In recent years, interest in cryptoassets such as Bitcoin, Ethereum, and XRP has grown exponentially. Its not hard to see why. A major development in financial technology, crypto has the potential to completely revolutionise the financial services industry.

Interested in learning more about cryptoassets and how to trade them? This guide to crypto is a great place to start. In this guide, well walk you through the basics of cryptoassets and explain how you can trade crypto through TBanque .

Table of Contents

What are cryptoassets?

Why trade cryptoassets?

Major cryptoassets

What drives cryptoasset prices?

How to trade cryptoassets

How to place a cryptoasset trade on TBanque

TBanque s Crypto Smart Portfolios

Risks of cryptoasset trading

Summary

Glossary

What are cryptoassets?

Broadly speaking, cryptoassets are cryptographically-secured digital assets that can be transferred, stored, and traded electronically.

A defining feature of all cryptoassets is that they are underpinned by distributed ledger technology (DLT). A distributed ledger is essentially a computerised database of transactions that is implemented across a network of computers and has no central administrator or centralised data storage. Because all of the information in the database is stored across the network, its said to be decentralised. With a distributed ledger, any transaction that takes place on the network is recorded in multiple places at the same time. This means there is a higher level of security relative to a centralised ledger, where data is stored in one place.

Blockchain is the most well-known type of DLT. This is the technology that many popular cryptoassets are based on. Blockchain groups transactions into blocks that are chained together, and uses cryptography to secure and verify all transactions. All transaction data is public and available for everyone to see. This makes it virtually impossible for anyone to forge a transaction.

Cryptoassets can generally be divided into three main categories:

- Cryptocurrencies: sometimes called payment tokens or exchange tokens, cryptocurrencies are digital currencies that are designed to work as a medium of exchange. Cryptocurrencies are in some ways similar to traditional currencies, however, what makes them unique is that they are generally not issued by any central authority. This means that they are theoretically immune to government interference and manipulation. Examples of well-known cryptocurrencies include Bitcoin, Bitcoin Cash, and Litecoin.

- Utility tokens: these are tokens which entitle the owner to use a function, product, or service provided by the token issuer. When you invest in a utility token, you receive some form of definable benefit in return. Examples of well-known utility tokens include Ethereum and XRP.

- Security tokens: these are digital assets that represent legal ownership rights in real world assets such as stocks, commodities, or real estate. Security tokens are designed as investment opportunities, and have characteristics associated with traditional financial instruments.

Trading cryptoassets

Cryptoasset prices tend to be highly volatile. Its not unusual to see the price of a particular cryptoasset move 20% higher or lower in a single day. This means that the asset class can present many opportunities for traders and investors.

To trade cryptoassets, you need an account with a trading platform that offers access to the crypto markets. At TBanque , trading cryptoassets is straightforward.

TBanque s platform is easy to use and gives traders the choice of buying cryptoassets outright or trading cryptoasset price movements via Contracts For Difference (CFDs).

Why trade cryptoassets?

There are a number of advantages to trading cryptoassets.

Some of the main advantages include:

- More volatility: cryptoassets such as Bitcoin, Ethereum, and XRP tend to be far more volatile than traditional assets such as stocks, bonds, and real estate. Just look at Bitcoin. Its price regularly moves 5% higher or lower in a day. This high level of volatility means that there are always plenty of opportunities for traders. And with TBanque , you can trade in both directions, meaning its possible to profit from both upward and downward price movements.

Past performances are not an indication of future results.

- Leveraged exposure: when trading cryptoassets with CFDs, its possible to use leverage to trade a larger amount of money than you have deposited. This can work to your advantage by potentially magnifying your gains. On the downside, however, leverage can also increase your losses, so its important to be aware of the risks. TBanque currently offers leverage of x2 (meaning you can trade $2,000 with a deposit of $1,000) on all cryptoassets.

- Low minimum investments: you can start trading cryptoassets with just a small amount of money. At TBanque , you can place a crypto trade after depositing just $200.

- Around the clock trading: a major appeal of cryptoasset trading is that the market is open 24/7. This means that you can trade at any time, on your own schedule.

- Low transaction fees: cryptoasset trading transaction fees are generally low. The only fees you pay on TBanque are spreads (the difference between the buy price and the sell price of the cryptoasset) and small overnight fees on CFD positions*.

* CFD positions that stay open overnight incur a small fee, relative to the value of the position. This is essentially an interest payment to cover the cost of the leverage that you use overnight.

Major cryptoassets

There are literally thousands of different cryptoassets available to traders and investors today.

Heres a look at some of the most well-known cryptoassets.

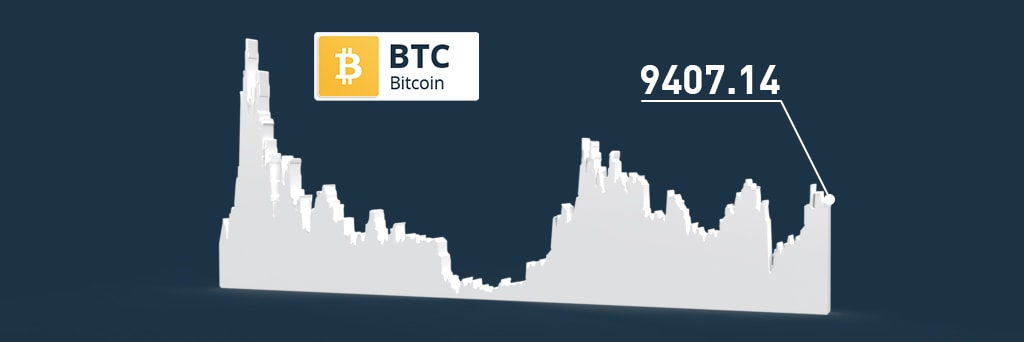

Bitcoin

Bitcoin (BTC) is undoubtedly the most well-known cryptoasset. Launched in 2009 by Satoshi Nakamoto (a pseudonym), Bitcoin is a decentralised digital currency that is based on blockchain technology. It can be sent from user to user on the global peer-to-peer Bitcoin network without the need for intermediaries such as banks.

Bitcoin was designed to be an alternative to traditional fiat currencies such as the US Dollar and the Euro. It is not managed by any central authority or government meaning that it cannot be manipulated in the same way that traditional currencies can be. All Bitcoin transactions are recorded on the blockchain ledger and must be verified, which makes them traceable and highly secure.

Bitcoin was the first cryptoasset to be launched and remains the worlds largest cryptoasset by market capitalisation today.

Ethereum

Launched in 2015, Ethereum (ETH) is a programmable blockchain technology that enables decentralised blockchain-related applications to be built and run without any downtime, fraud, or interference from a third party.

Ethereum has the potential to be an incredibly disruptive technology because it allows smart contracts to be written into the code on the blockchain. For example, it can be used to record banking transactions, legal contracts, and property deeds. This means that it has applications across a wide range of industries including financial services, law, and real estate.

When people talk about trading Ethereum, what they are actually talking about is trading Ether a tradable token designed to fuel the Ethereum ecosystem.

Bitcoin Cash

Bitcoin Cash (BCH) is a cryptocurrency that was created as a result of a hard fork with Bitcoin in December 2017. A hard fork is when a single cryptoasset splits into two cryptoassets. It occurs when members of the cryptoasset network have a disagreement usually regarding improvements to the network software. In this case, it was a disagreement in relation to an increase in the block size.

Like Bitcoin, Bitcoin Cash can be sent from user to user without the need for intermediaries such as banks. The advantages of Bitcoin Cash, however, are that it has faster transaction times and lower processing fees than Bitcoin.

Litecoin

Litecoin (LTC) is a cryptocurrency that was set up in 2011 by Charlie Lee, a former Google employee. It was also created as a result of a hard fork with Bitcoin.

Litecoin is similar to Bitcoin in that it is a peer-to-peer cryptocurrency. However, it has some notable improvements. For example, Litecoin can process transactions up to four times faster than Bitcoin.

Litecoin is often described as the silver to Bitcoins gold.

XRP

XRP is the token of Ripple a payments company that provides efficient solutions for global money transfers.

Ripple was created as an international payment system designed to help banks and financial institutions move large amounts of money around the world. It enables institutions to transfer any currency across the network at a fast speed, with a low cost. This direct-to-bank settlement eliminates intermediate financial institutions and currency exchanges.

Unlike most cryptoassets, XRP doesnt use Blockchain to reach a network-wide consensus for transactions. Instead, an iterative consensus process (a range of independent servers comparing their transaction records constantly) is implemented, which makes it faster than Bitcoin but also makes it more vulnerable to hackers.

What drives cryptoasset prices?

Cryptoasset prices are driven by supply and demand.

Higher demand for a particular cryptoasset will push its price up, while excess supply will push its price down.

Supply and demand can be impacted by many different factors. Heres a look at some of the main factors:

- Economic developments: economic developments that impact traditional asset classes such as stocks, bonds, and cash can have an impact on the demand for cryptoassets. For example, if investors believe that fiat currencies such as the US Dollar are going to be devalued by governments in the future, they might turn to cryptocurrencies for protection.

- Media coverage: there are many websites dedicated to covering cryptoasset developments and news in relation to a particular cryptoasset can influence supply and demand in the crypto market. Positive news, such as news that a certain cryptoasset is seeing a higher level of adoption, can increase demand. By contrast, negative news, such as news that a crypto exchange has been hacked, can reduce demand.

- Government regulation: governments around the world are increasingly looking to regulate cryptoassets and developments in relation to crypto regulation can affect supply and demand. For example, when China announced that it was blocking all websites related to cryptocurrency trading in early 2018, demand for Bitcoin and other cryptocurrencies fell significantly, pushing their prices down sharply.

- Investor sentiment: the crypto market tends to be highly emotional and investor emotions such as fear and greed can have a significant impact on cryptoasset supply and demand. When crypto prices are rising, investors tend to get greedy, pushing demand up further. Conversely, when prices are falling, investors tend to be fearful, which results in excess supply. A great example here is Bitcoin in late 2017 and early 2018. When Bitcoins price was rising rapidly in late 2017, the dominant emotion among crypto investors was greed. This had the effect of increasing demand. However, when Bitcoins price began falling, the dominant emotion switched from greed to fear. This resulted in excess supply of the cryptocurrency, which pushed prices down.

Tip: The News Feed on TBanque s Crypto home page is a great resource for crypto information. Here, traders and investors share information that can be very useful when trading cryptoassets.

How to trade cryptoassets

There are two main ways to trade cryptoassets on TBanque :

- You can buy and sell cryptoassets outright (i.e. buy the underlying asset)

- You can trade cryptoasset price movements via Contracts For Difference (CFDs). CFDs are financial instruments that enable traders and investors to profit from a securitys price movements without actually owning the underlying security.

Heres a look at how these two approaches work.

Buying the underlying asset

Buying the underlying asset involves exchanging traditional currency (i.e. US Dollars) for cryptoasset tokens (coins) such as Bitcoin, Litecoin, or XRP.

When you buy a cryptoasset this way, TBanque purchases the tokens on your behalf and registers them in a segregated account under your name.

If the price of the cryptoasset rises while you own it, youll profit. However, if the price falls, youll generate a loss.

The main advantage of this approach is that you own the cryptoasset outright. This means that the tokens are yours to keep and use as you like. You can transfer the tokens to a wallet, exchange them for other cryptoassets, send them to other people, or pay for goods and services with them.

For example, if you buy $1,000 worth of Bitcoin this way, you can use it to pay for goods at retailers that accept BTC.

When you buy the underlying asset on TBanque , you have the ability to transfer your cryptoassets to the TBanque Wallet. This is an easy-to-use, multi-crypto, secure digital wallet. As well as providing secure storage for your cryptoassets, the TBanque Wallet allows you to send and receive cryptoassets to and from other wallets, and convert one cryptoasset to another cryptoasset.

What is a crypto wallet?

A crypto wallet is a software program that enables users to send and receive digital currency and monitor their crypto balances. If you want to use Bitcoin or any other cryptocurrency to pay for goods and services, you will need to have a digital wallet.

Trading cryptoassets with CFDs

When you trade a cryptoasset via a CFD youre effectively betting on the future price movement of the asset, without owning the asset itself.

For example, if you buy $1,000 worth of Bitcoin CFDs, you will profit if Bitcoins price rises, however, you wont actually own any BTC tokens.

There are two main advantages of trading crypto with CFDs.

Firstly, with CFDs you can trade in both directions. This means that you can potentially profit from both upward price movements and downward price movements.

If you believe that a cryptoasset is going to rise in price, you would enter a BUY CFD trade (this is called going long). However, if you believe that a cryptoasset is going to fall in price, you would enter a SELL CFD trade (this is called going short.)

Secondly, with CFDs you can use leverage to boost your exposure. For example, with x2 leverage you can control $1,000 with just $500. This means theres the potential for higher profits (but also the potential for higher losses).

The downside of trading CFDs is that you dont own any crypto tokens yourself. This means that you cant transfer them to a wallet or use them to pay for goods and services.

Buying the underlying asset vs trading CFDs: which is the best approach?

Both approaches to crypto trading offer the potential for fantastic profits. Which approach is better for you will depend on your objectives and your risk tolerance.

Buying the underlying asset may be the best approach if you:

- Plan to hold the cryptoasset for an extended period of time

- Only want to profit from upward price movements

- Want to transfer the cryptoasset to a wallet or use it to pay for goods and services

- Are happy to pay the full value of the trade upfront

- Dont want to use leverage to increase your exposure

Trading via CFDs may be the best approach if you:

- Want to trade in both directions

- Want to use leverage to increase your exposure

- Are not concerned about owning the underlying asset

- Do not want to exchange your currency for cryptoassets

- Do not want to set up a crypto wallet

For clients of TBanque (Europe) Ltd:

All SELL (short) positions are CFDs.

From 3 September 2017, non-leveraged BUY (long) crypto positions are secured with real assets. Any such positions opened before this date were upgraded to real assets on 13 May 2018.

From 12 August 2019, BUY crypto positions with x2 leverage (excluding copy trading and Smart Portfolio transactions) are secured with the real asset. Margin Trading is used to leverage these trades. This offering does not apply to clients who are residents of China.

For clients of TBanque (UK) Ltd, all leveraged and SELL (short) crypto positions are CFDs. Non-leveraged BUY (long) crypto positions are secured with real assets.

For clients of TBanque Aus Capital Pty Ltd, all crypto positions are CFDs.

Trading cryptoassets with leverage is regulated and comes with a high risk of losing money. Buying cryptoassets is unregulated in most EU countries and therefore is not supervised by EU regulatory framework and carries no EU protections. Your capital is at risk

How to place a cryptoasset trade on TBanque

Placing a cryptoasset trade on TBanque is straightforward, whether youre looking to buy the underlying asset or trade the assets price movements via CFDs.

Heres how to trade crypto on TBanque :

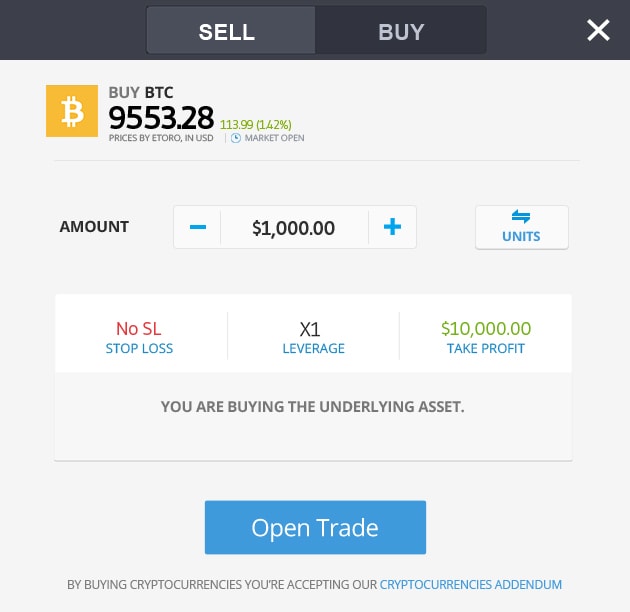

Buying the underlying asset

- Login or create an account by going to www.etoro.com

- Head to our Markets page, and then select Crypto to access the full list of cryptoassets

- Select the cryptoasset that you wish to buy, then select Trade

- Select BUY

- Ensure leverage is set to X1

- Enter the amount or number of units you wish to trade

- Set the take profit parameter if you wish to

- Select Open Trade

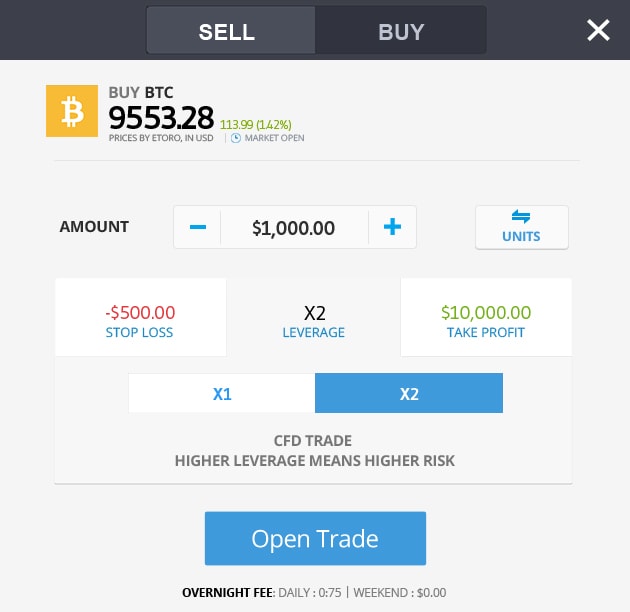

Trading via a CFD

- Login or create an account by going to www.etoro.com

- Head to our Markets page, and then select Crypto to access the full list of cryptoassets

- Select the cryptoasset that you wish to buy or sell, then select Trade

- Select BUY or SELL depending on the direction you wish to trade

- Enter the amount or number of units you wish to trade

- Set the stop loss, leverage, and take profit parametres

- Select Open Trade

Crypto Smart Portfolios

For those interested in a more passive approach to investing in cryptoassets, TBanque also offers a range of crypto-focused Smart Portfolios. These are essentially crypto-based investment funds that are managed by TBanque s investment committee.

Currently, there are four crypto-focused Smart Portfolios available to investors.

These are:

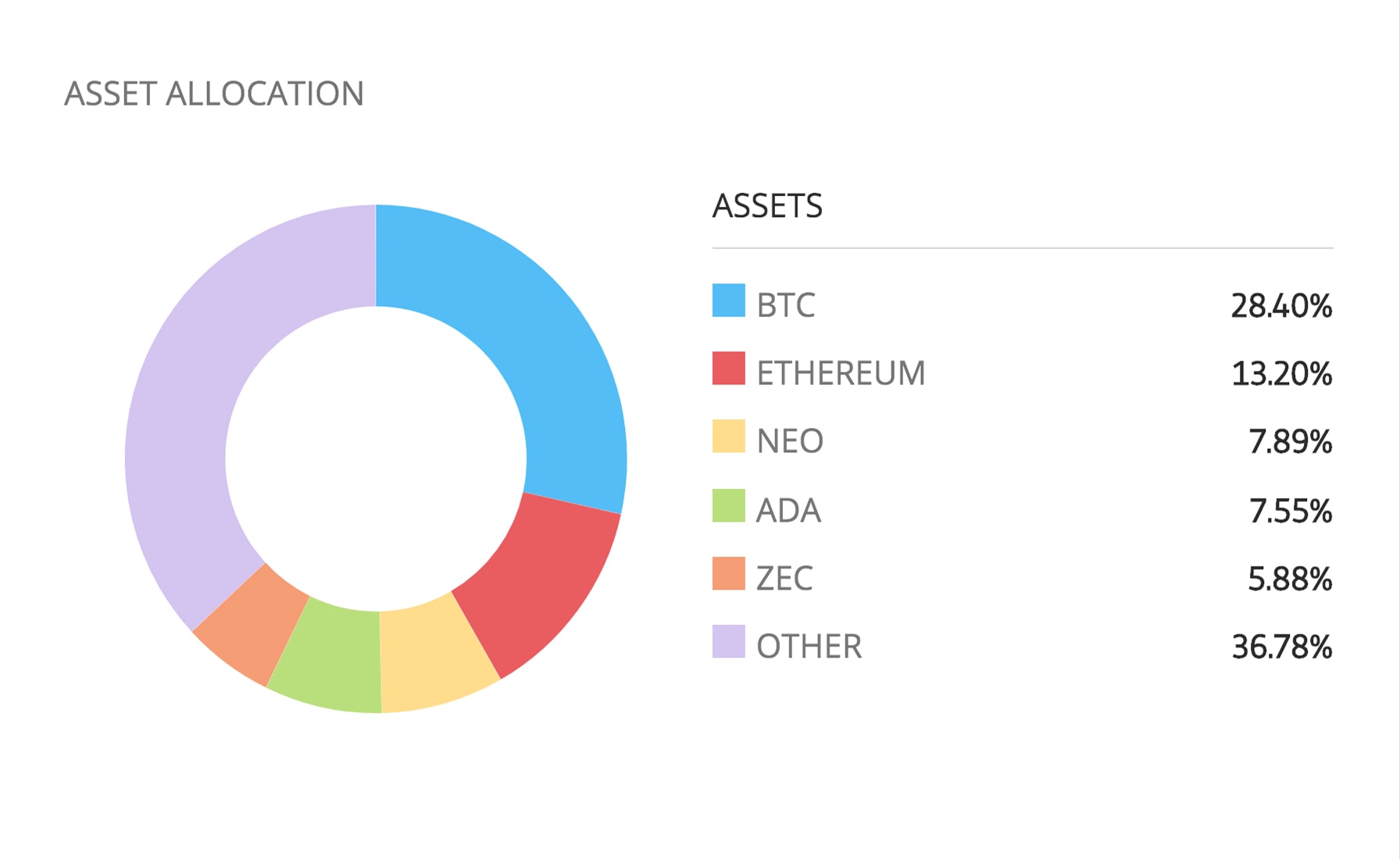

- The CryptoPortfolio Smart Portfolio: this investment strategy offers investors exposure to a diversified portfolio of cryptoassets. The portfolio allocation is based on market capitalisation, and includes exposure to major cryptoassets such as Bitcoin, Ethereum, and Dash.

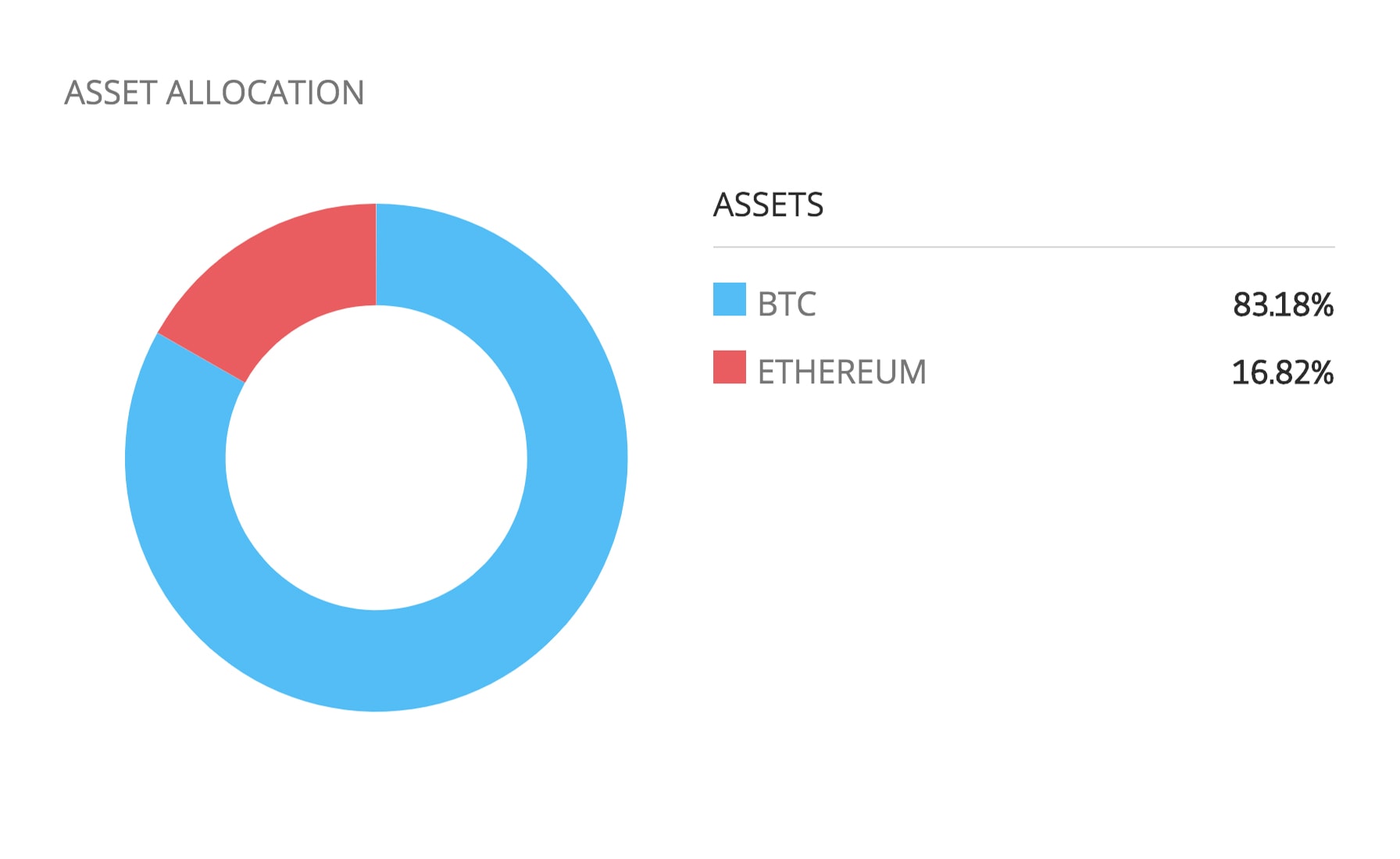

- The Crypto-currency Smart Portfolio: this is a simple investment strategy that provides investors with exposure to the worlds two largest cryptoassets Bitcoin and Ethereum.

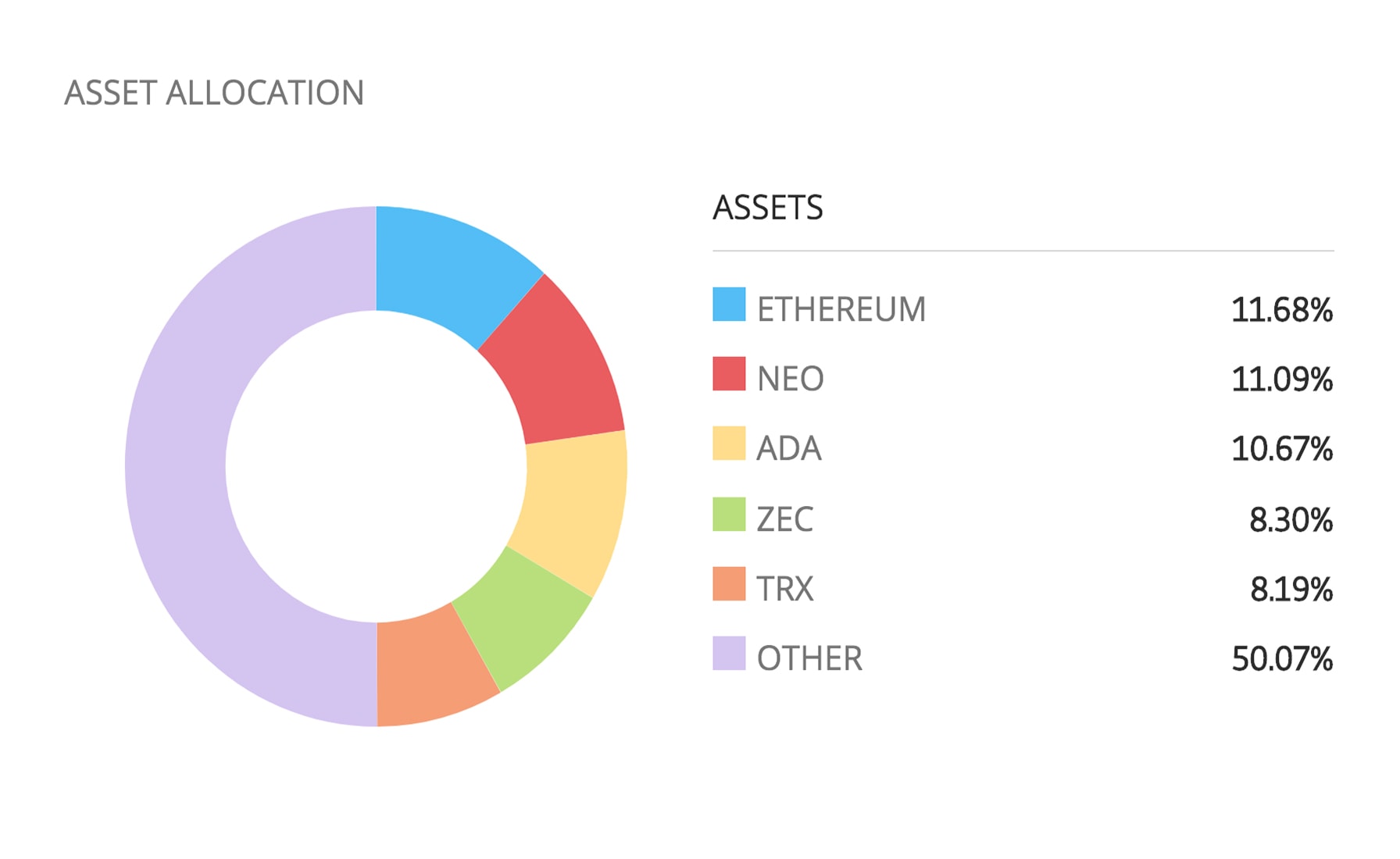

- The CryptoEqual Smart Portfolio: this strategy comprises leading large cap- cryptoassets at an equal allocation. It is a fully-managed investment portfolio for those who wish to receive balanced exposure to the cryptoasset market.

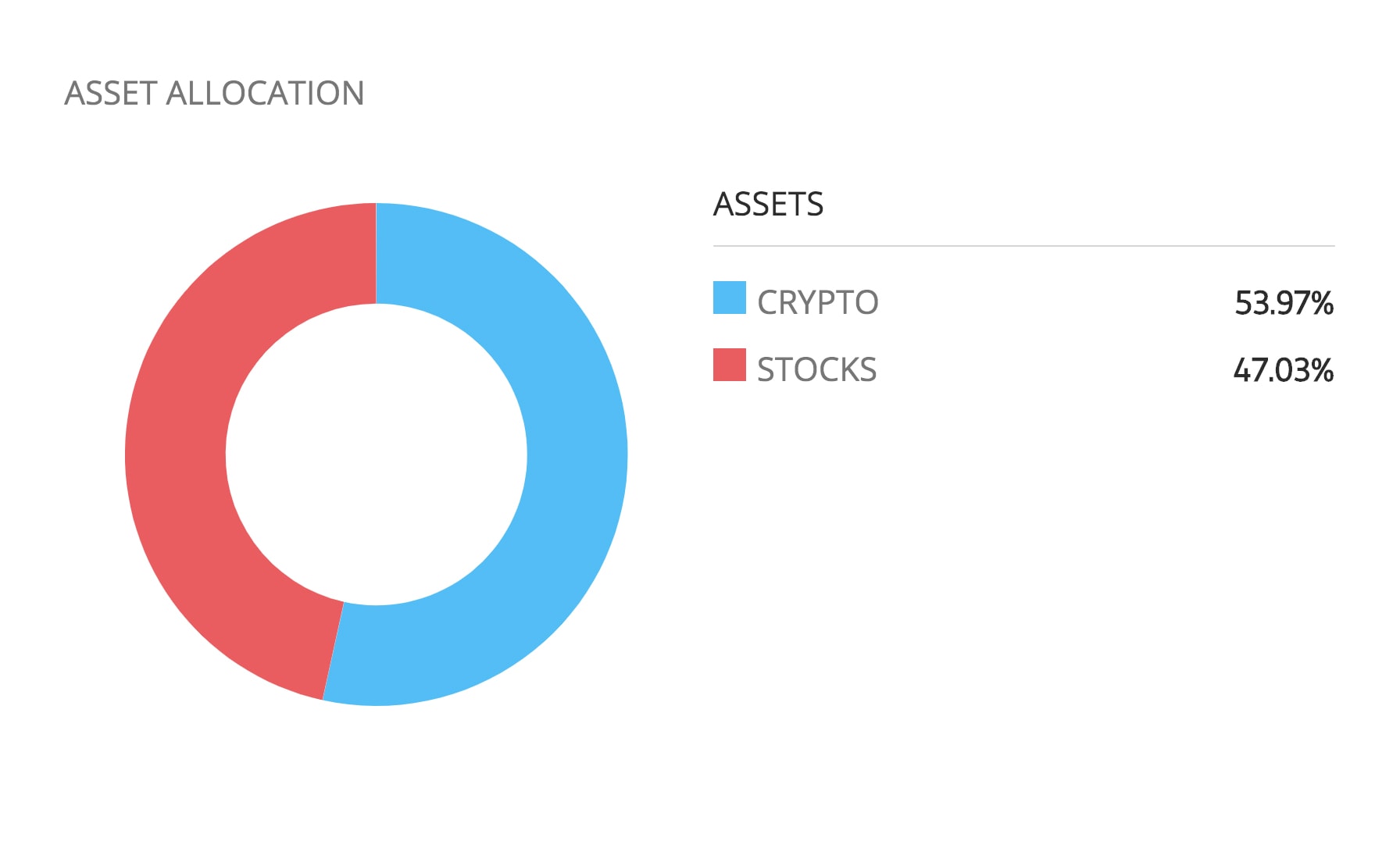

- The CryptoTakeover Smart Portfolio: this investment strategy comprises long (BUY) positions on cryptoassets such as Bitcoin, Ethereum, XRP and others, and short (SELL) CFD positions on the stocks of major banks, such as Citigroup, Goldman Sachs and Credit Suisse. It is designed for investors who believe that cryptoassets will overtake traditional banking services in the long run, and will increase in value, while bank stocks decline.

The minimum investment size for TBanque s Smart Portfolios is $5,000.

Risks of trading cryptoassets

Any form of investing or trading involves risks and crypto trading is no different.

Two of the main risks to be aware of with crypto trading are:

- Volatility risk: this is the risk associated with fluctuations in the prices of cryptoassets. Cryptoasset prices can be extremely volatile and while this volatility can create trading opportunities, it can also be a risk factor. Unfavourable price moves can result in significant losses for traders. If you do not have sufficient funds in your account to cover potential losses, your positions may be automatically closed.

- Leverage risk: while leverage is a powerful tool that can magnify trading gains, it can also work against you by magnifying trading losses. If a large amount of leverage is used to trade, even a relatively small price movement in the wrong direction can result in substantial losses. Its important to be aware that losses can exceed the amount invested.

Risk management strategies

When trading cryptoassets you can reduce your risk by focusing on risk management.

Three risk management strategies that can help reduce risk include:

- Determining your optimal position size: before you start trading cryptoassets, you should determine your optimal position size for each trade. A good rule of thumb is to avoid risking more than 2% of your capital on any single trade. Trading more than 2% per trade could expose you to losses that are hard to recover from.

- Putting stop losses in place when trading CFDs: stop losses are a fundamental component of a robust risk management strategy as they help to minimise trading losses by closing out losing positions before large losses build up.

- Diversifying your portfolio: a portfolio that contains a wide range of assets will have a lower level of risk than a portfolio that simply focuses on one asset such as Bitcoin. By diversifying your portfolio across multiple asset classes such as stocks, ETFs, commodities, and crypto, you can lower your overall portfolio risk.

Summary

- Cryptoassets are cryptographically-secured digital assets that can be transferred, stored, and traded electronically. A defining feature of cryptoassets is that they are underpinned by distributed ledger technology (DLT).

- Blockchain is the most well-known type of DLT. It groups transactions into blocks that are chained together and uses cryptography to secure and verify all transactions.

- Cryptoassets can generally be divided into three main categories: cryptocurrencies, utility tokens, and security tokens.

- There are a number of advantages to trading crypto. Not only does the high level of volatility within the crypto market provide plenty of trading opportunities, but you can also trade around the clock, and use leverage to increase your exposure.

- Five of the most well-known cryptoassets are Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and XRP. You can trade all of these cryptoassets on TBanque .

- Cryptoasset prices are affected by supply and demand.

- Supply and demand can be influenced by many factors including economic developments, media coverage, news in relation to crypto regulation, and investor sentiment.

- On TBanque you have the choice of buying cryptoassets outright or trading crypto price movements via CFDs.

- You can also gain exposure to cryptoassets through TBanque s Smart Portfolios.

- The main risks of trading cryptoassets are volatility risk and leverage risk. Risk can be reduced by focusing on risk management.

- Trading cryptoassets on TBanque is straightforward.

- TBanque s platform is easy to use and offers exposure to a wide range of cryptoassets.

Glossary

- BLOCKCHAIN- This is the technology that many popular cryptoassets are based on. Blockchain groups transactions into blocks that are chained together, and uses cryptography to secure and verify all transactions.

- CFD contract for difference. A financial instrument that enables you to profit from the price movement of a security without actually owning the underlying security

- Smart Portfolios investment funds developed by TBanque s investment committee

- CRYPTOASSET a digital asset that is underpinned by distributed ledger technology (DLT)

- CRYPTOCURRENCY a digital currency designed to work as a medium of exchange.

- DECENTRALISED a system where many computers and people have access to the data

- DISTRIBUTED LEDGER TECHNOLOGY (DLT) a database that is implemented across a network of computers and has no central administrator

- DIVERSIFICATION spreading your money out over many different assets to reduce risk

- GOING LONG buying a security

- GOING SHORT selling a security

- HARD FORK when a cryptoasset splits into two cryptoassets

- INITIAL COIN OFFERING (ICO) when a blockchain company offers cryptocoins as ownership in the company instead of stock at a public sale

- INVESTOR SENTIMENT the general mood of investors

- LEVERAGE using capital borrowed from a broker when opening a position to increase the potential return of an investment

- RISK the amount of capital exposed on any single trade

- RISK MANAGEMENT focusing on risk when trading in order to minimise losses

- SECURITY TOKEN digital assets that represent legal ownership rights in real world assets such as stocks, commodities, or real estate

- SPREAD the difference between the buy and the sell price. This is also the cost of placing the trade

- STOP LOSS an order designed to minimise losses

- TAKE PROFIT an order to close a trade at a certain profit level

- UTILITY TOKEN a token which entitles the owner to use a function, product, or service provided by the token issuer

- VOLATILITY fluctuations in price movements

- WALLET a secure online place where your cryptocurrency is stored. This is separate from a trading platform.

Get started on TBanque to learn more about cryptocurrencies

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.