The terms bullish and bearish are often used to describe the conditions in the market or the sentiment of investors. They are very important terms and are used in nearly all types of trading, from currencies to stocks. Traders can take advantage of both bullish and bearish markets if they have sufficient knowledge of the market conditions that are associated with these cycles. When traders understand the meaning of bearish and bullish and are able to identify the cycles, they will know how to profit off of any market condition.

The terms bullish and bearish are often used to describe the conditions in the market or the sentiment of investors. They are very important terms and are used in nearly all types of trading, from currencies to stocks. Traders can take advantage of both bullish and bearish markets if they have sufficient knowledge of the market conditions that are associated with these cycles. When traders understand the meaning of bearish and bullish and are able to identify the cycles, they will know how to profit off of any market condition.

Investors and Markets

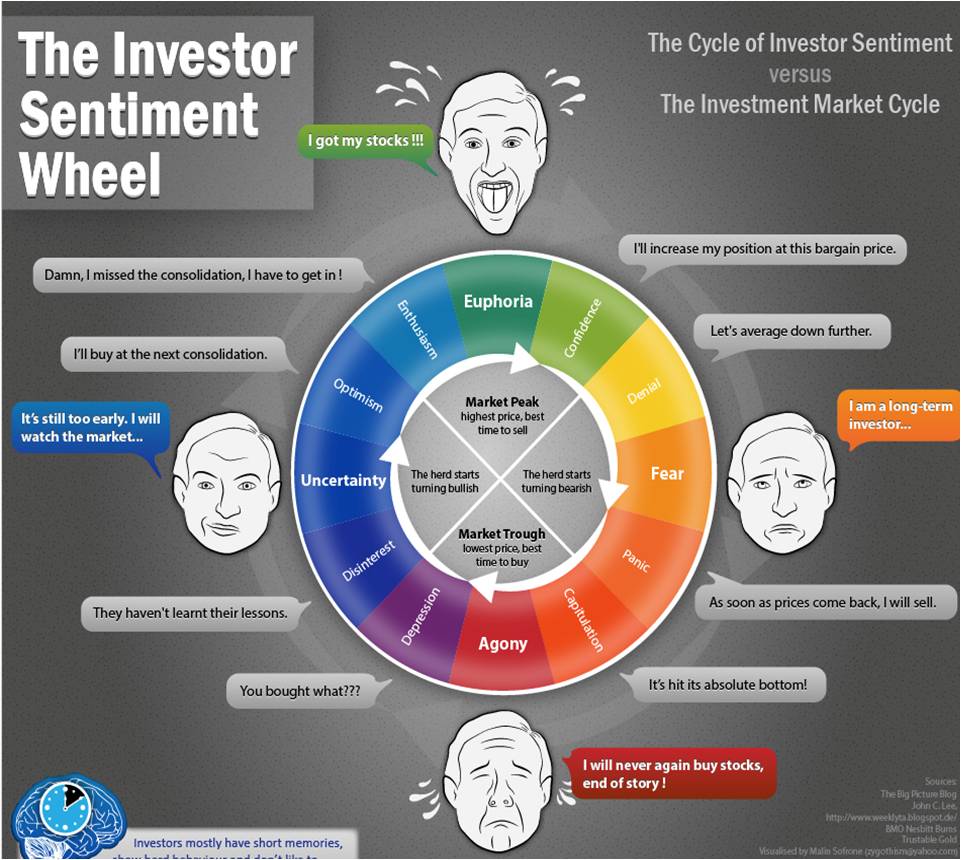

An investor with bearish sentiment believes that a rise in the value of asset prices presents an excellent opportunity to trade those assets and get out of the market. On the other hand, investors with bullish sentiment wait until prices are low before entering the market with the hope that prices will increase and they will then trade their stocks to make a profit. Traders can generate profits in both bearish and bullish market cycles. When a rise is suspected in the markets, bullish investors either purchase assets or hold onto long-term investments. Below is an illustration of investor sentiment.

Source: ritholtz.com

Bullish and Bearish Behavior

Traders may also ‘short’ a stock if they believe it will decline. However, institutional hedge funds and money managers are the primary players in shorting stocks. Investors who are bullish may eventually migrate to become bearish investors over time. Meredith Whitney is well-known for calling bull runs in markets and her fame grew in 2009 when she said the markets were rallying for no reason and the gains would soon be lost. According to Tom O’Halloran, an expert trader and Lord Abbeit mutual fund manager, investors who are seeking exposure to the best assets should not wait until a bear cycle before purchasing those assets. O’Halloran says that expensive assets are priced in proportion to the market rallying periods.