How and why to sell short?

Among those who do not trade or invest, there is often a common misconception that the only way to make a profit on an asset is if the price of that asset goes up.

However, this is not the case. By short selling stocks and other assets, traders can profit when the value of an asset depreciates. When we consider the short selling definition, how do we define short selling in the context of contemporary financial markets?

The concept of short selling basically revolves around betting that an asset will drop in price. At its core, the short selling meaning describes borrowing an asset, selling it, and buying it back at a lower price.

In financial markets, prices fluctuate on a minute-by-minute basis, according to a wide range of factors. As a short seller, you are taking a bearish position and taking advantage of anticipated dips in the market.

If you are wondering how can I short sell?, read this complete TBanque short selling guide to find out.

Table of Contents

What is short selling on the stock market?

Difference between long position and short

How to open a short position on TBanque?

Why integrate short selling into your trading strategy?

Benefits and risks of short selling on the stock market

Other opportunities in the event of a bear market

Conclusion

What is short selling on the stock market?

So, how does short selling work, and how do you profit from short selling? As mentioned, short selling involves a trader shorting a stock when they believe the price will go down. This is the act of selling a share and then buying it back at a lower price after the anticipated drop has occurred. If youve asked yourself what is short selling, then this is your answer.

This difference between the buy price and the sell price is what constitutes the profit. Short selling is, therefore, an attempt to capitalise on a decline. To understand how short selling works, it is first important to understand that the stocks you sell when shorting are usually stocks (or other types of assets) that you have borrowed from your broker.

So, how does selling short make money? Once you have sold the shares and then bought them back, you return the shares to your broker, while pocketing the price difference yourself. Lets walk through a quick example to illustrate one of the main types of short selling in the market.

Lets say that you think the price of a tech stock, currently trading at ?130, is due to fall shortly. You could borrow 10 shares at ?1300 and then immediately sell them for the market price.

Lets say your bearish position is correct and the price of the tech stock falls to ?120 per share. From here, you could buy the 10 shares back for ?1200 and return them to your broker. The ?100 you have leftover (?1300-?1200) is your profit from the short.

Short selling using CFDs

One of the most popular forms of short selling among retail traders is CFD short selling. This is a way of taking a short position on a financial asset without having to actually borrow the underlying asset from a broker.

Instead, you can use a brokerage platform like TBanque to short sell by using CFDs. CFDs, or Contracts for Difference, are financial products that act as contracts between you and the broker, in which you agree to pay the difference between the current value of an asset and its value at contract time.

With short selling, you can use the CFD to agree on a sale price for a particular asset without exchanging the underlying asset. With this agreement in place, you will still make the same amount of profit if the actual share price drops.

CFDs are popular because they can be used to quickly and easily take a short position against a wider range of assets. If you are curious about short selling forex or wondering can you short sell bitcoin?, CFDs are the answer, since they cover just about any asset you can imagine.

Even new traders at TBanque who might just be on the lookout for short selling ideas can benefit from our extensive range of CFDs, as well as the in-depth analytics you need to find out how to find short stocks to sell. Lets quickly walk through a CFD short selling example to better understand how this all works.

With all CFD trades, you are agreeing with your broker that you will exchange the difference in the price of an asset from the price when the position is opened to the price when the position is closed. With CFD shorting, you open a position to sell a particular asset. You could, say, open a CFD short position on a manufacturer stock when it is trading at ?750. You could then short sell 100 the manufacturer share CFDs and close the position once the price of the stock falls to ?740, making a profit of ?1000 [(?750-?740)x100].

Difference between long position and short position

To understand why people engage in shorting, it is essential to know the difference between long and short selling. The best way to understand the difference between the two is to think of them as a short sell and long buy dichotomy, or buy long and sell short.

A short position is when the trader sells an asset that they do not actually own (as it is borrowed from the broker), in the hopes that the asset will depreciate and the price will fall.

Once this occurs, the trader can buy the asset back at the cheaper price and return the asset to the broker, thus pocketing the difference. This is in contrast to a long position, wherein the trader buys an asset in the hopes that the asset will appreciate in value over time.

Once this happens, the trader can then sell the asset at the inflated price, pocketing the difference. With a long position, the trader may own the underlying asset, or they may use CFDs to capitalise on an anticipated future price increase.

Short selling is bearish and long positions are always bullish. Moreover, short sellers typically only need to know how to buy and sell stocks short term, since such positions are most often opened and closed within a very short time span, often the same day. Long positions, meanwhile, can be held for a few minutes or a few decades. This is the buy long sell short definition.

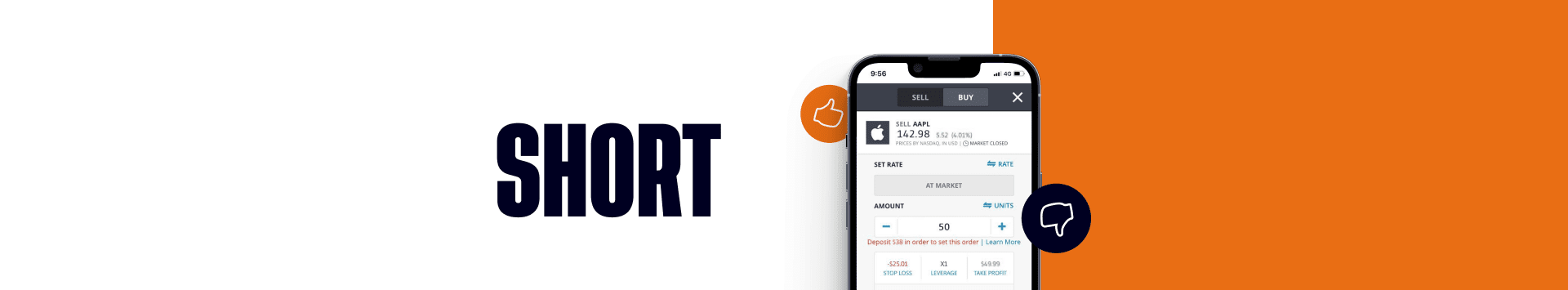

How to open a short position on TBanque?

With our platform, you can open a short position and short sell an asset in just a few clicks. Lets use a practical example of short selling to show how short selling on TBanque works. In this example, we will short sell Facebook stock.

Steps:

- Go onto the company page of the stock you want to short sell.

- Click on the trade button

- On the toggle, switch the option from BUY to SELL.

- There will be an option that will let you choose trade or order, which will let you define the rate and amount.

- You can also define your stop loss, leverage and take profit at this point.

- Once you are ready, the open trade button will open your position.

- This position can be managed within your portfolio, where you can also manage the close position.

Then youre done! You have now successfully taken a short position against your stock, meaning you know how to short sell.

Please be aware that every country has its own regulations in relation to CFD and short selling, meaning that there may be some limitations in what you can do. Some countries may not allow this at all. As such, this option may not be available for every user.

Why integrate short-selling into your trading strategy?

There are many benefits to short selling when you consider it as part of a wider, diversified trading strategy. To best illustrate some of the main advantages of short selling, lets look at two different types of traders; speculators and hedgers.

When asking how traders make money short selling stock, the most common response would be to describe a speculator. This is a short seller that holds bearish positions on assets to make a profit from their decline.

It is betting against that asset with the expectation that you will make money from its depreciation. Meanwhile, a hedger is someone who includes short positions in their trading portfolio to protect their long positions and to limit potential losses.

They might do this by taking simultaneous long and short positions on an asset, so that they could potentially make some money regardless of which direction the price moves in. They might even use a short sell profit calculator to predict the size of the short positions they would need to cancel out losses if a stock that they own goes south.

By using the best indicator for short selling at TBanque, you can balance out your portfolio with a combination of positions to hedge your bets and profit from asset market downturns.

Benefits and risks of short selling on the stock market?

Short selling is an immensely popular way to trade, but it is not without its risks. Lets walk through the pros and cons of short selling to illustrate why you should do your research and make sure you have a fully informed approach to shorting.

Lets start with the short selling pros:

Provide a hedge

As mentioned, short positions can provide a hedge in your portfolio, especially when your portfolio consists of long-only exposure. By adding in some short positions, you can counter your long positions so that you stand to make money regardless of which way the market moves, thus helping you to limit your losses.

Diversify

At TBanque, you can take a short position on a vast array of assets, thanks to CFDs. This underscores how helpful shorting can be when adding diversity to a portfolio. A diverse portfolio is more insulated from market risks and contains greater profit opportunities.

Potential for large profits

By shorting an asset, the potential for large profits can be significant. If you successfully sell a borrowed asset just before a very large price drop, you could make a huge amount of money when you close your position. As a general rule, price drops tend to be more significant and more rapid than price increases, which could translate to more substantial profits.

Meanwhile, these are some of the disadvantages of short selling:

Potentially limitless losses

Just, how do you lose money short selling stock? Just as the potential for profits is great, so too is the potential for losses. This is one of the major risks of short selling the fact that the amount that you could lose is limitless.

In theory, there is no cap on how much the value of a stock could increase while you hold a short position. If it rises in price by a large amount after you attempt to short it, you could lose all of your investment and be indebted to your broker.

To illustrate with a short selling example, lets look at the GameStop short squeeze that dominated headlines in early 2021. In this case, large amounts of funds and traders had opened short positions on GameStop shares, assuming the beleaguered retailer would depreciate in value.

However, as retail traders began to buy up large amounts of GameStop stock, the price rose dramatically, leading to those holding short positions losing billions of dollars.

Liquidity Troubles

Put simply, short selling can be tricky with less popular stocks, as brokers might not have niche shares that you can borrow. This can lead to liquidity problems for short-sellers. This is why CFDs are so popular with short sellers, as it allows anyone to take a short position on an asset without the underlying asset changing hands at all.

Regulation

Short selling regulation is fickle and subject to frequent change. For example, FCA short selling rules changed dramatically during the Great Recession, when it was decided to ban the practice altogether in the UK for a period of time. Meanwhile, the USA, France, Italy, Spain, Belgium, and South Korea have all instituted bans on short selling at one point or another. This is why short selling is bad for some long-term investors who prefer predictability.

Other opportunities in the event of a bear market

Short selling in a bear market is undoubtedly the best approach to making money during a decline. However, this is not the only opportunity that traders have in a bear market.

For example, you can use short ETFs to generate profits that are the inverse of the direction of a particular stock index, such as the S&P 500.

Meanwhile, you can also use put options to increase the value of our position whenever the price of a particular stock falls. These are some of the best ways to make money in a bear market.

Conclusion

Now that you know how short selling stock works, lets summarize what we have covered:

- Short selling involves borrowing assets from brokers and selling them at a higher price, before buying them back at a lower price

- Short selling is a bearish approach that aims to profit from market declines

- CFDs allow anyone to open a short position on an asset without the actual underlying asset changing hands

- Short selling comes with substantial financial risks

- Short selling allows you to hedge your bets and minimise potential losses in your portfolio

- Some countries may limit short selling or not allow it at all.

You can start trading quickly and easily by signing up to TBanque today.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.