If you are considering investing in cryptocurrencies or publicly listed companies on the stock market, the best way to manage your open positions is to activate stop-loss and take-profit orders as part of your exit strategy. A stop loss order helps you to define your risk ratio and the amount you are prepared to lose as part of a single trade. Meanwhile, a take-profit order can be used to circumvent the innately human traits of greed by locking in profits on short or long-term price moves.

Read on as we explain why stop losses and take-profit orders should become a fundamental part of your exit strategy trading cryptocurrencies, stocks, forex, and commodities with TBanque.

Table of contents

What are stop-loss and take-profit orders?

How can stop-loss strategies help minimize risk?

How to set stop-loss targets

How do take-profit strategies work?

Setting your own take-profit

What are stop-loss and take-profit orders?

A stop loss strategy is necessary to cap the maximum loss you will make on a position on a cryptocurrency or stock. At the other end of the spectrum, a take profit order determines a specific value at which you are happy to close an open position on a cryptocurrency or stock for a profit. By combining stop losses and take profit orders its possible to put together a risk ratio formula that works for your investments long-term ideally keeping your potential downside much lower than your potential upside.

How stop loss works in trading

What is a stop loss order? Put simply, risk-averse traders and investors will consider developing a stop loss strategy to protect their investments. A stop-loss order is triggered in the market once the price of an asset drops beneath the stop price specified by the trader. In this scenario, the market order would be executed, selling at the next available price below the stop loss level.

Lets say for example that you bought 10 shares in Company ABC at ?50 apiece an investment totaling ?500. You go on to set a stop loss order at ?40. The share price of Company ABC goes on to tumble in the days after you open your position and it breaches the ?40 stop loss. The stop-loss order is triggered, and your position is closed at ?39.95 for a loss of ?10.05 per share.

What does take profit mean?

A take-profit order is known as a limit order, which guarantees that a position is closed at or greater than a predefined price point. If a position on a cryptocurrency or stock moves in the right direction to the take-profit level, the position is closed for a profit. Generally more popular with short-term traders that monitor daily or even hourly price moves, take-profit orders are the most efficient way of executing a trade and taking the human element out of managing an open position.

By using stop loss and take profit orders in tandem you can control the risk Vs reward ratio of any trade you enter more on that shortly.

How can stop-loss strategies help minimize risk?

It is important to know what is take profit and stop loss trading to enable you to manage your open positions like a professional. The beauty of a stop-loss is that you no longer need to micro-manage your portfolio. You can specify the size of your stop-loss, enter the order into the market and it will sit and wait until it needs to be triggered.

Sure, there are potential drawbacks to a stop-loss order. In particularly volatile markets you may find that your stop loss is triggered following a particularly volatile short-term spike in the markets, only to watch the value recover or move into profitable territory over the medium-to-long term.

This means there are certain trading scenarios where stop-loss orders are best employed, including:

- Stocks or cryptocurrencies experiencing a bullish uptrend with no apparent risk on the horizon.

- Trading opportunities based on fundamental analysis e.g. press releases or news stories using high leverage. These stories will often be published in the news feeds of reputable TBanque traders.

- Uncertain markets whereby companies have solid fundamentals.

- Stocks or cryptocurrencies experiencing bearish downtrends or shares heading for a market correction based on technical analysis.

Stop loss trailing techniques

Its even possible to use a form of stop loss to protect your profits. A modification of the bog-standard stop loss order, trailing stops can be set at a predefined percentage or monetary value below an assets existing market value. If you intend to buy (go long) on a stock you will place a trailing stop loss beneath the market value. If you intend to sell (short) a stock you will place a trailing stop loss above the market value.

In the event your open position moves favorably in the direction you intended, your trailing stop moves with you. It will trail the current market value and close your position in the event the market pares some of the stocks gains or losses.

How to calculate the risk ratio when trading online

Once you have grasped the concept of stop-loss orders and take-profit orders, its very straightforward to determine your risk/reward calculation on any trade you enter in the market.

One of the biggest reasons that newcomers to financial trading lose their own money is that their poor bankroll management gives them little margin for error.

To work out your risk ratio, simply divide your target net profit by the price of your maximum risk i.e. where your stop loss order is placed. Many investors wont consider risk/reward profiles of less than 2:1 e.g. risking ?1 to win ?2. Although it may seem conservative, its the best way of ensuring your bankroll lasts and allows you to ride out the peaks and troughs of the markets.

How to set stop-loss targets

Determining where to place your stop-loss order is once again based on your risk threshold. After all, a stop-loss should be viewed as a worst-case scenario a signal in the market that your judgment on a share price is wrong, whilst limiting your losses.

Once you have defined the minimum risk/reward ratio that you are comfortable with using, it should be simple to position your stop-loss order. For example, if you have a 4:1 risk ratio, you may be prepared to risk 25% of your initial investment to hit your take-profit.

How do take-profit strategies work?

Take-profit orders are particularly popular among traders that place short-term trades in the marketplace to feed off volatility and fluctuations in a stock or cryptocurrencys value. However, with so much market noise, it can be tricky for some traders to know when to take their profits. Before too long, theyve missed the perfect exit point and their gains are lost.

A take-profit order closes your open position for a profit once it reaches a predetermined percentage of profit or monetary value. It removes all human emotions from a trade, with no turmoil or angst necessary over when to sell or hold onto an asset.

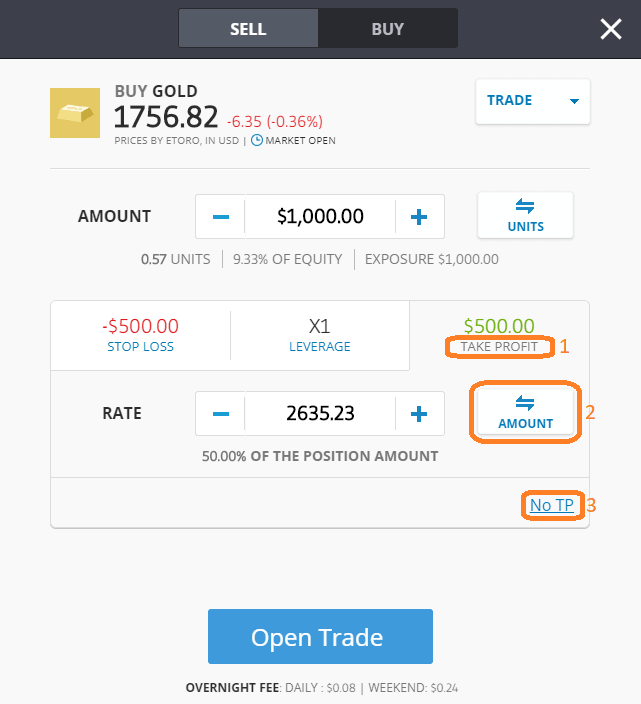

Setting your own take-profit

There are various strategies you can adopt with take-profit orders. Well list a few of the most popular methods used by experienced traders below:

- Placing them at major support or resistance levels

Many traders will use technical analysis to pinpoint support or resistance points and use previous highs and lows to set take-profit orders at similar levels.

- Understanding the peaks and troughs of Fibonacci trends

Fibonacci extensions can give you an idea behind a stocks profit potential based on how far its trends extend. - Placing them based on the moving average

During trending market periods, some traders will also place a take-profit order in and around the price of the moving average, particularly when a stock has dipped well below its medium-term moving average. - Where price action suggests a switch in market sentiment

Its also possible to use signals based on price action alone to determine changing market sentiments e.g. engulfing bars and rejections at highs or lows.

The easiest way to learn about these market orders and execute them with confidence is to follow experienced traders that know what they are doing. TBanque has developed a social trading platform to help make the financial markets more accessible and user-friendly to those new to investing in stocks, forex, or cryptocurrency. Its made it possible for beginners to learn about trading angles and strategies from traders that have demonstrated long-term profitability in the markets.

Weve even gone one step further to provide Smart Portfolios that clients can use to diversify their investments and automate their trading selections.

Once you have mastered the concepts of stop losses and take-profit orders, you can enter a trade using your TBanque account knowing full well what your best and worst-case scenarios will be. To be forewarned is to be forearmed in the markets.

Sign up to TBanque to practice your stop-loss and take-profit strategies

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.