UPDATE 26/07/2015: Up until today, stats were calculated based on closed trades only, which we found did not represent the full picture of investors’ performance. Starting today, all stats will include open trades data.

This means that, for example, profitable trades percentage and even number of trades, will include any trades you have open at the moment.

This is another step towards our goal of making the stats accurate and truly representative of our investors’ trading activities, to enable you to make smart and informed copy decisions.

* * *

The user stats page on TBanque is probably the most important page you need to look at in order to make a copy decision.

With that in mind, we are excited to announce that the new revamped stats page is finally here!

The new page is filled with only the most important and relevant pieces of information, so it is now easier to get an overall picture of each investor’s performance and trading style.

Note that this is not just a design change – we’ve changed formulas, added new elements and enhanced existing components – all in order to help you make more informed copy decisions.

The new stats page is built out of 5 cards:

- Performance

- Risk

- Copiers

- Trading

- Additional info

Let’s elaborate more about each card:

1. Performance

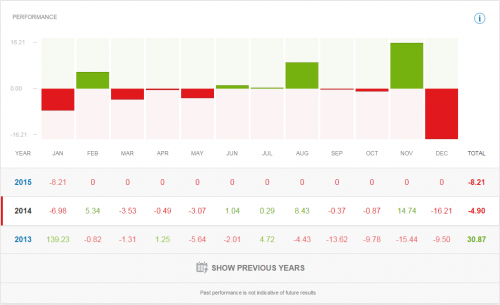

We went with a completely different approach here, viewing each user and potential copy as an investment fund. As such we’ve aligned with industry standard and are now showing monthly and yearly returns. You can see the monthly returns both in a clear table as well as in the accompanying bar chart.

Along with this new approach, we’ve also changed the way we calculate monthly performance. We no longer use the modified Dietz formula, which has raised many questions among you, due to its complexity. Instead we decided to go with this simple formula:

Where:

E1 – is the equity at the end of the month

W – is the total amount of funds removed from the account within the month*

E0 – is the equity at the beginning of the month

D – is the total amount of funds added to the account within the month*

*funds added and removed from the account may include but are not limited to: deposits, withdrawals, adjustments due to technical issues or interest payments.

To explain: this formula simply represents the net change in equity during a given month.

For example: Let’s imagine that in January you had a starting equity amount of $1200, you lost $300 through trading, and deposited an additional $800. Later that month you gained $1100 through trading, so that on the last week of January you had $2800 in your equity. You decided to withdraw $500 to buy something nice to yourself, and therefore your account equity at the end of January was $2300. So what was your return for January?

E1 – $2300 is the equity at the end of the month

W – $500 is the total amount of funds removed from the account within the month

E0– $1200 is the equity at the beginning of the month

D – $800 is the total amount of funds added to the account within the month

The return for January was therefore: 40%.

The yearly performance is calculated traditionally by multiplying the monthly returns throughout the year.

If the returns over 12 months are r1,r2,r3….r12 then the yearly return is:

(1+r1)(1+r2)…(1+r12) -1

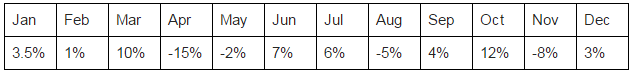

So if these are the monthly returns:

The yearly return is:

(1+0.035)(1+0.01)(1+0.1)(1-0.15)(1-0.02)(1+0.07)(1+0.06)(1-0.05)(1+0.04)(1+0.12)(1-0.08)(1+0.03)-1=13.92%

2. Risk

As the old saying goes, there’s no reward without risk, especially in the financial markets.

The returns shown in the performance card, were not achieved without risk, and it’s important to know and understand the risks that the investor is likely to take going forward.

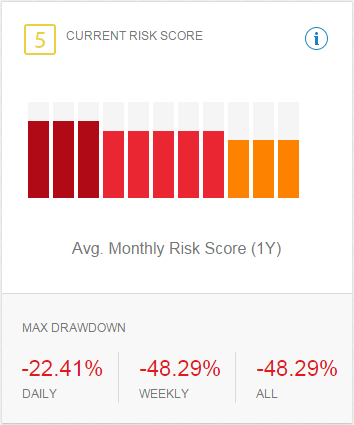

We’re introducing the Risk Score – based on industry standard risk assessment calculations (VAR), the risk score shows the risk the investor is taking on a scale of 1 to 10, where 1 means very low risk and 10 means extremely risky (as in – likely to blow out the account without taking restrictive measures).

The risk card shows the following elements:

Current risk score – is actually the last 7 day average of the user’s risk score. We’re using an average here because risky traders can close all of their positions to try and lower their risk, however it is the average that tells the real story.

Monthly Average Risk Score – this bar chart shows the monthly risk score average over the last 12 months. Compared with the performance table above, it shows you the real risk and reward picture. It also shows you the history of the investor from which you can learn about his/her risk taking tendencies.

Max Drawdown – the max drawdown is the greatest loss the account equity suffered during the selected period (daily, weekly, all time).

3. Copiers

TBanque is a social investment network, and its strength is in the wisdom of the crowd. It’s important to learn what the community thinks about an investor, not only in terms of discussions, but in terms of actual investments.

The copiers card shows exactly that – the amount of copiers currently copying this investor, as well as the copier chart showing copier amounts for the last 12 months and copier trend in the last 7 days, where you can see the change in absolute number of copiers and in percentages.

A new element we’re introducing in this card is the Copy AUM, a figure that represents how much money is currently allocated to copying the investor. This is actually the sum of all of the funds copiers have invested in this trader, shown in ranges of: under $50K, $50K-$100K, $100K-$300K and over $300K.

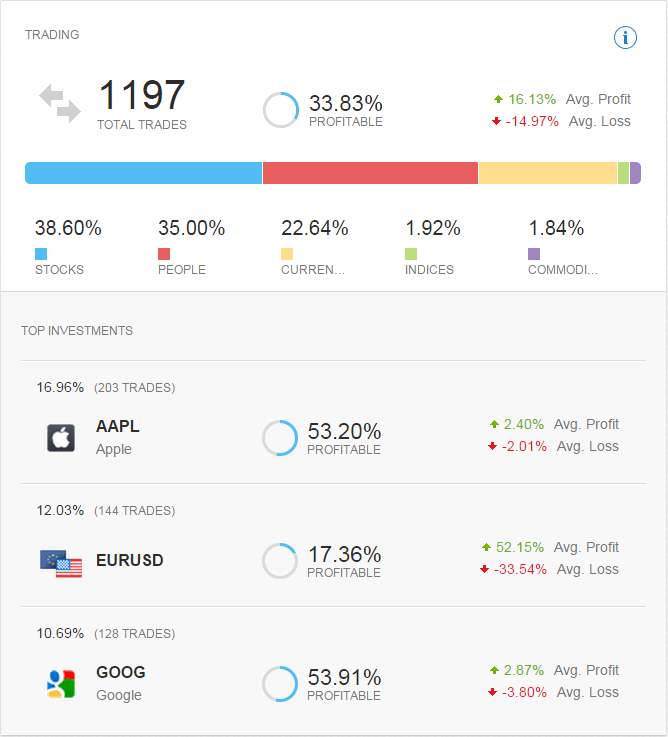

4. Trading

We’ve covered performance, risk and copiers, but it’s also important to learn how this investor achieved the above results. The trading card shows important information about the user’s trading history and investment style.

The upper part of the card shows total trades and profitability (along with average profit and loss) as well as the portfolio distribution shown as a colored bar.

The lower part of this card shows the investor’s top 3 investment instruments in terms of number of positions. In other words – what does this investor like to trade? For each of the 3 most frequently traded instruments (markets or people) you can see the number of positions, profitability and average profit and loss.

It’s important to mention, that in generating these stats we no longer see copied trades as your own. This means that the copy action is in itself counted as a trade, with profit or loss, and the copied trades made by the copied user do not count towards your statistics.

5. Additional info

These are other important stats that you should take into consideration when copying a user:

Active Since – This is the date the investor started trading with TBanque. It’s important to understand whether you’re looking at a novice trader, who started trading 2 weeks ago, or an experienced investor that’s been trading on our network for over a year.

Trades per Week – How many trades this trader opens every week on average. This is an indication on his/her activity level. A trader with 50 trades per week on average is very active, whereas a trader with less than 3 is more of the long term investor-type.

Average Holding Time – This statistic shows you what kind of trader you’re looking at. Is this a day trader, holding trades open for a few minutes only, or a long term investor holding his/her positions open for months?

Profitable Weeks – Shows what percentage of weeks, since this user started trading with TBanque, have been profitable. A high Profitable Weeks rate shows consistency over time.

We’d like to thank all the TBanque community members that have given us the feedback which has guided this long and thoughtful redesign process. The entire conceptual framework behind this new page was born out of adopting your point of view and considering what information you need in order to have the best possible Copy Trading experience.

Now all that’s left to do is head to the eToro and check out the new page for yourselves!

What do you think of the new stats page? We’d love to hear it!