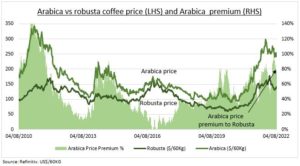

COFFEE: Arabica coffee prices have held near decade highs as consumers did not want to give up their morning brew despite squeezed finances. This has tightened the coffee market, as lower Brazilian yields have cut the supply and inventory outlook. This took Arabicas price-premium to Robusta beans up sharply (see chart), incentivizing more blending and helping restrain prices. High bean prices have added to the building consumer downtrading and profit margin pressures on big users from Starbucks (SBUX) to Nestle (NESN.ZU). Similar to the Big Mac index, the Latte index shows Switzerland with the worlds priciest lattes and Turkey with the cheapest.

CONSUMER: Beans are a fraction of the end-consumer coffee price. But along with energy and labour prices they have driven cost pressures. This has come just as consumer spending is being squeezed by the cost-of-living crisis. This is acute in the EU, which drinks by far the most coffee globally, at nearly a quarter. Starbucks, which only uses arabica beans, saw higher commodity prices eat into its profit margins last quarter. Whilst Nestle saw less demand for its expensive Nespresso pods as it hiked prices but is also hedged as is worlds largest instant coffee maker.

COMMODITY: More delicate and harder-to-grow Arabica dominates the ground coffee market, whilst Robusta the instant market. Brazil leads the coffee trade, as the largest Arabica producer, sending 40% of global exports. Largest Robusta producer Vietnam, follows, responsible for 16% of world exports. The International Coffee Organisation sees consumption growing a healthy 3.3% this year, but with supply down 2.1%, driving a near record 3.1 million 60kg bag deficit.

All data, figures & charts are valid as of 16/08/2022