Summary

Big-tech, small cap, crypto as inflation eases

Markets relief rally been validated by peaking US inflation. This has been the biggest investor risk, and is now easing. This gives room to add more risk to defensive portfolios. Big tech, small cap, crypto seem to have most attractive risk/reward vs others that leading rebound, like disruptive tech and meme stocks. Risks remain high but the US inflation peak is a key marker.

Lower US inflation validates the market rally

Markets rallied on peaked US inflation and lower recession risks. Crypto and tech led, and S&P 500 now retraced half of losses this year. US dollar moved lower, relieving pressure on both the EUR and EM currencies, and commodities. Corporate news saw DIS take the global streaming lead, and Musk sell down his TSLA stake. See presentation, video updates, and twitter @laidler_ben.

Enjoy the inflation peak

After string of bad monthly US inflation surprises the fifth was charm. This was positive across-the board and likely shows past US inflation peak, even if falls to be gradual and sticky.

Threatening the markets golden goose

US political gridlock eased to pass optimistically named Inflation Reduction Act. Cuts drug prices and helps EVs and renewables (See @Driverless) but adds tax on the $1 trillion of stock buybacks that are a key stock market support.

Burgernomics gives much to chew on

Big Mac Index a useful shorthand for currency valuation. Shows how pricey US dollar (DXY) is, and cheap emerging market FX. Global Big Mac prices +8% in only six months.

Building some market muscle

Cost-conscious consumer down trade to cheaper proteins. Hurts likes of Beyond Meat (BYND) but helps from Lean Hogs to Tyson (TSN).

Crypto sentiment improving

Crypto recovery continued, helped by equity rally and final Ethereum (ETH) merge test. Saw Bitcoin (BTC) dominance fall to 40%. Avalanche (AVAX) led big coins up on its record transaction activity. Coinbase (COIN) lower Q2 profits but stable user base. TradFi crypto integration continues with Abrdn (ABDN.L) digital exchange buy.

Lower recession fear helps commodities

A weaker US dollar and easing recession fears boosted commodity prices. Dr. Copper was among leaders. Whilst brent oil rebounded to near $100/bbl. as surging natgas and electricity prices drives substitution to oil. EU natgas prices are now back at all-time-high levels.

The week ahead: Quietest week of the year?

1) US Fed minutes focus as look to Jackson Hole and Sept. 21 rate meeting. 2) Ending Q2 earnings season with big US retailers WMT, HD, TGT, LOW, plus overseas BHP, NTES, NU. 3) German ZEW economy sentiment as EU largest economy faces energy crisis and now Rhine drought.

Our key views: Inflation drives everything

Peaked US inflation drives sight of end to Fed rate hikes and less recession risk. Supports from both resilient consumers and corporates, But recovery likely U not V shaped. Gradually lower inflation will be a bumpy ride but slowly de-risks market, allowing higher-risk assets, big tech to crypto, alongside core defensives.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 2.92% | 7.90% | -7.09% |

| SPX500 | 3.26% | 10.79% | -10.20% |

| NASDAQ | 3.08% | 13.93% | -16.60% |

| UK100 | 0.82% | 4.78% | 1.58% |

| GER30 | 1.63% | 7.24% | -13.15% |

| JPN225 | 2.20% | 7.14% | -0.85% |

| HKG50 | -0.13% | -0.60% | -13.77% |

*Data accurate as of 15/08/2022

Market Views

Lower US inflation validates market rally

- Markets rallied on signs of peaked US inflation, and therefore an easing recession risks. Crypto assets and tech equities led, and S&P 500 now retraced half of its losses this year. US dollar saw a big move lower, relieving pressure on the EUR and EM currencies, and commodities. Corporate news saw DIS take the global streaming lead, and Musk sell down TSLA stake.

Enjoy the inflation peak

- After a string of negative monthly US inflation surprises the fifth was the charm. This positively surprised across-the-board and validates the rally from June lows. Markets remain supported by now-peaked inflation, resilient corporates and consumers, and still depressed sentiment.

- There will be bumps in the lower inflation road. Heavily-weighted sticky inflation is still rising as labour and housing prices remain strong. But investors have now likely seen the top of the key price inflation mountain.

Threatening the markets golden goose

- US political gridlock eased enough ahead of the midterm elections to pass the optimistically renamed Inflation Reduction Act. It raises personal and company taxes to fund $430 billion of clean energy and healthcare subsidies, and to trim the budget deficit. See @RenewableEnergy.

- Growth and inflation impacts are minimal near term, with $23 trillion economy and 9% inflation.

- But the late-day inclusion of a 1% share buybacks tax threatens a key pillar of the US equity market. These totalled a record $1 trillion the past year, making companies the single largest buyer of the market. Apple (AAPL) is by far the largest, buying over $90 billion its shares last 12-mths.

Burgernomics gives much to chew on

- The Economist Big Mac Index is a useful shorthand for currency valuation, with a good track record. Latest numbers (see chart) show only four big currencies pricier than the US dollar (DXY) after its recent surge. This could be a USD reality check with global risk-aversion now fading and as we near a potential Christmas Fed interest rate peak.

- Data also highlights the large 8% global average Big Mac price increase in only the past six months. Also the relative attraction of emerging market currencies like RON and ZAR, with cheap Big Mac valuations and high real interest rates.

Building some market muscle

- We all need two portions, or 50g, of protein a day to stay healthy and keep muscle. The longer term demographic trend is for growing populations to consume much more meat as they get richer.

- The consumers cost-of-living crisis is driving downtrading to less-pricey proteins or cuts today. This hurts substitute makers like Beyond Meat (BYND). But helps traditional proteins, like cattle and hogs, and related stocks, from Tyson (TSN) to Hormel (HRL), into ports to shelter from the rising recessionary storm. See @FoodTech.

FX Big Mac valuations versus the US dollar (LHS) and level of real interest rate (RHS)

Crypto leading all assets higher

- Crypto assets up on catalysts of a tentative peak in US inflation, and successful last Ethereum (ETH) test before its September merge. Ethereum (ETH) led recent rally from June lows and seen Bitcoin (BTC) market cap. dominance fall to 40%.

- Ethereum rival Avalanche (AVAX) strongest gainer as daily transaction count hit a new all-time high, helped by its growing popularity for NFT projects.

- Crypto exchange Coinbase (COIN) reported sharply lower Q2 revenues and a widening loss but with a broadly stable user base, and assets evenly split between retail and institutional. TradFi crypto integration continues with asset manager Abrdns (ABDN.L) digital exchange buy.

Lower recession fear helps commodities

- The fall in US inflation weakened US dollar and eased recession fear, helping hard-pressed commodities, with Dr. Copper among leaders.

- Oil was further helped by IEA forecasts of stronger demand this year. High natgas and electricity prices are driving substitution to oil, and recovering air travel also supports demand. EU natgas prices rose back to near all-time-highs.

- Falls in crude oil prices have helped take average US gasoline prices below $4/gallon, down from June levels over $5. This is welcome for the hard pressed US consumer, but still leaves prices more than double the July 2020 low of $1.89/g.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.77% | 15.22% | -18.01% |

| Healthcare | 1.62% | 5.26% | 7.13% |

| C Cyclicals | 3.73% | 18.52% | -17.51% |

| Small Caps | 4.93% | 16.84% | -10.19% |

| Value | 3.57% | 9.31% | -5.97% |

| Bitcoin | 5.84% | 22.36% | -48.98% |

| Ethereum | 14.77% | 77.23% | -48.57% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: the quietest week of the year?

- US Fed meeting minutes from July 0.75% hike. As digest recent inflation fall ahead of August 25-7 Jackson Hole symposium and the still far-off next September 21 FOMC meeting.

- Ending second quarter earnings season sees big US retailers WMT, HD, LOW, TGT for consumer insights, plus network hardware CSCO and ag giant DE. Overseas names BHP, LI, NU, and NTES also in reporting spotlight.

- Latest weak German ZEW economic sentiment survey to be scrutinised as Europes largest economy is on the verge of recession. With natgas price skyrocketed, drought threatening Danube supply chain, ECB to hike 0.5% again.

- S&P 500 technicals as the market crossed key 50% sell-off retracement level at 4,321, with next big level 200 moving average at 4,328.9.

Our key views: Inflation drives everything

- Peaked US inflation drives sight of end to Fed rate hikes and eases recession risks. Market supports from both resilient consumers and corporates, But recovery U not V shaped. Gradually lower inflation will be a bumpy ride but it slowly de-risks markets and allows more higher-risk assets, from big tech to crypto.

- Focus on core cheap and defensive assets to be invested in this new world, to manage still high risks. Sectors, like healthcare, defensive styles like div. yield, and related UK to China markets.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 4.54% | 8.58% | 29.46% |

| Brent Oil | 3.54% | -3.09% | 25.75% |

| Gold Spot | 1.48% | 6.59% | -0.63% |

| DXY USD | -0.89% | -2.21% | 10.11% |

| EUR/USD | 0.76% | 1.71% | -9.78% |

| US 10Yr Yld | 0.43% | -8.04% | 132.49% |

| VIX Vol. | -7.66% | -19.40% | 13.41% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Anatomy of the market rally

Relief rally validated by US inflation fall. Move up led by tech, crypto, and US. Room to add risk.

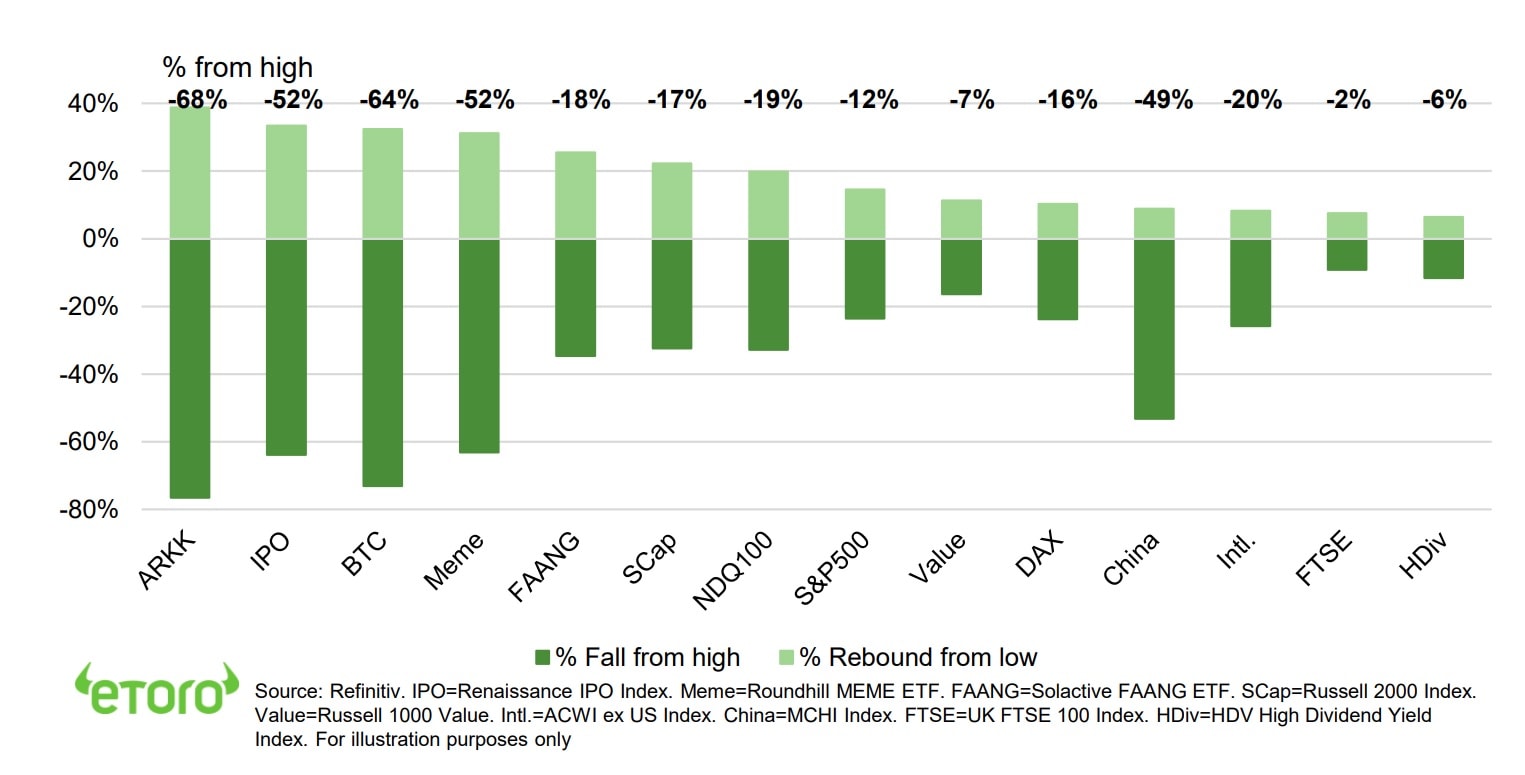

The NASDAQ is up over 20% from its June low, putting is technically in a new bull market. The S&P 500 has retraced 50% of its bear market slump. The most depressed assets have rebounded the most from their lows (see chart). This is unsurprising. They are the most sensitive to the less-bad-news we have had on both inflation and the recession outlook. Lower bond yields also disproportionately boost the value of the most expensive assets, or those with value far off in the future. But these assets, from disruptive tech to recent IPOs and meme stocks, are still down dramatically from 2021 highs. We are fully invested, believing we have seen the market bottom. We maintain a tilt towards defensive assets, such as healthcare and high dividend yield, believing markets will be volatile. But the peak in US inflation, outlook for less interest rate hikes, and lowered recession risks, all allows for a gradually more aggressive stance. Big tech equities, small caps, and crypto assets seem to be the most attractive of the higher risk assets.

Lower inflation risks allow for gradually adding more risk. Big tech and crypto our focus

Disruptive tech, proxied by the ARK Innovation ETF (ARKK), the recent IPO index, and Meme stocks, have rebounded the most from the June lows. But most of these remain expensive and starved of new funding. We are more constructive on the risk-reward of Big tech stocks (@BigTech), to add risk into this recovery. With more-attractive valuations and now peaked bond yields, and all-weather recession resilience. They have fortress balance sheets, high profit margins, and sell-off made stronger by weakening their disruptive tech competitors. Similarly, small caps as recession risks start to ease, with a near record valuation gap vs large caps. Also, bitcoin (BTC) and crypto assets (@CryptoPortfolio), given their positive network adoption and institutionalization trends, and catalysts of the Ethereum (ETH) merge, and easing US inflation.

The US-centric rebound makes sense, with inflation drivers differing globally

Recent performance highlights that relief has been US-centred. This makes sense. The driver is peaked US inflation, and the situation differs globally. European inflation is more energy focused and could be stickier. China and Japan have few inflation worries. But all benefit from the easing fears of a global recession.

A long road to sustained inflation fall and eventual cuts in US interest rates, but journey has begun

We believe markets have seen their lows. This is supported by peaked US inflation, resilient consumers and companies, adjusted valuations, and still very poor investor sentiment. But the recovery will likely be two steps forward and one back. There will be plenty of bumps in the road on the US inflation decline, with labour and housing markets still strong. The Fed will likely lean against the rally. Recession risks and energy prices remain uncomfortably high. This keeps us fully invested, focused on defensive assets, but adding to select riskier tech and crypto as the outlook for gradually lower inflation de-risks markets.

Select asset performance: The harder they fall, the stronger they bounce

Key Views

| The TBanque Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | Worlds largest equity market (60% of total) seeing slowing GDP growth but still-resilient earnings growth. Valuations led market rout, and now at average levels, and are supported by peaked bond yields and high company profitability. Faster Fed hiking cycle is boosting recession risks. Focus on traditional cash-flows defensives, like healthcare and high dividend. Big-tech supported by structural growth outlook. See a gradual U-shaped rebound as inflation falls. |

| Europe & UK | Favour defensive and cheap UK equities (Economies are not stock-markets) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm buffers of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and worlds highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | Tech sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. Big-tech the new defensives. Disruptive tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Cyclical sectors, like consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a slowdown not recession scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and safer-haven bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, real inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In sweet spot of robust GDP growth, green industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Clear supply rules a benefit as inflation high. Volatility still high, with the 16th -50% pullback of the last decade. Adoption and development continuing regardless. See Ethereum merge to Proof-of-Work. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: TBanque

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

TBanque Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the week ahead view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipients investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.