eToros collaborative community of millions of users is what makes our platform truly unique in the world of online trading. Our innovative, award-winning CopyTrader system engages eToros user base and is designed to help you explore new ways to build your portfolio.

How Does CopyTrader Work?

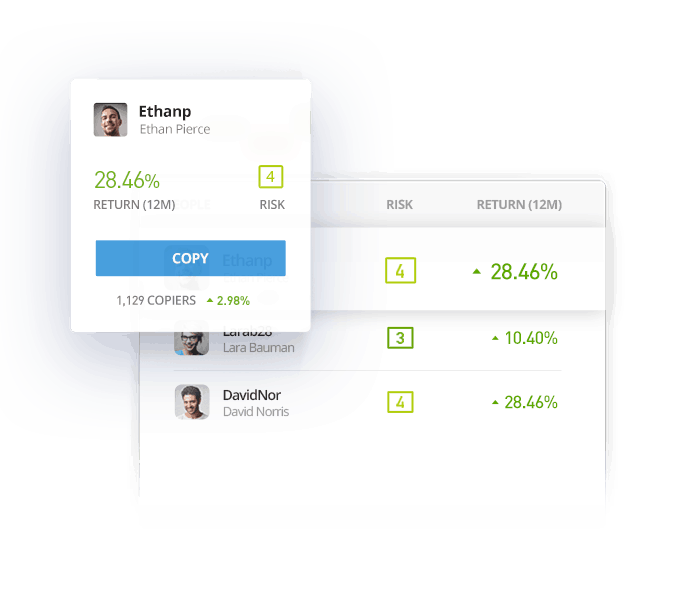

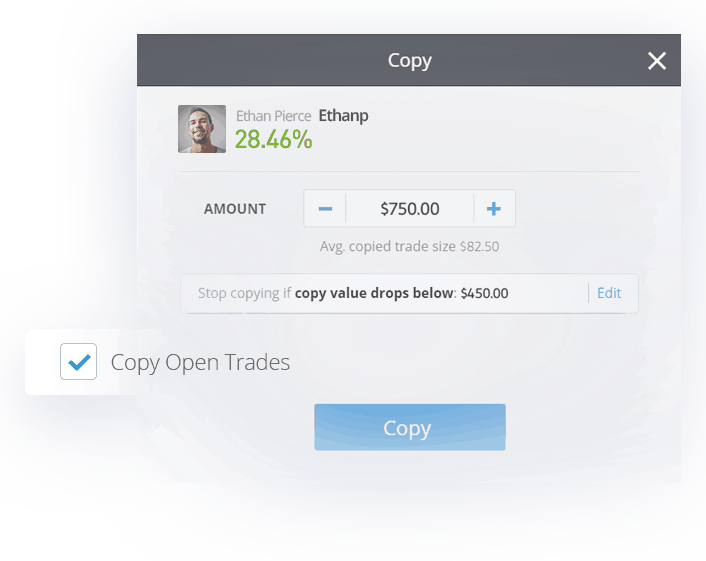

Using CopyTrader is simple: Choose the Popular Investor whom you wish to copy, set the amount to allocate for copying this trader, and click COPY. Going forward, youll be mirroring their positions automatically in real time and in proportion to the amount invested. You can start or stop copying a user at any time.

IMPORTANT NOTES

- Popular Investor portfolios currently only contain crypto assets. We are working to add stocks and ETFs to our CopyTrader program soon.

- While all TBanque users have full viewing access to any public profile on the platform, due to current regulations, US clients can only copy other US users at this time.

Copy Open Trades

When you start copying a trader, the CopyTrader system gives you the option to copy a users entire existing portfolio or to copy only new positions from this point forward. To copy existing positions, check the Copy Open Trades box.

Users who select Copy Open Trades in the Copy interface will duplicate all of the copied users existing open positions, with the following terms:

- The existing open positions will be opened in the copiers account with the market price available at the time of copying (not the price at which the original positions were opened).

- When an investor copies another user, their investments will use the current* makeup of the copied users portfolio (current market value of each asset allocation + available balance) as the basis for the proportion of the copiers portfolio. The portfolio weightings will be exactly the same between the two investors at any point, regardless of when the user begins copying. For example, if the copied user splits their investments 50/50 between two assets, but market movements cause that portfolio weighting to become 60/40 at the time of copying, the copiers portfolio will reflect the 60/40 split that exists at the time of copying.

- You can close a specific copied position without closing the copy relationship.

- To see all positions copied from a single user, go to your portfolio and click the copied users name.

- The positions will all open in your account at the same time. You will see them at a slight loss which reflects the spread between the Buy and Sell rates, to show you a real-time representation of the funds you will receive if you close the position.

- If the copied user withdraws funds, you will receive a copy dividend. If the copied user deposits funds, you will receive a notification suggesting that you add funds to the copy, in order to maintain an optimal ratio.

- If the user you are copying closes all open positions, your copy relationship will still remain open until he/she opens new positions.

**These terms and conditions are subject to change at eToros discretion at any time.

**Please note that cryptoassets held in CopyTrader positions are not available for transfer to the TBanque Money crypto wallet.

Copying only new positions

Users who deselect Copy Open Trades in the Copy interface will replicate only new positions opened after the copy is initiated, with the following terms:

- New positions will open at the same rate as the copied user opens them.

- Each new trade executed will be weighted based on the current market value of the copied users trades vs. the total unrealized value of their portfolio. The copiers trade will mirror that proportion relative to the amount they have allocated to the copy.

- All of the copied users actions will automatically be duplicated in the copiers account, including the closing of the positions.

- You can close a specific copied position without closing the copy relationship.

- To see all of the positions copied from a single user, go to your portfolio and click the copied users name.

- The proportion can change when the copied user changes their available balance. This can occur when the copied user makes a deposit or withdrawal or closes an old position that was opened before you started copying them.

**These terms and conditions are subject to change at eToros discretion, at any time.

Setting Stop Loss for the Copy

When you start copying an investor, you will now have the option to set the Stop Loss level for the copy relationship. Simply set the Stop Loss value (either in dollar amount or ratio percentages) to your preference.

If this copy relationship reaches the chosen Stop Loss value, you will immediately stop copying this investor.

You can also set a Stop Loss for existing copy relationships by choosing Set Copy Stop Loss from the copy settings menu in your portfolio.

Please note that if funds are added or removed from the copy trade, the Copy Stop Loss level that you defined will automatically be kept in proportion as a percentage. Of course, you may readjust the Copy Stop Loss level at any time.

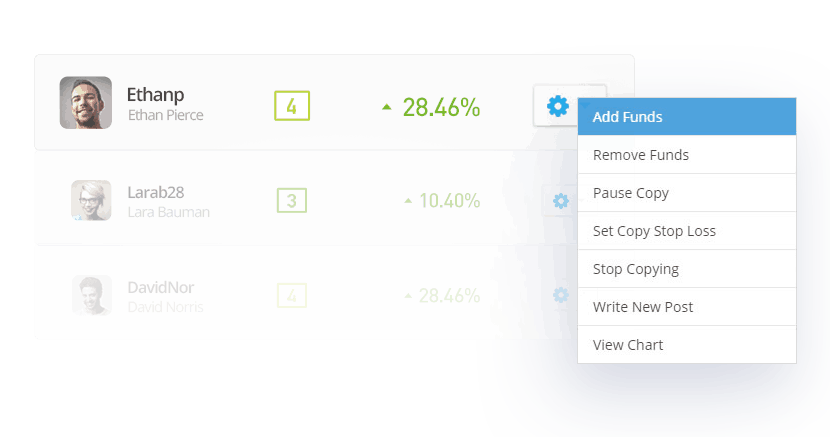

Adding Funds

To add funds to the existing copy, go to the portfolio page and click on the settings button for the relevant copy.

Select Add Funds from the drop-down menu.

In the popup window that opens, select the amount that you wish to add. Click Update.

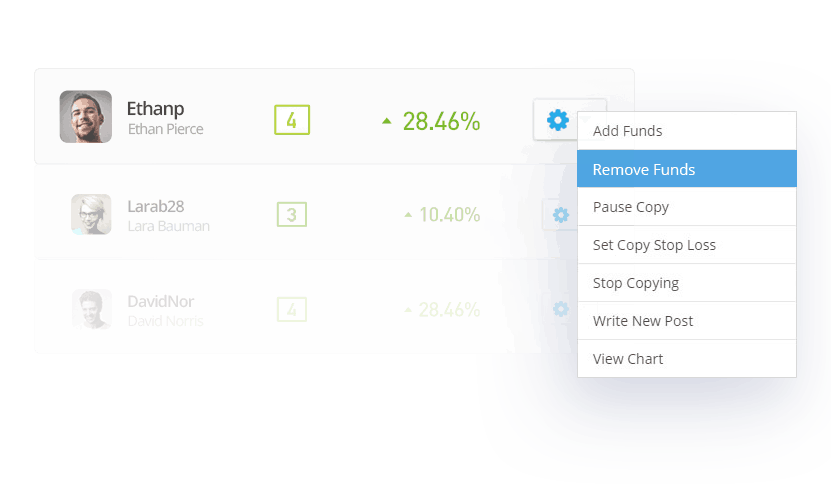

Removing Funds

To remove funds to the existing copy, go to the portfolio page and click on the settings button for the copy. Select Remove Funds from the drop-down menu.

In the popup window that opens, select the amount that you wish to remove. Click Update.

Pause Copy

This feature allows you to stop copying a user without actually closing all the currently opened positions. When Pause Copy is activated, no new positions will be opened under that copy relationship. However, all the currently opened positions will still be copying the actions of the copied user.

Pause Copy can be activated from the portfolio page on TBanque by clicking on the settings button and Pause Copy.

Stop Copy

When you wish to stop copying a trader altogether, choose Stop Copying from the copy settings menu. All copied positions will be closed.

For more frequently asked questions about CopyTrader, click here.

*If you opened a position before August 3, 2022, your position will still be weighted using the original weighting method. This means that the position will be weighted based on the the weight of the copied users trade when it was initially opened, rather than its weight in at the time when the copy occurs. For example, if the copied user split their investment 50/50 at open, the copied users investments at the time of copying will reflect the initial 50/50 split despite changes in the copied users portfolio weighting.