Chiliz stays red hot with 14% gains

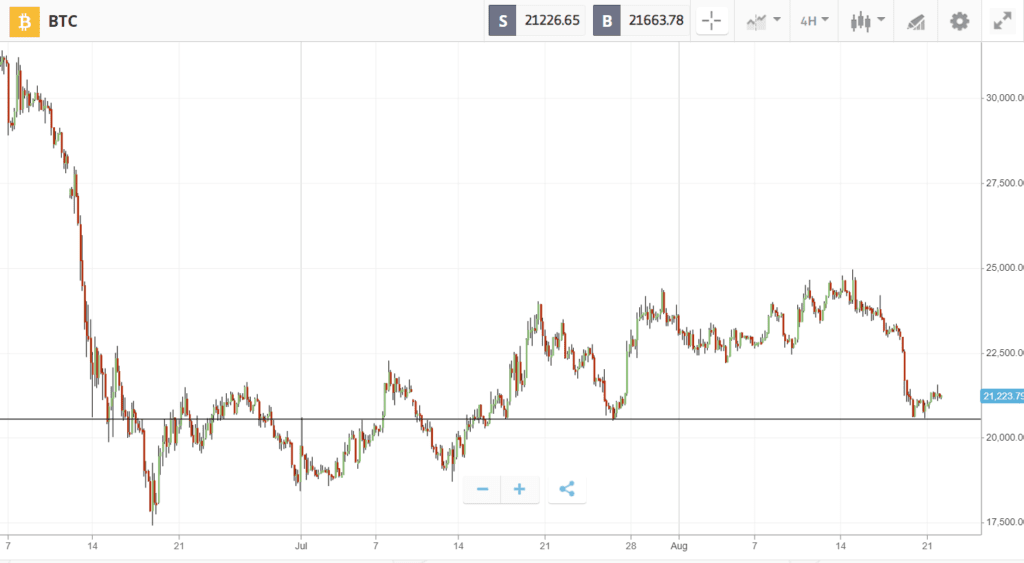

After climbing higher on hopes that inflation might have peaked, Bitcoin has fallen below $22K on fresh macroeconomic uncertainty.

The downturn was driven largely by the release of minutes from the US Federal Reserve’s July meeting, which suggested that interest rate hikes will continue until inflation falls significantly. This was matched by more uncertainty from across the Atlantic, with the UK reporting the first instance of double-digit inflation in decades. Meanwhile, crypto firms are continuing to suffer the after effects of the recent market collapse: another crypto lender has halted withdrawals, and one of the biggest crypto brokerages has slashed jobs 20% as the CEO steps down.

Meme coins Shiba Inu and Dogecoin briefly managed to escape the market malaise, rallying early in the week before getting caught up in the downturn. Elsewhere, most other altcoins saw double-digit percentage losses, except Chiliz which stayed red hot with 14% gains as partner platform Socios won regulatory approval in Italy.

This Week’s Highlights

– Meme coins rally before broader market rolls over

– Another crypto lender bites the dust

Meme coins rally before broader market rolls over

Rallying meme coins have been identified as a warning by some analysts, who speculate that an upswing in this corner of the crypto market is a sign that the broader market is running out of steam.

This exact sequence of events played out last week, with Bitcoin and Ethereum both taking a hit after Dogecoin and Shiba Inu made short-lived double-digit gains.

Nevertheless, Dogecoin’s rally was driven by fundamental developments. Last week the project announced the launch of Dogechain, a new Ethereum-compatible smart contract network built using the Polygon Edge framework.

Another crypto lender bites the dust

Despite the optimism of Bitcoin’s recent rally to $25K, the fallout from the collapse of Terra Luna continues to ripple across the crypto ecosystem.

Last Monday, Hodlnaut became the latest crypto lender to halt withdrawals, following Celsius and BlockFi. The Singaporean firm then disclosed layoffs and pending “police proceedings” in a Friday blog post.

Elsewhere, Wednesday saw the CEO of Genesis step down as the crypto brokerage slashed 20% of its workforce. The firm is thought to be owed more than a billion by bankrupt hedge fund Three Arrows Capital.

Week ahead

Excitement and uncertainty around the Ethereum Merge are likely to continue driving crypto markets in the week ahead, with tensions around Tornado Cash and censorship concerns now increasing the potential for volatility.

On the macroeconomic side, Friday will see Federal Reserve Chair Jerome Powell speak from the Jackson Hole Economic Symposium, and his words could give investors more clarity on the future path of the economy.

Earlier that same day, the US Bureau of Labor Statistics is set to publish more data that will give investors another indication of whether inflation has peaked.