There is no shortage of options when it comes to investing. From traditional stocks that have been around for decades to cutting-edge cryptocurrencies that are booming, there are plenty of markets out there into which you can dive. While you have probably heard plenty about crypto, stocks, indices and ETFs, you might not be as familiar with forex trading. And what might be even more surprising is that the forex market is the largest in the world!

Does that pique your interest? In this guide, you will learn what the forex market is, what it takes to be a forex trader and important forex information for beginners to help you find your feet before taking the next steps towards actively trading currencies.

Table of Contents

What is forex trading?

How does forex trading work?

What is a currency pair?

Is forex trading worth it?

The risks of trading forex

What is forex trading?

So, what exactly is forex trading?

Forex is a shortened form of the phrase foreign exchange and refers to the overall market in which people are able to buy and sell international currency. It is also sometimes referred to as FX trading. When compared with other investing instruments such as stocks and bonds, forex trading is relatively new. A mere 30 years ago, retail or individual forex trading was not an option for the average trader and was mainly utilised by large banks. In the late 90s and early 2000s retail, forex trading became available to the general market and started to boom.

The forex market provides an excellent opportunity for those with relatively small amounts of capital available to still be able to invest. Traders invest in exchange rate pairs to trade one currency against another. You sell one currency to buy another, which is what makes the pair. So, for example, you might want to invest in USD/AUD, thinking that the USD will become stronger against the AUD. This isnt very different to when you used to exchange your native cash at the airport when travelling overseas.

While the term forex is a shortened version of foreign exchange, there is no one specific marketplace or platform in which currencies are traded.

How does forex trading work?

Forex trading works similarly to any other normal transaction you would make, except when you make a forex transaction, you are also actually making a sale in addition to a purchase. So, for example, if you are investing in USD/AUD, you are actually selling a certain amount of your AUD for a certain amount of USD.

There are three main ways to conduct forex transactions:

Spot market. This forex trading market is probably the easiest to understand, as it is based on current exchange rates and the transaction happens on the spot. These are often known as cash markets and represent the most basic type of transaction. You pay money (in this case, a type of currency) and you get that equivalent value in a different currency back based on the current exchange rate. With the rise of online trading platforms such as TBanque, the spot market has become the most popular way to trade forex.

Forward market. When you trade on the forward market, you dont actually trade for cash as you would in a spot market transaction. Instead you invest a contract for a certain type of currency at a certain exchange rate on a specific date when the exchange will take place. These are private agreements between two parties, which sets them apart from

Futures market. Trading on the futures market is very similar to the forward market, in that it is built on the idea of agreeing to a contract that will see currency exchanged at an agreed-upon rate at an agreed-upon time. However, the main difference between a futures market and a forward market is that a futures market is a legally binding agreement settled on an official commodities market.

What is a currency pair?

A currency pair is exactly what it sounds like a pair of currencies. In forex trading, a currency pair shows which type of currency is being traded for another. Or, in another way of looking at it, it shows how much of one type of currency it costs to purchase one unit of another type of currency.

The way in which the currencies are listed in the pair matters. The first currency listed in a currency pair is the base currency. The second is called the quote currency. The currencies are listed by standardised abbreviations used in markets around the world.

For example, lets say you are looking at a forex market and you see AUD/USD = 1.10000. The AUD represents Australian Dollars, which is the base currency. The USD represents US Dollars which is the quote currency. That means you can exchange 1.10 US Dollars for 1 Australian Dollar.

Here are some of the most commonly traded currency pairs:

| CURRENCY PAIR | DESCRIPTION |

| EUR/USD | How many US Dollars it takes to purchase 1 Euro. |

| USD/JPY | How many Japanese Yen it takes to purchase 1 US Dollar. |

| USD/GBP | How many Great British Pounds it takes to purchase 1 US Dollar. |

| EUR/JPY | How many Japanese Yen it takes to purchase 1 Euro. |

| EUR/GBP | How many Great British Pounds it takes to purchase 1 Euro. |

| USD/CAD | How many Canadian Dollars it takes to purchase 1 US Dollar. |

| AUD/USD | How many US Dollars it takes to purchase 1 Australian Dollar. |

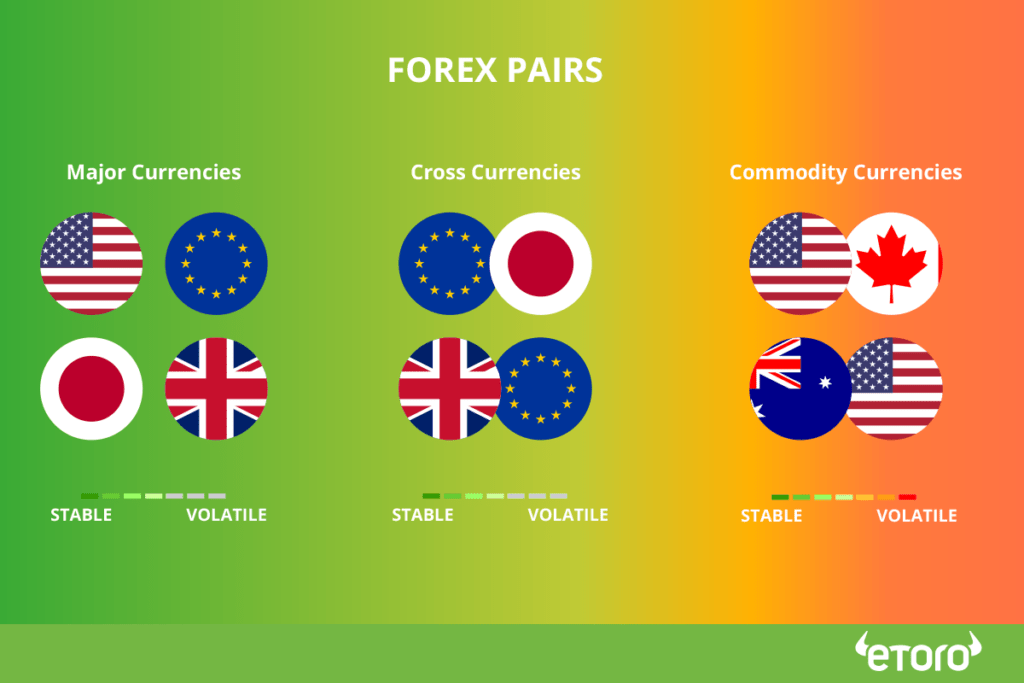

Forex currency pairs are often thought of in three types:

Those first three currency pairs listed (EUR/USD, USD/JPY, USD/GBP) are commonly referred to as major currencies. These are from generally large, stable economies that will not have as much volatility as other smaller, emerging markets that can be influenced by one or two major natural events or business decisions.

Cross currencies are pairs that do not include the US Dollar (USD). The fourth and fifth pairs listed in the table (EUR/JPY, EUR/GBP) are good examples of cross currencies, as this type often includes major currencies such as the Japanese Yen (JPY) or Euro (EUR).

Those final two currency pairs in the table (USD/CAD, AUD/USD) are called commodity currencies. That is because both Canada and Australia feature economies with strong ties to commodities such as oil, gas and iron. Because of this, there can be high liquidity as well as high volatility when it comes to these currency pairs.

Is forex trading worth it?

So, the big question: Is forex trading profitable? As with any investment opportunity, foreign currency can be a worthy investment of your time and resources. But, also as with other investment types, there can also be some drawbacks.

We break down some of each here.

The benefits of forex trading

There are several aspects of trading forex that make it a great investment opportunity, including:

Liquidity. As mentioned above, many of the most commonly traded forex currencies are very liquid. That means there is a lot of this currency available, so trades can be completed at almost any time. The pervasive nature of these currencies also makes them resistant to sudden changes or manipulations. That means traders do not have to be as worried about being caught out by major business moves or political decisions. By being liquid, a currency has the freedom to stay flexible and absorb such changes.

Flexibility. With forex markets so heavily traded around the world, it is much easier for traders to get on or off positions when they feel like it. And since it is not traded on one official market, forex transactions can take place around the world 24-hours a day, five-and-a-half days a week. Contrast this with, for example, the US stock market, which has opening and closing hours on business days.

Availability. As discussed towards the beginning of this article, the forex market was created in large part to service everyday punters who wanted to have a crack at nabbing the big profits that major economic players were gaining. This accessibility has only grown with the increase in online trading platforms, such as TBanque, that are available with just a few taps.

Leverage. Many forex brokers will allow traders to take advantage of leverage, which means traders will be able to trade with much more than their initial outlay. For example, if you want to apply 100x leverage to your account, you only have to supply $1,000 of your own money to be able to trade with $100,000. This allows traders to benefit from minute changes in currency values called pips.

The risks of trading forex

Of course every investment opportunity comes with risks that potential traders need to be aware of before diving in. Here are a few of the major things to think about before you get started.

Leverage. Wait, isnt leverage a benefit of forex trading? Yes, it is, but for that same reason it can also be a huge drawback. If you get in too deep with real leverage, you can quickly lose a giant portion of your capital with even a small shift in the market.

Failure. It is no fun to think about failing when it comes to investing, and nobody plans on losing money when they enter a market. But it is important to go into forex trading with your eyes open. Public data shows that between 73-95% of retail traders lose money trading forex. With such a high statistic, responsible trading is a must.

Inexperience. Unlike with stocks or mutual funds, forex traders do not have the same guidance options such as financial advisors and portfolio managers. This can make investors feel more aimless in the market. Compounding this feeling is the fact that enormous institutions such as banks and other corporations still control a lot of forex trading, which can be intimidating for individual investors.

Education. The aforementioned lack of help from professionals can be especially harmful because of all the different macroeconomic factors that play such a huge role in determining the strength of global currencies. To be a successful forex trader, you need to have a big-picture understanding of global economies and what makes them tick. This sort of information can be a little difficult for the everyday investor to grasp.

For example, a countrys interest rate rising and falling plays a huge part in how strong its currency is. This is called interest rate risk. Meanwhile, country risk is associated with the overall stability of a nation. This can be shaky for smaller nations that have less room for error in regards to payments and reserves, which in turn can make them more prone to currency crises.

Getting a handle on so many global factors can be a barrier to success for relative forex trading newcomers.

Forex trading can be an excellent opportunity for traders with various levels of experience and capital available for investment. It provides you access to a truly global market that is the largest in the world. Of course, it also comes with risk, as any investment opportunity does.

You have exchanged currency at the airport on trips overseas. Ready to get even more involved in forex trading? Currency trading on TBanque gives you a chance to buy and sell a range of international currencies while also following the advice and moves of successful Popular Investors. By copying their moves, you can mimic the activity of some of the best traders on TBanque. Get started today.

Sign up to TBanque to practice your Forex Trading.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.