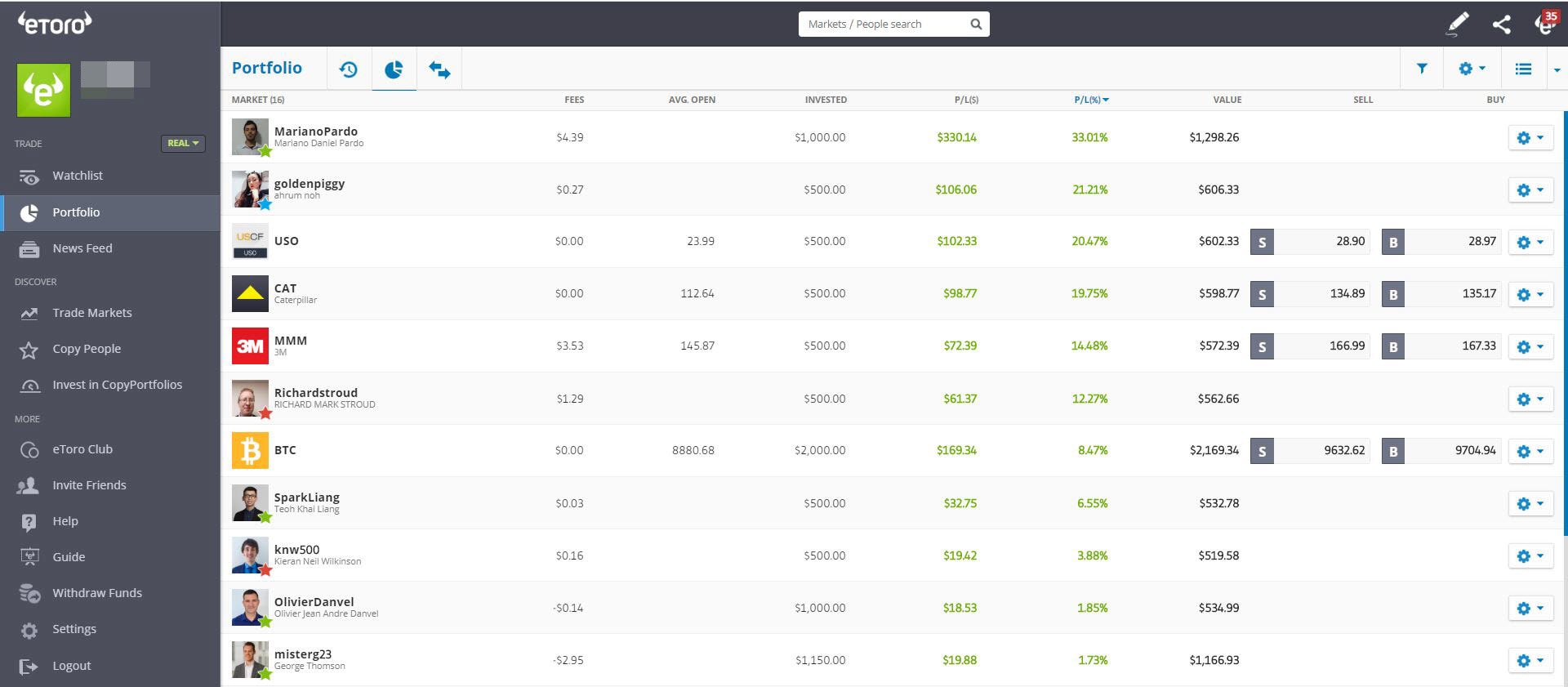

CopyTrader™

When using CopyTrader™, there are no extra fees or hidden costs.

Spreads and overnight fee may be applied according to each opened copied position as listed on this page.

Smart Portfolios

Investing in leading, thematic ready-made portfolios. There are no management fees or any kind of commission, other than those applied with assets comprising each portfolio. Stock portfolios are commission free.

General Fees

Ready to start trading?

Trade a wide range of assets and benefit from low fees and competitive spreads

FAQ

You can join TBanque for free and any registered user receives a $100,000 demo account for free.

However, like all online platforms, TBanque charges various spreads and fees for some trades and withdrawals. To learn more, please refer to Crypto, CFDs, and Other Fees.

Bid and ask rates are equivalent to BUY/SELL prices on TBanque. When a position is long (BUY), the ASK rate is applied. When a position is short (SELL), the bid rate is applied.

CFD positions that stay open overnight incur a small fee, relative to the value of the position. It is essentially an interest payment to cover the cost of the leverage that you use overnight. Weekend fees are overnight fees that are charged for keeping positions open over the weekend. Therefore, a weekend fee is triple the overnight fee. Weekend fees are charged either on Wednesday or Friday, depending on the asset.

Leverage is a temporary loan given to the trader by the broker, enabling the trader to open a trade of a larger size with a smaller amount of invested capital. Leverage is presented in the form of a multiplier that shows how much more than the invested amount a position is worth.

For example: If you trade with no leverage at all and invest $1,000, for every 1% move in the market, you can gain or lose $10, which equals 1% of $1,000. However, if you were to invest the same $1,000 and trade using x10 leverage, the dollar value of your position would be equal to $10,000.

For further details and examples click here.

The LIBOR is the most commonly used benchmark rate that is given by banks when charging other banks for short-term loans. LIBOR stands for London Interbank Offered Rate. There are a total of 35 different LIBOR rates posted each day, ranging from overnight to 12 months, and based on five different currencies. TBanque uses the 1-month USD LIBOR rate for calculating overnight fees for stocks.

Rollover (weekend/overnight) fees change from time to time based on global market conditions. When this happens, we will implement the changes. Please be aware that fee changes always apply to open positions. We encourage you to keep up to date with the current rollover fees/refunds by checking our fees page. Please note that fees may change without advance notice.

Spread:

Spread * Price in USD * Number of units

Overnight fees (per night):

Fee * amount of units

In your portfolio page, on the history tab, you can see the fees that were paid for each trade as well as aggregated fees for different periods.

Overnight fees appear at the bottom of the trade window when opening a new trade.

Overnight fees are charged every night between Monday and Friday at 17:00 EST for open CFD positions. The weekend fee (x3) is charged on Fridays for most stocks, ETFs and indices CFDs and on Wednesday for most commodities and currencies. Overnight fees for oil and natural gas are charged on Fridays.

Overnight fees for cryptocurrencies are charged daily.

For more information on overnight fees, please see What are overnight fees?

As soon as you open a new trade, you will see a “loss” in the position — this is due to the spread. However, the final calculation of the spread is made when you close the position and it is adjusted at that moment, according to the closing price.

Find more FAQ’s here.

For SELL trades made in euros (EUR), overnight fees will be calculated according to 2.9% + ESTR.

For BUY trades made in euros (EUR), overnight fees will be calculated according to 6.4% + ESTR.

For SELL trades made in Swiss Francs (CHF), overnight fees will be calculated according to a 2.9% + CHF Overnight Deposit.

For BUY trades made in Swiss Francs (CHF), overnight fees will be calculated according to a 6.4% + CHF Overnight Deposit.

The market spread arises from the difference for which a product can be bought and sold (bid and ask). This difference does not arise from TBanque and is not incurred as a cost when you buy or sell a real stock on TBanque.

The market spread arises from the difference for which a product can be bought and sold (bid and ask). This difference does not arise from TBanque and is not incurred as a cost when you buy or sell a real stock on TBanque.