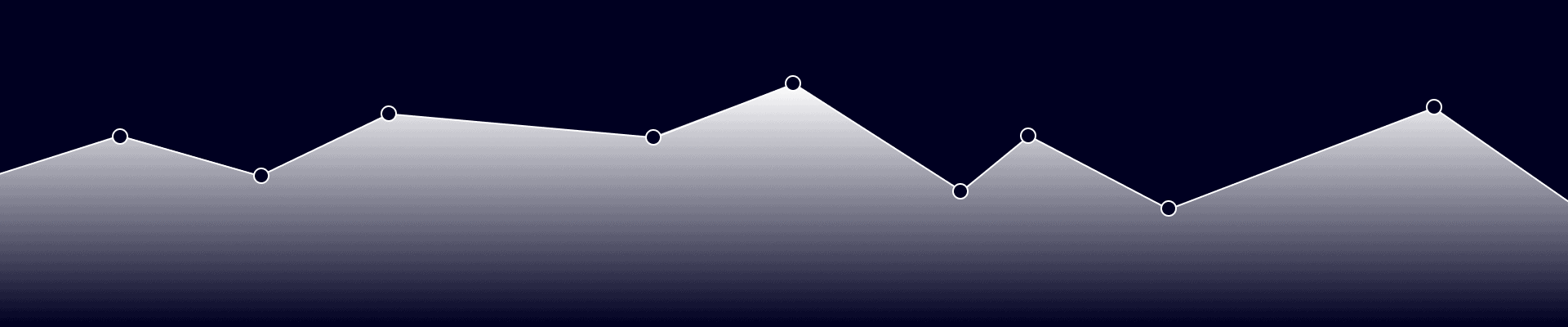

DEPRESSED: Capitulated investor sentiment was a big driver of the 13% S&P 500 relief rally from the June lows, as a little less-bad news went a long way. And this support continues, with our contrarian investor sentiment indicator (see chart) still at similar levels to the 2020 ‘covid crash’ and 2008 global financial crisis, despite their much more dramatic scale. These indicator lows have historically been long-term buy signals, and echoes Warren Buffett’s maxim to ‘be greedy when others are fearful’. Because if everyone is this bearish, who is left to sell? Together with resilient Q2 earnings, poor sentiment is an important market support as we await the needed turn down in reported inflation and Christmas peak in this Fed interest rate hiking cycle.

INDICATORS: Continued pessimism is being led by the S&P 500 equity put/call ratio that is well-above average at 0.67, and by individual investor sentiment, with an above average 40% outright bearish. Less dramatic is the VIX volatility index, which is above the long-term average of 19, and mutual fund and ETF flows which have stabilized after a run of strong outflows.

INDEX: Our proprietary composite sentiment indicator is made up of 1) equity mutual fund and ETF flows. 2) The long running American Association of Individual Investors (AAII) sentiment survey. 3) VIX index of expected S&P 500 volatility. 4) S&P 500 put/call ratio, measuring the proportion of put buying (option to sell in future) vs calls (to buy in future). Whilst not part of our index, we also cross-check versus the NAAIM hedge fund exposure to US equities index and news-based economic policy uncertainty indices. Both are similarly off lows, but still depressed.

All data, figures & charts are valid as of 02/08/2022