Table of Contents

What is a Dividend?

How Do Dividends Work?

How to Identify Dividend Stocks

How to Evaluate Dividends

What is Dividend Tax?

How to Buy Dividends with TBanque

Risks of Dividend Investing

Frequently Asked Questions (FAQ) About Dividends

Summary

What is a Dividend?

What are dividends? In short, these are payments made by limited companies to shareholders. This payment can be cash or in the form of some other incentive, such as additional shares. However, the fundamental premise of dividend payments is that theyre regular rewards issued to those with a stake in the company.

Thats a fairly brief dividend definition, but it sets the tone for the rest of what this guide is about. To provide a complete dividend meaning, there are a lot more pieces of the puzzle to put in place. For example, as well as knowing what these payments are, you need to know when they occur and how theyre accounted for. Indeed, if youre interested in dividend investing, you need to understand everything about them.

From dividend tax and yields to allowances and regulations, all of these things have to be considered before you start investing. This guide will explain all of this and more. By the time youre finished, youll be able to answer simple questions such as what is a dividend and how do dividends work. Youll also be able to tackle more complex issues. So, if youre ready to expand on this dividend definition, lets get started.

How Do Dividends Work?

A dividend payout has to be agreed upon by a companys board of directors. However, the amount thats voted on isnt some ethereal number. The amount that will be redistributed to shareholders is based on the companys earnings. More specifically, the payment is based on the companys net profits.

A portion of the profits will be kept within the companys retained earnings. This is money thats set aside to cover costs, make investments and grow the company. Any profit thats left over, i.e. an amount the board decides is reasonable, will be distributed as dividend payments. The total value of the money to be paid out will then be divided evenly among the number of shares that have been issued.

For example, if the company is going to pay out ?10,000 in dividends and 10,000 shares have been issued, each share receives ?1. Therefore, if Person A has 100 shares, theyll receive a dividend of ?100. If Person B has 500 shares, theyll get ?500. Thats how a standard cash dividend payment works.

Depending on the company, these payments might happen once a year, four times a year, or a different timescale. Thats a matter for the board of directors but there will be a dividend schedule published so investors know when they might get something. (Note: quarterly payments are the most common).

Cash payments arent the only way companies redistribute profits to shareholders. There are various types of special dividends that dont involve cash:

Stock Dividends

Dividend stocks are when a company issues new shares to existing shareholders. These shares arent open for consideration. In other words, they cant be bought. Theyre only given to existing shareholders. Stock dividends cant equal more than 25% of the existing number of shares. If more than 25% of the total value of shares is issued as new stock, its known as a stock split.

Preferred Dividends

Preferred dividends are payments made to those who hold preferred stock. A company can issue two types of stock: common and preferred. The latter tend to have limited or no voting rights. However, preferred stockholders have a higher claim to dividends and assets than those with common stock.

In fact, if a company is unable to pay all of its dividends, preferred dividends take precedence. Moreover, dividends for preferred stockholders tend to be higher than those paid on common shares. A company must declare its preferred dividends stocks ahead of time.

Dividend Reinvestment Programs

Dividend reinvestment programs, aka dividend reinvestment plans (DRIPs), allow shareholders to get more stock. Instead of receiving their dividends as a cash payment, shareholders can use their payment to buy more stock. This stock comes directly from the companys own reserve, which means it isnt available for general sale. As such, commission fees are often waived. Moreover, its a way for existing shareholders to increase their stake in a company when they otherwise wouldnt be able to.

Dividend Yield Matters

Understanding how a dividend payout works and what it means when you see things like Tesco special dividend payments is important. However, what does all of this mean if youre an investor? How can you use this information to make better decisions when you trade on TBanque? This is where the concept of dividend yield comes into play.

What is a dividend yield?

This is the amount a company pays out relative to its stock price. As a general rule, mature companies pay higher yields than start-ups. And, in terms of sectors that offer the best dividend yields, those that focus on utilities or consumer services often do best. For example, Coca-Cola has offered strong dividends for more than 50 years. Therefore, its important to take yield into account when youre looking for options to trade.

So, you need to ask, what is a companys share price and how much money is it making each year? If the profits are high, the stock price is high and the dividends are strong, its a good yield and, potentially, a sound investment. However, if the stock price is high but the dividends are low in comparison, it might not be such a good company to invest in. Of course, this is only a basic example, but it shows the type of thought process you have to go through when it comes to investing in dividend stocks.

How to Identify Dividend Stocks

If you can answer the question what is a dividend and you know how dividends work, youre on the way to getting more from your investments. Indeed, if you can find companies that offer strong yields, dividend investing becomes a lot more enticing. The question, therefore, is: how do you find dividend stocks?

There are a variety of ways to determine if a company pays dividends. Our new dividend calendar provides all the information you will need to know about which companies are about to pay dividends. The stocks and their dividends are categorised by market capitalisation, but you can also search for specific companies.

The information pages here on TBanque will also give you an overview of major companies and what their remuneration policies are. For example, you can search for Aviva on TBanque and youll find general information about the company and its share price, as well as details about its dividends.

Another way to find dividends stocks is by going to the companys financial pages or the stock exchanges on which theyre listed. For example, if a company is listed on the London Stock Exchange, you can find information about its dividend payment schedule as well as historical data on past payments.

Finding the Best Dividend Shares

Thats how to find dividend stocks, but how do you separate the weak from the strong? This is far from an exact science and requires a certain amount of personal research and opinion. However, in general, established companies that have been publicly listed for a long time are more likely to offer strong dividends. Investing in established dividends stocks has the added benefit that the share price is likely to be relatively stable.

Take, for example, Apple. This company is well-established and, barring short-term fluctuations, its share price has trended in a bullish direction for many years. This means its a fairly stable stock to trade and, in turn, the dividends are likely to be fairly consistent. Indeed, as we now know, a dividend payment is based on a companys net profit. If a company doesnt make a profit, theres no dividend. Thus, if you can invest in a major company like Apple, youre more likely to get dividends than if its a new company.

You can also look at dividend yields to see if theres a strong correlation between earnings, share price and return. Moreover, you can look at a companys dividend growth over time. The best way to do this is to take a five-year average. So, take the dividend yields for the last five years and look at the average. Compare this to the previous five years and see if its increased. You can also do this on an annual basis. However, averages give you a better overall sense of how a company is evolving.

Top Dividends Stocks

Those are some of the ways you find potentially lucrative dividend stocks. Again, learning how to choose the best dividend stocks isnt an exact science. The goalposts are always moving and you have to do some research to stay on top of the game. However, if you look at well-established companies and assess their yields, youll start to get a good idea of where to put your money.

With that being said, here are some well-known dividend stocks you can trade on TBanque:

- BP Dividend = The dividend yield for BP, as of 2021, was 6.98%.

- Aviva Dividend = The dividend yield for Aviva, as of 2021, was 5.40%.

- Vodafone Dividend = The dividend yield for Vodafone, as of 2021, was 6.49%.

- Apple Dividend = The dividend yield for Apple, as of 2021, was 0.60%.

- Lloyds Banking Dividend = The Lloyds dividend yield, as of 2021, was 1.27%.

- Royal Dutch Shell Dividend = The Shell dividend yield, as of 2021, was 4.82%.

- Barclays Dividend = The dividend yield for Barclays, as of 2021, was 0.57%.

How to Evaluate Dividends

Lets dive a little deeper in the process of finding the best dividends. Weve said that looking at dividend yield is important, but you can go further than this. Its possible to perform calculations on stocks that pay dividends. You can use a dividend calculator in the UK if you dont want to do the maths manually. However, in reality, its not that hard to work out the dividend payout ratio using the following formula:

Dividend Yield = Annual dividend per share / the current share price X 100

- So, lets say a company has a share price of ?100 and it declares a dividend of ?15 per share. This equates to a dividend yield of 15% (15/100 = 0.15 X 100 = 15).

- If the company had the same share price but declared a dividend of ?4 per share, the yield would be 4% (4/100 = 0.04 X 100 = 4).

- Alternatively, if the companys share price was ?80 and it declared a dividend of ?4 per share, the yield would be 5% (4/80 = 0.05 X 100 = 5).

This simple formula can help you get the FTSE 100 dividend yield for all the major companies listed. From there, you can start to determine which UK dividend stocks offer the best potential yield based on the current value and the value over time.

What is the Dividend Tax?

Dividend tax is something you will have to think about if youre an investor in the UK. This section discusses the rules with regard to UK dividend tax rates. For information on dividend tax for countries outside of the UK, switch to our guides in other languages. Well run you through the basics of tax on dividends in the UK.

Do You Pay Tax on Dividends?

- Dividends are taxable in the UK.

- Everyone has a tax-free dividends allowance. The dividend allowance for 2020/2021 was ?2,000. This means you dont pay any tax on the first ?2,000 of income you derive from dividends.

- Anything outside of the dividends allowance is taxable. However, the good news here is that the dividend tax rate in the UK is lower than what youll pay on other earnings.

- Additionally, you may be able to reduce your tax liability if you make investments through a stocks and shares ISA.

Are Dividends Taxable?

Yes, dividends are taxable in the UK. The dividend tax rate is subject to change every year but its always based on your income tax band:

| Income Tax Band | Tax on Dividend Income |

| Basic Rate Taxpayer | 7.5% |

| Higher Rate Taxpayer | 32.5% |

| Additional Rate Taxpayer | 38.1% |

You can work out what you might own by using a dividend tax calculator UK. For more information about your dividend tax rate, you can visit the governments official website.

How to Buy Dividends with TBanque

You can learn more about high dividend-paying stocks in the UK by clicking here. This list is updated regularly so you can keep track of the best dividend-paying stocks in the UK. As well as showing you the companies that are performing well, our list of high dividend stocks shows you how to invest.

The first question to address in this regard is how are dividends paid on TBanque? The answer is that is depends on your position. We allow you to trade stocks, ETFs and indices; each of which can pay dividends. If you hold a buy position, youll receive a dividend payment into your account. This payment is made in cash.

If, however, you hold a sell position, the value of a dividend payment equal to your position will be debited from your balance. Therefore, its important to consider your position carefully when it comes to the best dividend shares.

Once youve established that you want to trade dividend stocks, you can choose a variety of options. The first way is to buy the best-paying dividend stocks individually. For example, you can take a buy position on Apple and receive dividends.

Dividend-Focused ETF

If that doesnt suit, you can trade dividend-focused ETFs. These options can be good if you like to spread your risk. Instead of speculating on one company, youre covering a group of stocks. This means you can trade the best dividend-paying stocks in the UK via a single ETF.

Some of the ETFs you can trade on TBanque are:

- iShares Core Dividend Growth ETF (DGRO) this tracks the performance of an index composed of US dividend growth stocks.

- Vanguard Dividend Appreciation Index Fund ETF (VIG) this tracks the performance of the NASDAQ US Dividend Achievers Select Index.

- iShares Select Dividend ETF (DVY) this tracks the performance of an index composed of relatively high dividend-paying US equities.

- iShares Asia Pacific Dividend UCITS ETF (IAPD.L) this is a UK-listed ETF that offers exposure to the 30 highest dividend-paying stocks from developed countries in the Asia-Pacific region.

- SPDR S&P US Dividend Aristocrats UCITS ETF (UDVD.L) this is a UK-listed ETF that tracks the S&P High Yield Dividend Aristocrats Index. This index comprises stocks within the S&P Composite 1500 Index that have increased their dividends every year for at least 20 consecutive years.

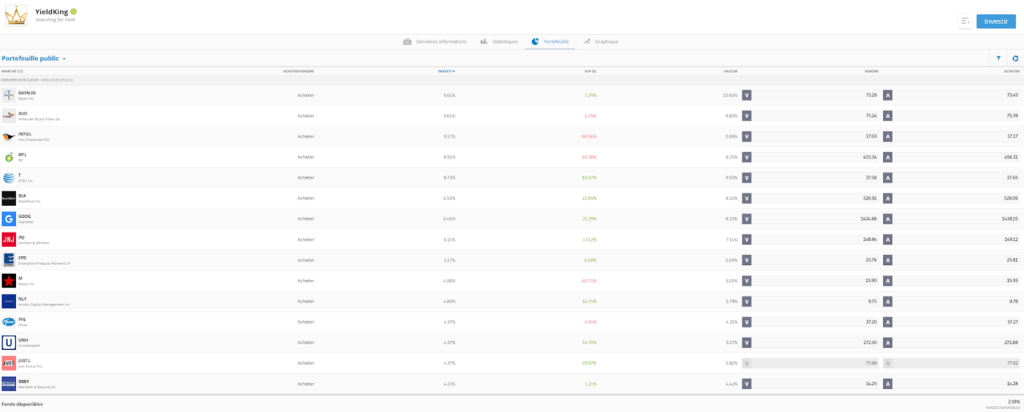

Dividend Growth Portfolio through Smart Portfolios

If ETFs dont suit you, you can try our Dividend Growth Portfolio. This is available via the TBanque Smart Portfolios feature and it allows you to copy the trades of successful investors. Using this feature is a great way to create a well-rounded, low-risk investment solution. Although there are still risks associated with this type of trading, it can be a good way to cover the best dividend stocks, particularly when used in conjunction with ETFs.

Risks of Dividend Investing

The final thing to note is that no investment is ever guaranteed. Dividend risk is a real thing, even in companies that have been strong performers for a number of years. For example, if a company starts to lose money unexpectedly, it can affect dividend payments. In fact, if profit drops significantly, dividend payments could be stopped.

Foreign exchange fluctuations that affect a companys earnings can also affect dividend payments, as can a drop in its share price. Add to these things factors such as inflation and you can start to see that no dividend stock is ever guaranteed to provide a return. Moreover, the returns you receive can and often will fluctuate every year. However, as long as youre willing to accept dividend risk, this wont be a problem.

Frequently Asked Questions (FAQ) About Dividends

Why do companies pay dividends?

Companies pay dividends as a way of giving something back to investors. People that put money into a company to help it grow are rewarded when it makes a profit.

What does ex-dividend mean?

An ex-dividend is a stock without the value of the next dividend. The ex-dividend date is typically one business day before the record date. Anyone that buys ex-dividend stock wont be eligible for a dividend payment.

How often are dividends paid?

Dividend payment dates usually occur four times per year. In other words, dividends are paid every quarter. However, certain payments might be deferred or stopped. Additionally, some companies may set their own dividend payment schedule.

What is a good dividend yield?

Its hard to say what a good dividend payout ratio is because it will depend on the market and current trading conditions. However, as a guide, anything from 2% to 6% is considered a strong dividend yield.

Do dividends count as income?

Yes, they do. You will have to pay tax on dividend earnings once it goes over the allowance threshold which, as of 2021, is ?2,000 in the UK.

How are dividends paid out to investors?

Dividends are usually paid in cash. However, you may receive additional stock options or alternative types of remuneration.

Summary

Thats all you need to know about dividends. You should now be able to answer the question what is a dividend but also go much deeper into the topic. The main points to remember are:

- Dividends are payments made to investors from the profit a company makes.

- Dividends are usually paid in cash but can come in other forms.

- Its important to look at yield to find the best dividend stocks.

- You will have to pay dividend tax if you live in the UK and your income is more than ?2,000 per year.

- There are risks involved in dividend stocks.

If you can keep all of this in mind and make the right moves, there are plenty of opportunities to trade the best dividend stocks in the UK on TBanque.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.