The term “selling a stock” sounds pretty straight forward. And it is. However, in the investment world it can have two different meanings. On the TBanque platform, we use two distinct terms in order to prevent confusion.

Closing a trade

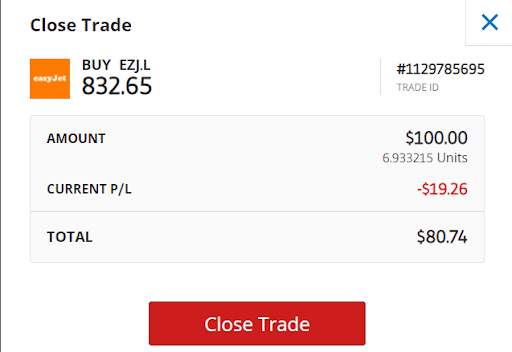

On the TBanque platform, closing a trade or closing a position means that I am terminating an investment that I had previously made. For example, you had one share of EasyJet stock which is now trading at $832. If you choose to close your position this means that you are ending your investment in EasyJet stock and you will receive the $832 back to your account. When you close the position, you no longer own a share of EasyJet stock.

In the image below, you can see what the screen looks like when you are about to close a trade with EasyJet stock.

Closing a trade is not only related to investments in stocks. It is connected with all types of investments of financial assets on the TBanque platform. Closing a trade is synonymous with the popular phraseology of selling a stock. However, selling a stock, or any other asset, has another meaning on the TBanque platform, which we will now explain.

Selling an asset (aka “short selling”)

“Selling” a financial asset, sometimes referred to as “short selling” or “shorting” is different from “closing a trade”.

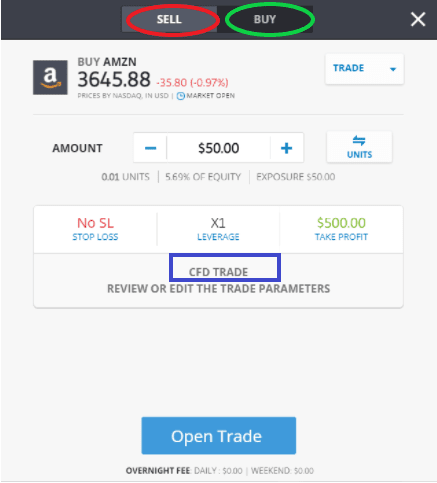

Let’s say, you want to purchase Amazon stock or any other financial asset on the TBanque platform. Here is the screen you will see:

At the top of the screen, you have the option to BUY (green circle) or SELL (red circle) the stock. You might say: how can I sell a stock I don’t own? Good question.

The answer is that “selling” refers to “short selling”. This means you are opening a position where you believe that the Amazon stock will decline in value. Your position is called a Contract For Difference or CFD as can be seen in the image (blue rectangle). Here, you are not actually selling the asset, but rather entering into an agreement with TBanque where your position is “selling” oil. In this agreement, the terms are agreed upon between you and TBanque where if the asset goes down in value, you gain a certain amount of money and if it rises in value you lose a certain amount of money, all based on the amount you invest. You can learn more about selling here.

BUY an asset

In the image above, there is the option to SELL – which we spoke about – and also to BUY. Here “buying” is synonymous with “long”. Buying is what it sounds like – you are purchasing the asset. For example, if you buy amazon stock, you would say “I am going long on Amazon.” This means that you are opening a position where you believe that the Amazon stock will rise in value.

Summary

There are three takeaways from this blog.

- “Closing a trade” means terminating an investment. In the laymen’s terms it would be called “selling” a stock or a financial asset.

- Selling an asset, synonymous with “short selling”, means entering into a contract with a broker, or simply an investment, where you believe an asset will decline in value.

- Buying an asset, labeled “BUY” on the TBanque platform, means that you are buying an asset that you believe will rise in value.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.