Exchange-traded funds (ETFs) have become extremely popular with traders and investors in recent years for good reason. Simple, transparent, and cost-effective, they offer a straightforward way to gain exposure to a wide range of assets including stocks, bonds, commodities, and real estate.

Interested in learning more about ETFs? This guide to ETFs is a great place to start. In this guide, well walk you through the basics of ETFs and explain how you can invest in them through TBanque.

Table of Contents

Beginners Guide to ETFs: How to start trading Exchange Traded Funds

What is an ETF?

How are ETFs created?

What are the pros and cons of ETFs?

Types of ETFs

Whats the difference between ETFs, index funds, and mutual funds?

How investing in ETFs works

ETF fees

Risks of investing in ETFs

How to choose an ETF

ETF trading strategies for beginners

How to trade ETFs on TBanque

Summary

Glossary

Beginners Guide to ETFs: How to start trading Exchange Traded Funds

Exchange-traded funds (ETFs) have grown in popularity among retail investors in recent years and with good reason. They provide a simple and direct way to get exposure to a broad spectrum of financial assets, spanning commodities, bonds, stocks, and even real estate. ETF trading is preferred to the use of mutual funds, as they dont incur the same trading fees and expense ratios, whilst providing the accessibility of being able to open and close positions multiple times daily like stock trading.

If you are keen to learn more about trading ETFs, read on as we provide a full guide to investing in ETFs for beginners.

What is an ETF?

An ETF, or exchange-traded fund, is a type of investment fund that aims to track the performance of a specific stock market index, industry sector, or asset.

The concept of ETFs was established in 1990 by American investment firm Leland, OBrien, and Rubinstein (LOR). The group believed it was possible to combine multiple stocks into one cluster, placed onto a stock exchange, and then traded as a single entity.

In Canadas Toronto Stock Exchange, a modern-day-style ETF was created and launched the same year. The Toronto 35 Index Participation Units (TIPs 35) was a financial instrument that tracked the TSE-35 index. By January 1993, an ETF was launched called the S&P 500 Trust ETF. This remains one of the most actively traded ETFs in the present day. This ETF represents the top 500 US companies and it tracks as close to the S&P 500 index as possible.

ETFs are in many ways similar to mutual funds. However, unlike mutual funds, they are traded on the stock market. This means that they can be purchased and sold just like regular stocks.

There are ETFs available for virtually every asset class, including stocks, bonds, real estate, and commodities.

Some examples of ETFs include:

- The SPDR S&P 500 ETF (SPY), which tracks the performance of the S&P 500 index.

- The Technology Select Sector SPDR ETF (XLK), which offers exposure to US technology companies.

- The SPDR Gold ETF (GLD), which tracks the performance of gold.

To buy or sell an ETF, you need a trading account with a stock broker or investment platform.

At eToro, buying and selling ETFs is very straightforward. eToros platform is easy to use and offers zero commissions* on ETFs as well as low minimum investments.

This means that investing in ETFs is something that anyone can do.

*Zero commission on ETFs is only available to UK and European clients of TBanque UK Ltd. and TBanque Europe Ltd. and does not apply to short or leveraged trades.

How are ETFs created?

When learning what ETF trading is, one of the fundamental points is knowing how ETFs work. Firstly, its important to understand their origins. When you look at an ETF Vs mutual fund comparison, ETFs may appear similar to mutual funds. However, they differ in the way they are created.

Investors looking to buy into a mutual fund will send money directly to a fund company. This company uses that money to buy securities and issue new shares of the fund to the investor. When investors sell their shares in a mutual fund, their shares are returned to the fund company in exchange for money ideally more money than you originally invested.

Creating an ETF is quite different from a mutual fund as it does not involve cash transactions. Any individual wishing to manage a new ETF submits a proposal with the U.S. Securities and Exchange Commission. Providing that proposal is approved, the individual (known as the sponsor) then seeks an agreement with a market maker (often a large-scale institutional investor) to create or redeem these new ETF shares. The sponsor and the market maker can be the same person or organization.

The market maker for the new ETF then borrows shares for the relevant stocks, usually from a pension fund, placing them directly in a trust. These form the basis of ETF creation units. The trust then distributes shares in the new ETF, giving investors legal claims on the shares held in the trust.

What are the pros and cons of ETFs?

There are a number of advantages to investing in ETFs.

These include:

- Low costs: ETFs tend to have extremely low ongoing charges meaning that they can be a great way to invest cost-effectively. They are generally much cheaper than actively-managed investment funds because they do not have investment managers actively making investment decisions.

- Diversification benefits: investing via ETFs is an easy way to diversify your portfolio. Through one security, you can potentially gain exposure to hundreds of different individual stocks. For example, the SPDR S&P 500 ETF (SPY) offers exposure to 500 different US stocks.

- Instant access to a wide range of markets: ETFs can be a very useful asset allocation tool as they can help you gain access to different areas of the financial markets including foreign markets, commodity markets, and real estate markets. For example, if youre looking for portfolio exposure to Chinese stocks, you could invest in the iShares China Large-Cap ETF (FXI). Similarly, if youre looking for portfolio exposure to silver, you could invest in the iShares Silver Trust (SLV).

- Transparency: ETFs are very transparent. Unlike mutual funds, investors can see exactly what an ETF holds.

- Easily traded: Because ETFs are traded on the stock market, its very easy to buy

- Tax-efficient: ETFs can be a more tax-efficient way of trading than mutual funds. However, tax is only applied in certain countries and not in others. For example, in the UK, approximately 75% of ETFs are classified with reporting or distributor status, meaning they are subject to capital gains tax. Regardless, capital gains tax is cheaper than rates of income tax if it is applicable in your location.

- Dividends are reinvested instantly: The dividends derived from firms in an open-ended ETF are reinvested immediately. In comparison, the timing of reinvestments with mutual funds is more variable.

In addition, there are some disadvantages to weigh up before you start trading ETFs.

These include:

- Higher costs if compared to buying stocks: Although the costs of trading ETFs are typically cheaper than mutual funds, the costs of trading ETFs are still more expensive than investing in specific stocks, with no management fee paid for the latter.

- Lower dividend yields: Although you can buy and sell ETFs that pay dividends, the size of the yields may not be as substantial as those paid out by high-yielding individual stocks.

- Some leveraged ETFs if held for long periods could multiply losses fast: If you buy an ETF with double or even triple leverage, any losses compared with the tracked index are likely to be magnified by two or three times the underlying security too.

- Actively-managed ETFs incur higher fees: Management fees must be factored into the equation before investing in ETFs.

- Single industry focus ETFs limit diversification: By investing in an ETF across a single industry or asset class, you are not spreading your risk across multiple assets or sectors.

Lack of liquidity can hinder transactions: ETF asset classes like bonds are less liquid than ETFs tracking popular indices like the FTSE 100 or S&P 500. This can make it harder to sell at a price you want.

Types of ETFs

There are many types of ETFs available to investors today.

Some of the main types of ETFs include:

- Stock index ETFs: these are designed to track a particular stock market index such as the S&P 500, the FTSE 100, or the Nikkei 225. Examples of stock index ETFs include the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, and the iShares FTSE 100 UCITS ETF (ISF.L), which tracks the FTSE 100 index. Investing in stock index ETFs can be a great way to gain broad exposure to the stock market at a low cost.

- Sector or industry ETFs: these are designed to provide exposure to specific areas of the stock market such as technology companies, healthcare companies, or financial companies. An example of an industry ETF is the Healthcare Select Sector SPDR ETF (XLV), which provides exposure to healthcare stocks in the S&P 500 index.

- Style ETFs: these are designed to track stock indexes that are based on a specific investment style. An example of a style ETF is the iShares Edge MSCI USA Quality Factor ETF (QUAL), which invests in large-and mid-cap US stocks that have strong fundamentals.

- Bond ETFs: these are designed to provide exposure to fixed income securities. They can contain all kinds of bonds including US Treasury bonds, corporate bonds, high-yield bonds, and more. An example of a bond ETF is the iShares Barclays 1-3 Year Treasury Bond ETF (SHY), which provides exposure to US Treasury bonds.

- Commodity ETFs: these are designed to track the price of a commodity such as gold or oil. An example of a commodity ETF is the SPDR Gold ETF (GLD), which tracks the performance of gold.

- Real estate ETFs: these are designed to track real estate indexes. An example of a real estate ETF is the Vanguard Real Estate ETF (VNQ), which tracks the performance of the MSCI US Investable Market Real Estate 25/50 Index.

- Leveraged ETFs: these are designed to provide amplified exposure (2x, 3x, etc.) to the underlying shares or market. An example of a leveraged ETF is the Proshares Ultra S&P 500 (SSO), which provides 2x the daily return of the S&P 500 index. Leveraged ETFs can magnify your potential investment gains, however, they can also magnify your losses.

- Inverse ETFs: these are designed to help investors profit from a decline in the underlying index or market. If the underlying index falls, the inverse stock index ETF will rise. An example of an inverse ETF is the ProShares UltraPro Short QQQ ETF (SQQQ). This ETF rises if the underlying index, the NASDAQ 100, falls. Note that this particular ETF is also leveraged and provides 3x the regular exposure.

Whats the difference between ETFs, index funds, and mutual funds?

You might be wondering how an ETF differs between an index fund and a mutual fund. Thats why weve put together an ETF Vs index fund and ETF Vs mutual fund section to compare and contrast these financial instruments for beginners.

ETF Vs Index Fund

Although ETFs and index funds are similar in that they offer passive investment opportunities, with retail investors capable of investing in a cluster of securities that track a market index, there are some sizable differentiators between the two instruments. While ETFs can be bought and sold via a stock exchange or broker, index funds are purchased directly via a fund manager. This means that active traders may prefer ETFs, due to the ability to implement stop-loss orders.

Furthermore, retail traders can buy as little as one ETF share, while minimum investments in index funds can be somewhat higher. However, index funds remain an attractive option if the liquidity of the equivalent ETF is somewhat thin.

ETF Vs Mutual Fund

ETFs and mutual funds have plenty in common, but there are key differences too. Mutual funds are typically actively managed, with fund managers buying and selling assets within a fund to try and beat the market.

Meanwhile, ETFs are a more passive investment vehicle, tracking an existing market index autonomously. With mutual funds requiring active management, mutual fund investors will pay management fees and often require much bigger levels of an initial investment than an ETF. For example, the Vanguard 500 Index Investor Fund requires a minimum investment of $3,000.

The overriding similarity between ETFs and mutual funds is that they both represent clusters or baskets of individual bonds or stocks. Retail investors preferring to automate investments and withdrawals in and out of a fund may prefer a mutual fund over an ETF, with automated investments or withdrawals not permitted with ETFs.

However, as with index funds, ETFs offer more hands-on control over the price you buy and sell than a mutual fund. You can buy and sell ETFs at fluctuating prices throughout a trading session. However, those who buy into a mutual fund will pay the same price as anyone else thats invested that day. With mutual funds, the values are not calculated until the end of each trading day.

How investing in ETFs works

ETF trading and investing is quite simple. Heres a look at the basics.

Profiting from a rising market

If you believe that a stock market index or asset (such as gold) is likely to rise in the future, you would open a BUY position on an ETF that covers that index or asset. This is called going long.

For example, if you believe that the S&P 500 index is going to rise over the next year, you would open a BUY position on an ETF such as the SPDR S&P 500 ETF (SPY), which tracks the performance of the S&P 500 index.

If the S&P 500 index does rise, your investment in the SPDR S&P 500 ETF (SPY) will increase in value, and you can close the trade for a profit if you wish. However, if the S&P 500 index falls, the value of your ETF will fall as well, meaning you will generate a loss.

Profiting from a falling market

If you believe that a stock market index or asset is likely to fall in the future, you could open a SELL position on an ETF that covers that index or asset. This is called going short.

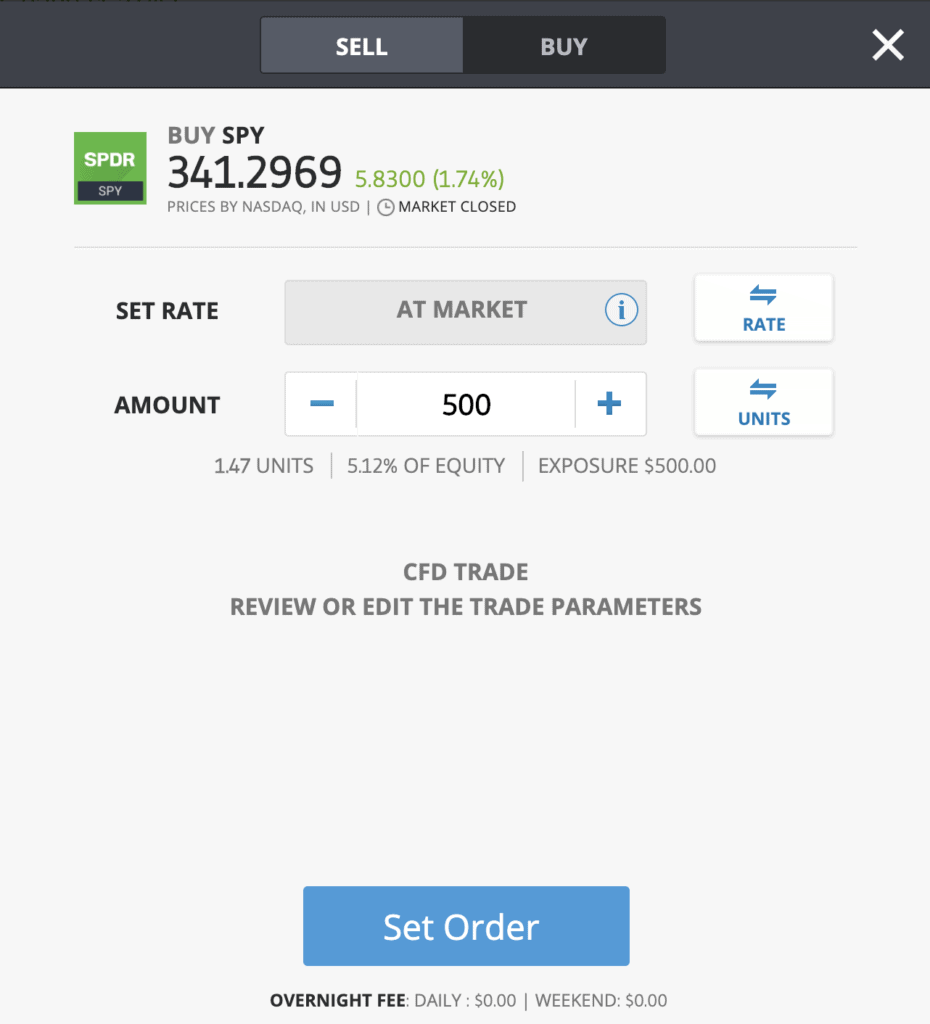

You can open a SELL position on an ETF by trading Contracts For Difference (CFDs). CFDs are financial instruments that offer traders and investors the opportunity to profit from the price movements of a security without actually owning the underlying security.

For example, if you believe that the S&P 500 index is going to fall over the next three months, you could open a SELL position on the SPDR S&P 500 ETF (SPY), which tracks the performance of the S&P 500 index.

If the S&P 500 index does fall, you will profit from your short position. If the S&P 500 index rises, however, you will generate a loss.

Dividends

A third way you can potentially profit from ETFs is through dividends.

Dividends are cash payments that some companies pay to their investors out of their profits. Not all companies pay dividends but many well-established companies do.

If you hold an ETF that invests in dividend-paying companies, you will receive dividends on a regular basis.

For example, if you hold the iShares FTSE 100 UCITS ETF (ISF.L) which has exposure to a number of dividend-paying companies listed on the London Stock Exchange you will receive regular dividends.

ETF Fees

There are two types of fees associated with ETFs.

These are:

- Trading commissions: these are the fees that brokers and investment platforms charge to place a trade. On TBanque, there are zero commissions* to open and close ETF positions.

- Ongoing charges: these fees, which are sometimes referred to as the total expense ratio, are charged by the fund company / ETF provider, i.e. iShares or ProShares. Ongoing charges are generally very low. For example, ongoing charges on the SPDR S&P 500 ETF (SPY) are around 0.095% per year.

*Zero commission on ETFs is only available to UK and European clients of TBanque UK Ltd. and TBanque Europe Ltd. and does not apply to short or leveraged trades.

Risks of investing in ETFs

All forms of trading and investing involve some degree of risk and ETF trading and investing is no different.

The main risk that ETF traders and investors face is market risk or investment risk.

This is the risk that the underlying index or asset falls in value.

If you own an ETF and the underlying index or asset falls, the value of your ETF will also fall.

For example, if you buy a S&P 500 index ETF such as the SPDR S&P 500 ETF (SPY), and the S&P 500 index falls 20%, the value of your investment is also likely to fall by around 20%.

Similarly, if you buy a gold ETF such as the SPDR Gold ETF (GLD) and the price of gold falls 20%, the value of your investment will also fall by about 20%.

Its important to note that leveraged ETFs carry additional investment risk.

For example, if you buy a leveraged ETF that offers 2x the exposure to the S&P 500 index and the S&P 500 falls 10%, you are looking at a loss of 20% instead of 10%.

In addition, some ETFs carry greater tax efficiency than others. For example, actively managed ETFs may incur capital gains, which are owed to the fund holders.

Due to the access to exotic ETFs, many require complex homework and research on behalf of the trader before investing in them. Some retail traders make the mistake of investing blindly in exotic ETFs, just because they have recently performed well.

There is also the potential for ETFs to be liquidated. Shareholders are paid in cash if this scenario occurs.

Risk management strategies

You can never eliminate risk completely when investing in ETFs, however, there are ways to reduce risk.

One of the most effective ways to reduce risk is to diversify your portfolio. This means spreading your money out over many different investment assets so that youre not over-exposed to any single asset. A diversified portfolio might have exposure to equity ETFs, bond ETFs, and commodity ETFs.

For stock index ETFs, adopting a long-term investment horizon is another strategy that can help reduce the risk of losing money. In the short term, stocks can be highly volatile. However, in the long run, the stock market tends to rise. So, generally speaking, the longer you invest for, the less chance you have of losing money.

For short ETF trades, stop losses can also be an effective risk-management tool. Stop losses help minimise investing losses by closing out losing positions before large losses build up.

How to choose an ETF

There are hundreds of ETFs available to investors today.

When it comes to choosing an ETF, the first thing to do is to define your goals and objectives, and your risk tolerance.

Common goals and objectives include:

- Investing in the stock market, or a particular sector, to generate capital growth

- Generating passive income from dividend-paying companies

- Diversifying your investment portfolio across multiple asset classes such as equities, bonds, and commodities

- Hedging your portfolio against risks such as falling share prices or currency movements

As a beginner to investing in ETFs and broadening your trading portfolio, its also important to look for ETFs that offer the following characteristics:

- Wide exposure

Its possibly a good idea for ETF beginners to start with buying a broad international fund that invests in stocks across several countries at least until you learn how to identify opportunities in a specific country. Its the easiest way to diversify and spread your risk when honing your ETF investment strategy. - Stable growth

Beginner ETF investors may be more prone to making moves rashly. Anyone new to buying and selling ETFs could try and stick to buy-and-hold funds in that instance. These are ETFs designed to integrate safety and stability without sacrificing too much growth. - Low fees

Ensure you choose ETFs that arent subject to commission fees to avoid adding to your expense ratio.

Once you have determined your goals and objectives, you can identify an ETF that can help you achieve them and is suited to your risk tolerance.

With hundreds of ETFs to choose from on TBanque, including stock index ETFs, sector ETFs, commodity ETFs, and inverse ETFs, youll find one that matches your requirements.

You can check out the full range of ETFs TBanque offers at the etoro.com ETF page.

ETF trading strategies for beginners

When you are looking to develop an ETF investment strategy, you should carefully consider which approach appeals to you the most. The most common ones are:

- Growth systems

Investing in growth ETFs are designed to provide a steady return, with these funds including stocks of underlying companies with a strong potential for growth. - Value investing

Buying shares in value stock ETFs can make it easier to profit from companies that experience cyclical periods of growth. - Momentum trading

Momentum ETFs are funds investing in companies demonstrating positive momentum in the markets or their respective industries. These funds may also include shorted stocks of companies with negative momentum. - Social trading

Its also possible to begin your ETF trading journey by leveraging social trading opportunities. At TBanque, our Copy Trading function allows you to follow the investments of long-term profitable users. This entry-level opportunity helps you to understand how to invest in ETF funds and the thought processes behind the most profitable TBanque users. Each user has a risk score, which demonstrates how much risk each user is taking from 1 to 10 1 being the lowest risk and 10 being the highest risk.

How to trade ETFs on TBanque

ETF trading and investing is straightforward on TBanque.

Heres how to place a trade:

- Login or create an online trading account by going to www.etoro.com

- Head to our Markets page, and then select ETFs to access the full list of ETFs that are available to trade

- Select the ETF that you wish to trade, then select Trade

- Select BUY or SELL depending on the direction you wish to trade

- Enter the amount of money you wish to trade or invest or the number of units of the ETF you wish to buy or sell

- If going short, set a stop loss

- Select Open Trade

Summary

- An ETF, or exchange-traded fund, is a type of investment fund that aims to track the performance of a specific stock market index or asset.

- ETFs are traded on stock exchanges. This means that they can be bought and sold just like individual stocks. To invest in an ETF, you need a brokerage account with a stock broker or investment platform.

- ETFs are available for virtually every asset class, including stocks, bonds, real estate, and commodities.

- ETFs offer a number of advantages including low trading costs, diversification benefits, instant access to a wide range of markets, transparency, and ease of trading.

- There are many types of ETFs including stock index ETFs, sector ETFs, style ETFs, bond ETFs, real estate ETFs, commodity ETFs, inverse ETFs and leveraged ETFs.

- The main type of risk associated with ETFs is market risk. This is the risk that the underlying asset or index falls in value.

- The risks of investing in ETFs can be reduced by diversifying your portfolio.

- Trading ETFs on TBanque is straightforward.

- eToros platform is easy to use and offers zero commissions on ETFs as well as low minimum investments.

Glossary

- CFD contract for difference. A financial instrument that enables you to profit from the price movements of securities without actually owning the underlying security

- DIVERSIFICATION spreading your money out over many different investments to lower portfolio risk

- DIVIDENDS cash payments that some companies make to shareholders out of their profits

- ETF exchange-traded fund. A type of investment fund that aims to track the performance of a specific stock market index or asset.

- GOING LONG buying a security

- GOING SHORT selling a security

- INVERSE ETF An aTF that is designed to help investors profit from a falling market

- LEVERAGE using capital borrowed from a broker when opening a position to increase the potential return of an investment

- LEVERAGED ETF an ETF that provides amplified exposure to an index or asset

- MARKET CAPITALISATION the total value of a companys shares

- MARKET RISK the risk that the underlying index or asset falls in value.

- MUTUAL FUND an investment fund that pools money together from many individual investors to purchase securities

- RISK the amount of capital exposed on any single trade

- RISK MANAGEMENT focusing on risk when trading in order to minimise losses

- SPREAD the difference between the buy and the sell price. This is also the cost of placing the trade

Get started on TBanque to learn more about ETFs

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.