Cardano est une blockchain open source et une plateforme de contrats intelligents à la croissance ultra rapide depuis son lancement, en 2015.

Développé selon une approche scientifique et ingénierique, Cardano utilise un ensemble de principes mathématiques dans son mécanisme de consensus, ainsi qu’une architecture multicouche unique. Sa structure particulière rend cette crypto-monnaie plus agile que son concurrent direct, l’Ethereum, tout en suivant un développement plus rapide, et une évolution plus efficace.

Analysons de façon détaillée comment fonctionne cette plateforme, ce qu’est la crypto-monnaie Cardano, ses différents usages, mais également comment l’acheter, et la stocker dans un portefeuille Cardano.

Table des matières

Qu’est-ce que Cardano ?

Architecture blockchain Cardano

Usages du Cardano (ADA)

Qui a créé Cardano ?

Les principaux acteurs d’ADA

Cardano est-il vraiment mieux qu’Ethereum ?

Roadmap

Prix et offre Cardano

Comment acheter Cardano ?

Conclusion sur le Cardano

Qu’est-ce que Cardano ?

Cardano se présente comme une pièce numérique qui peut être utilisée pour stocker des valeurs, envoyer, et recevoir des fonds, sous la forme de jetons ADA (appelés tokens), d’un portefeuille Cardano à l’autre.

La blockchain Cardano, dite de troisième génération, est décentralisée, ce qui signifie qu’aucune entité (gouvernementale, par exemple) n’a le contrôle sur la sécurité et le processus des transactions. Étant donné sa structure unique en son genre, Cardano développe et déploie ses propres contrats intelligents au sein de son écosystème, libérant régulièrement des fonds lorsque les conditions des contrats sont remplies.

Se positionnant comme rival de l’Ethereum (parfois appelé « Tueur d’Ethereum »), Cardano a été conçu afin de répondre aux nombreuses problématiques de la blockchain de ce dernier. Cardano vise ainsi le maintien d’une blockchain en Proof of Stake, tout en fonctionnant plus vite quant à l’application des forks, et cela, sans avoir recours à un consensus global. Cela permet alors de réaliser des transactions sans frontières.

Architecture blockchain Cardano

The Cardano blockchain consists of two core components. The Cardano Settlement Layer (CSL) acts as a unit of account and is the place where token holders can send and receive ADA instantaneously with minimal transaction fees. The Cardano Computational Layer (CCL) is a set of protocols, which is the backbone of the blockchain, and helps to run smart contracts, ensure security and compliance, and allow for other advanced functionality, such as blacklisting and identity recognition. The Cardano open source code is written using Haskell, a universally recognised and secure programming language.

Cardano works on a specially designed proof-of-stake (PoS) blockchain protocol for consensus called Ouroboros. This consensus mechanism allows for ADA to be sent and received easily and securely at all times, while also ensuring the safety of smart contracts on the Cardano blockchain. At the same time, as a PoS consensus mechanism, Ouroboros provides rewards to token holders who stake their ADA to the network and help ensure network consensus.

The Ouroboros process goes like this:

- The network randomly selects a few nodes to have the opportunity for mining new blocks. These nodes are known as slot leaders.

- The blockchain is split into slots, each of which is called an epoch.

- Slot leaders have the ability to mine their specific epoch, or subpartition of an epoch. Any participant who helps mine an epoch or part of an epoch receives a reward for their services.

- An epoch can be partitioned infinitely. This means that the Cardano blockchain is, in theory, infinitely scalable, making it possible to run as many transactions as needed without hitting a bottleneck.

The greatest benefit of Ouroboros is its mathematical security in choosing blockchain validators. Other blockchains claim that they choose block validators at random, but these claims cannot be verified. On the other hand, Ouroboros offers a provable way to randomly select a validator and ensure that all token holders who stake ADA to the Cardano blockchain have a fair chance of mining a block and receiving the associated reward. This eliminates any need for excessive computational power prevalent in proof-of-work (PoW) blockchain networks and guarantees an objectively fair staking model that is not found in any other PoS blockchain protocol.

Daedalus wallet

Unlike other major cryptocurrencies such as Bitcoin and Ethereum, Cardano has its own wallet for the ADA cryptocurrency. With the Daedalus wallet, users don’t just get a wallet, they run a full blockchain node, giving them total control over their funds and the ability to ensure transparency over the Cardano blockchain.

In addition, Daedalus serves as the only wallet where ADA holders can take part in the Cardano staking system. Because Cardano operates a PoS blockchain protocol as previously mentioned, token holders can receive rewards for either delegating ADA, or running a staking pool within the Daedalus wallet. This gives Cardano (ADA) holders the opportunity to earn cryptocurrency while supporting the network.

Uses for ADA Cardano

The Cardano coin can be used as a transfer of value in a similar way that cash is currently used. This is not very different from other cryptocurrencies such as Ethereum and Bitcoin, but ADA has other uses as well.

One of the core principles of Cardano is its PoS blockchain protocol where ADA is staked to the blockchain to help “stake pool operators” successfully verify transactions on the blockchain. This is where Cardano crypto comes in handy. Those who stake their ADA to the blockchain are rewarded for their efforts with more Cardano crypto in return. This staking system helps maintain security throughout the blockchain.

There is also the use of ADA in voting. In Cardano, unlike other blockchain projects, it is not miners who vote and decide on changes to the protocol, it is token holders. Therefore, when a new change or development is proposed to the Cardano blockchain, Cardano crypto holders use their ADA to vote on these proposals. This way, everyone who owns the cryptocurrency has a say in its development.

In the future, ADA will also be used to power the smart contract platform on the Cardano blockchain. Developers will utilise ADA to create smart contracts and applications that run on the secure, decentralised Cardano blockchain. Without a native Cardano coin, there would be no way to execute these contracts.

Who created Cardano?

In the early days of Ethereum, one of its co-founders, Charles Hoskinson saw the need for a more standardised, and scalable blockchain. With his mathematics background, Hoskinson began thinking about more scientific ways to build a blockchain. During this time, Hoskinson connected with Jeremy Wood, a former co-worker at Ethereum, who was looking to create a better blockchain and smart contracts platform. The two began to pursue Cardano as it exists today.

The major stakeholders of ADA

Even though Hoskinson and Wood are the masterminds behind the core principles and smart contract platform that make up Cardano, they do not own or operate the Cardano blockchain. In fact, there are a variety of different stakeholders involved in the project.

- Cardano Foundation — Acts as a nonprofit, custodial entity for the entire project to help market and ensure the security of the blockchain.

- IOHK — Founded in 2015 by Charles Hoskinson and Jeremy Wood, this research and development company has helped with the design and engineering of the Cardano blockchain.

- Embargo — Acts as a large funding entity to financially support Cardano and assist with its development.

Is Cardano really better than Ethereum?

Both Cardano and Ethereum have similar goals and aspirations in that each wants to be the world’s primary decentralised blockchain platform for building new tools and protocols. When Hoskinson left Ethereum, he recognised the need for a different kind of blockchain that would be immediately scalable and secure, two things that he feared Ethereum would never be. Currently, Ethereum is having its own issues with scalability, and is already going through its second iteration of the Ethereum blockchain in order to ramp up scaling. And while Ethereum is about ten times the size of Cardano in market capitalisation, the project has had a significant head start.

Here are a few differences between the two projects:

| Cardano | Ethereum | |

| Start Date | September 2017 | January 2014 |

|---|---|---|

| Figurehead/Leader | Charles Hoskinson | Vitalik Buterin |

| Consensus Mechanism | PoS | PoW (moving to PoS) |

| Programming Language | Haskell | Solidity |

| Architecture | 2 layers (Cardano Settlement Layer and Cardano Computational Layer) | 1 layer |

Roadmap

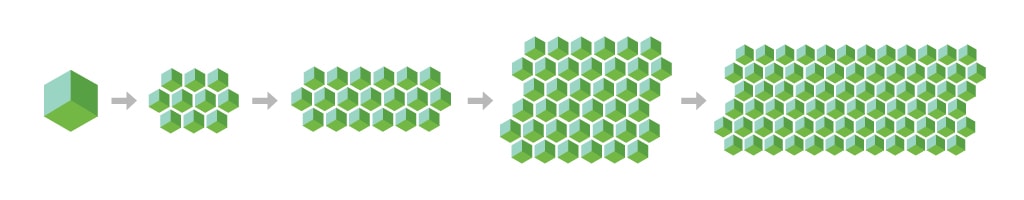

Unlike other blockchain technology, Cardano is still relatively new. It was only launched in 2017 and has spent the first several years of its existence under development.

Cardano has laid out five distinct phases for its blockchain. Currently, Cardano is past its Shelley stage of the process, and is working toward finishing the second half of its five phases:

- Byron — Creates the foundational architecture of the network and tests the initial functionality so the network runs properly.

- Shelley — Launches the Cardano mainnet and begins decentralisation of the blockchain network.

- Goguen — Implements a smart contract platform, allowing for the function of building decentralised applications.

- Basho — Scaling solutions are to be implemented, allowing for blockchain optimisation and improved performance.

- Voltaire — Introduces treasury and voting systems to create a self-sustaining network.

Even though these are five distinct phases, many parts of each phase run in parallel with one another. Each phase goes through a variety of processes before being integrated into Cardano. There is heavy academic research that has gone into each step of the process. Prototyping is also an important part of the process, as each piece of open source code must be rigorously tested to meet predetermined technical specifications before being implemented.

While these roadmap phases have often been delayed, Charles Hoskinson and the developers of Cardano are quite confident in their ability to follow through with the roadmap as promised, and deliver the next generation of PoS blockchain protocols to the world.

Cardano price and supply

ADA Cardano has traded inline with much of the cryptocurrency industry over the past several years. During the bull market of late 2017 and early 2018, the price of ADA shot up from $0.03 to $1.20, valuing the project at close to $32 billion. While early investors were afforded an immediate 3,900% return, this would be short-lived. As you can see in the Cardano chart, the price of Cardano began to steadily decline over the next several years.

While the price of Cardano has declined back to below $1, it is believed that if the project can perform in the ways it has promised, the value of ADA should have no problem rising.

In addition to its price, it is important to note that ADA has a fixed monetary policy, meaning that there will only ever be 45 billion ADA created. Once that number is reached, no more Cardano crypto will ever be created. Cardano sold 25,927,070,538 ADA during its initial sale, with the remaining approximately 19 billion ADA set to be released through the blockchain as rewards for mining blocks. The remaining ADA is set to be distributed in staking rewards through generated blocks on the Cardano blockchain.

Since there is only a set number of ADA that will be in existence, in theory, there will be an increasing demand for the coin. This deflationary monetary model is expected to create demand for ADA in the future.

How to buy Cardano

You can quickly and easily buy Cardano on TBanque with fiat currency in just a few easy steps.

Simply:

- Sign up for an TBanque account

- Verify your account to ensure security

- Deposit funds into TBanque via wire transfer or bank deposit

- Use the deposited funds to buy and sell ADA on TBanque

But hold on just a minute. How do you know if you are getting a good Cardano price on your trade? On TBanque, you can easily see the Cardano price, chart, and conversations about Cardano all in one easy platform — so you can buy ADA knowing you have excellent tools and information at your disposal. Navigate to the Cardano chart to see its price history and get an idea of a good Cardano price prediction for the future.

TBanque provides transparent trading fees for everyone. You will never be charged hidden fees when trading on TBanque.

Now that you know all there is to know about Cardano, you can buy ADA on your own with TBanque.

Get started on TBanque to learn more about bitcoin.

Cette information est destinée à des fins éducatives uniquement. Elle ne peut en aucun cas être qualifiée en tant que conseil d’investissement, offre ou invitation à acheter ou vendre des instruments financiers.

Ce contenu a été rédigé sans tenir compte des objectifs d’investissement particuliers ou de la situation financière personnelle de chacun. De plus, il ne peut être considéré comme conforme aux obligations légales et réglementaires visant à promouvoir la recherche privée ou indépendante. En outre, toute référence à des rendements ou performances passées d’un instrument financier, indice ou produit d’investissement quelconque ne constitue pas et ne peut sous aucun prétexte être assimilée à une indication concernant les résultats futurs.

TBanque ne garantit aucunement l’exhaustivité ou l’exactitude du contenu de ce guide et ne peut être considéré comme responsable en la matière. Il est de votre responsabilité de comprendre les risques liés au trading et à la spéculation avant d’engager votre capital. Ne risquez jamais plus que ce que vous êtes disposé à perdre.