In recent times, more and more people have become interested in investing in the stock market. But what is the stock market, and how does the stock market work and how can you invest in stocks in the UK? These are all very important questions, and in this stock investing guide, we will provide you with all the information you need.

Table of Contents

Definition of stock exchange

What is the role of the stock market?

Main players in the financial world

How does the stock market work?

Risks and mistakes to avoid when investing

Whats your investor profile?

How to select the best broker for you?

How can I stay informed on stock market news?

Tips for beginning with the stock market

Conclusion

Definition of the Stock Exchange

While investing in stocks for beginners can seem a bit daunting, it really doesnt have to be. How to invest in stocks is a question many ask. So, first, we have to start at the very beginning.

The stock exchange, otherwise known as a bourse or even securities exchange, is a marketplace where buyers and sellers can sell stocks, bonds, shares, or other securities. Typically, stocks are issued by companies, and entities are issued on primary markets and then made available for trade on exchanges.

There are currently at least 60 stock exchanges in the world, including 13 in the United States alone. The New York Stock Exchange is the largest in the world and has equity of more than $25 trillion. In terms of other large exchanges, the NASDAQ (US) is second, followed by the Japan Exchange Group, the Shanghai Stock Exchange, Hong Kong Exchange, and Euronext.

For a company to be listed on a stock exchange, it must reach an agreement with the stock exchange in question. This allows its securities to be listed for purchase by buyers as long as their share price reaches a certain value. When offering their shares for the first time, the company does so via an Initial Public Offering.

When it comes to buyers, they can be amateurs who are interested in investing in stocks for beginners, professionals, institutional investors, or private individuals. They can execute trades via telephone or email with a broker, online via a broker, or via a trading platform like TBanque where they conduct trading remotely, as and when they wish.

The reason people want to know how to invest in stocks and how to buy and sell stocks and bonds is to make their money work for them. By investing in the stock market, investors aim to put their money to use by buying a segment of the company. They buy a share or other security at a certain price, in the hope that it will increase in value. This means that they can sell it for a profit at a future point in time. Of course, the value of shares and stock can go up and down a lot, and frequently so investors need to decide if they are playing a long, or short term game.

Each stock exchange has different opening times, but due to the variety of exchanges around the world in different time zones, its possible for buyers to trade around the clock.

To see examples of these different stock markets in action, you can sign up for your TBanque account here.

What is the role of the stock market?

The role of the stock market is comprised of several functions but, largely, the stock market exists as a safe space for investors and companies to buy and sell assets and shares, as well as providing valuation of said assets and shares. When investing in stocks for beginners, its important to understand how each and every section of the market functions.

- For companies- the stock market allows companies to raise money through the offer and sale of shares and bonds. It gives the opportunity to members of the public and professional investors to buy a slice of a particular company. One of the leading benefits and roles of the stock market for companies is that it gives them access to liquidity. Liquidity can be used to pay debts, launch new services and products, invest in infrastructure, and of course, make more profit. Floating on the stock market is a key turning point in the history of the company and marks the start of a new stage of success.

- For economies- the stock market impacts both the national and international economy. On a national scale, a functioning stock market, or several functioning stock markets, can encourage business, foster competition, and ultimately drive forward economic growth. The economy of a country can be partially judged on the performance of its stock markets as it represents the level of confidence in various sectors and companies. Its also worth noting that companies listed on stock exchanges tend to be large employers and contribute significantly to the country in this way also. If a company performs well on the stock market, it can hire more staff, expand operations, and better the economic outlook of the country.

On an international scale, the leading stock markets serve as indicators for a countrys economic health and can also impact the value of its currency. The forex market is the worlds largest, most liquid and its performance can impact the stock market and vice versa. Furthermore, the positive performance of stock markets in a particular country can also encourage investment from international companies as well as further diversification of industries in that nation. - For investors- In terms of investors, the role of the stock market is to provide opportunities for them to own a slice of companies of all sizes, and also to enjoy the benefits of their success. When a company does well, the stocks go up and any stocks held by an investor are worth more. At this point, they can choose whether to cash them in and sell them, thereby profiting instantly, or holding them to see if they continue to increase.

For example, if an investor buys a share in ABC Company for $10 and it rises in value to $15, they have instantly achieved 50% profit. At this point, they can sell it and pocket the difference plus their original investment, or they can keep it and see how it performs in the medium or long term. The ultimate goal is to profit from buying stocks that will continue to go up in value.

Main players in the financial world

In order to ensure the smooth running of the 60 or so stock exchanges, there are six main players. A key part of getting to grips with the stock market for beginners is understanding each of these and how they are linked. These individuals and organisations have specific roles that involve oversight, regulation, supervision, and investment activities. Without these players, the financial industry and the stock market would cease to function.

Issuers

The issuer of stock is a government, corporation, or other legal entity that sells securities such as stocks to buyers. In other words, the issuer is the one that creates and puts forward the stock that will be available for trade on the stock market. Examples of issuers include Apple, Walmart, and Pfizer. These stocks can be offered privately or publicly depending on the companys decision.

Investors

An investor is an individual who buys, holds, and then potentially sells a stock or security on the stock market. They can be professionals or amateurs and can invest via trading apps like TBanque, through a broker, or directly with the company. Some companies issue shares to employees as a form of remuneration.

Intermediaries

Otherwise known as a middleman, an intermediary is either an individual or an institution that facilitates trades and investments in the stock market. They could include the stock exchange themselves, brokers, commercial banks, investment banks, investment funds, financial advisors, or simply the online trading platform that is being used. They assist with the buying, selling, and trading of stocks or securities.

Independent public authorities

Examples of independent public authorities in the US include the Securities and Exchange Commission (SEC), the Financial Conduct Authority (FCA) in the UK, and the Financial Services Agency of Japan (FSA). While they are mandated by the government, they operate independently from them. Their role is to oversee the functioning of all other players in the stock market sector.

Central institutions

There are several central financial institutions that are involved in the stock market ecosystem. They include audit and accounting firms like Deloitte and EY, as well as central banks such as the Bank of England (UK) and the Federal Reserve System (US).

Rating agencies

There are three, main rating agencies; Standard & Poors, Moodys, and Fitch Ratings. They provide important and actionable information to financial markets and help investors make smart decisions. The decisions of these agencies can impact the stock price, especially in terms of credit rating changes.

How does the stock market work?

So now you have an idea of what the stock market is, its role, and the main players that facilitate its functioning, its time to understand exactly how does the stock market work?

As mentioned, the stock market is not just one, but rather many that are located around the world. Traders and investors can buy, sell, and trade stocks of public companies with the hope of profiting from price increases. The value of each stock or share constantly changes and is impacted by features such as supply, demand, economic factors, political events, and matters that occur within the particular company itself.

An investor will look at the value of the currencies applied to certain equities and decide whether it is worth investing in. They may decide to invest in a single company or in indices which includes the stock of several.

How to invest in stocks?

If they are happy with the current value, they will purchase it for a certain price. After purchasing it, they will then keep it for a predetermined amount of time, or until it reaches a better price and they want to sell it. In some cases, the buyer will engage in futures trading. This requires them to predetermine when they will sell the share they are about to purchase, regardless of its value at the time. Additionally, they can engage in obligation trading, trade in UCITS and ETFs, or even branch out into exotic derivatives.

Glossary

Currencies

Currencies refers to fiat currency such as the USD, EUR, GBP, and others. These are the national currencies of a country and are used to determine the value of a stock, share, or other security. The currency used to determine value will depend on where the stock exchange is located. Additionally, traders can trade in currencies in the forex market, hoping to make a profit on changes in value.

Equities

Equities is another word for stocks or shares in a company. For example, you could say you are investing in stocks in a certain company, or you could say you are investing in equities in that company.

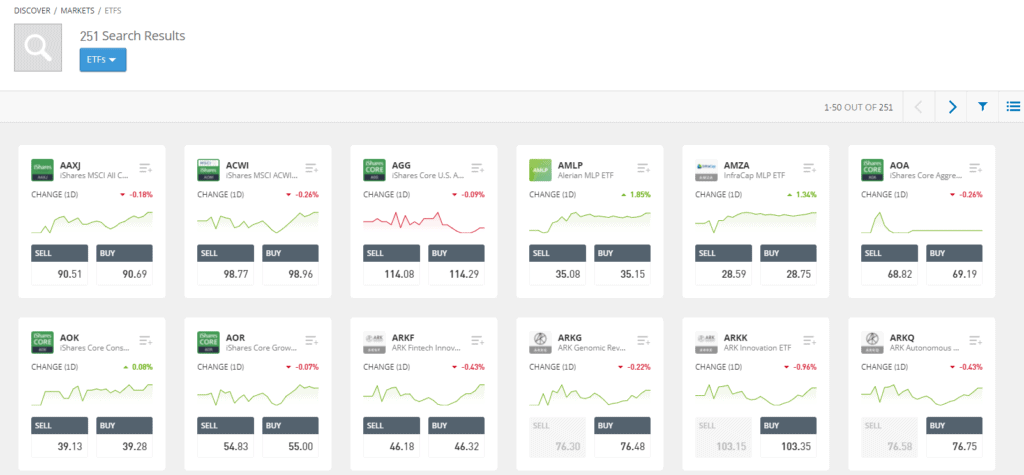

UCITS/ETFs

UCITs and ETFs are the same. The name just differs, depending on where they are domiciled and regulated. UCITs are European and ETFs are in the US. In short, they are funds that can be traded on exchanges. They are highly regulated and a fund must receive approval to be able to be traded on the stock market exchange.

Commodities

In the context of trading, commodities encompass the trading of raw materials of varying value. This covers a variety of goods, including products that can be split into the following categories:

Precious/industrial-use metals: Gold, silver, copper, aluminium, nickel, platinum, and palladium

Energy: Oil and natural gas

Agriculture: Sugar, cotton, cocoa, and wheat

The value of such items fluctuates continuously, much like any standard share or index, allowing traders to speculate on price changes. Many traders choose to add commodities to their portfolio alongside shares and forex trading to create a balance that potentially weathers varying market conditions.

Indices

An index refers to a position that is taken by an investor on a stock index. A stock index is the combined performance of several different companies. It is popular as it allows an investor to be exposed to a whole sector at one time without having to invest in multiple shares.

Futures

Future, or futures refers to a derivative financial contract that obliges parties to engage in a transaction of an asset at a certain date or time in the future. Regardless of how that asset is performing at the time, the buyer and seller are committed to executing the transaction.

Obligations

In the stock market world, an obligation is when an investor sells the shares the day after they have been purchased.

Exotic Derivatives

Otherwise known as an exotic option, exotic derivatives refer to more complicated and unusual contracts and products. A somewhat colloquial term, those defined as exotic are typically complex and even developed specifically for a client or market.

But one of the best ways to understand how the stock market works, is to see it for yourself. You can sign up with TBanque and see for yourself here.

Risks and mistakes to avoid when investing

You might think it sounds quite straight forward but how to invest in stocks and do so successfully is quite complex. There are a number of risks that need to be considered before engaging in stock market activity.

- Volatility- In simple terms, stock market volatility is how much and the range that the value of a stock can change in a set period of time. If the price of a share doesnt change much, it can be considered as having low volatility. If it goes up and down or changes significantly, it is considered to have high volatility.

- Currency risk- this is a risk that arises from the change in value between two or more currencies. For companies that have operations in multiple countries and in different markets, have increased levels of currency risk which can lead to unpredictability.

- Commodity risk- this is a risk related to the uncertain future that a certain commodity may have. Grain, oil, gas, or electricity could have uncertain market values and it may be difficult to predict what the future values will be.

- Interest rate risk-this risk relates to the possible changes in the value of interest rates. Depending on how the interest rate changes, it could impact the value of a share, bond, or similar asset.

- Risk on transactions- otherwise known as transaction risk, this refers to the impact that foreign exchange rate changes can have on a transaction after its been completed. This is more of an issue when there is a long period of time between opening the contract and closing it.

What is your investor profile?

The next stage of understanding how to invest in stocks is knowing what investor profiles are. An investor profile is a definition of the way a trader or investor acts. These profiles can vary significantly based on your goals and what you want to achieve in the long, and short term. While the investor profile can be as individual as the investor themselves, there are three main profiles that are known within the industry.

- The first of these is the conservative investor. This individual is averse to risk and wants to focus on creating a stable portfolio that can be preserved for the long-term. This type of profile is prepared to get low or even negative returns some years, and they hope that it will pick up during other years. They look for low volatility and are in it for the long run.

- The second type of investor profile is the moderate investor. These are individuals that are more willing to take a risk. They seek to strike a balance between stability and appreciation and are prepared for some volatility. Moderate investors are also prepared to lose a bit more capital through their investments than conservative investors.

- The third type of investor profile is an aggressive investor. These individuals are ready to take significant risks by investing in volatile markets. They hope to achieve above-average returns and appreciation but are also prepared to lose more if things go wrong.

We always advise that investors should never invest an amount that could impact their personal life if it was to be lost. Its important to be realistic, make informed decisions, and set achievable goals.

How to choose a broker based on your profile and strategy?

Success on the stock market for beginners will also depend on how you go about it. One of the most important decisions you will make during your how to invest in stocks journey is which broker to go with.

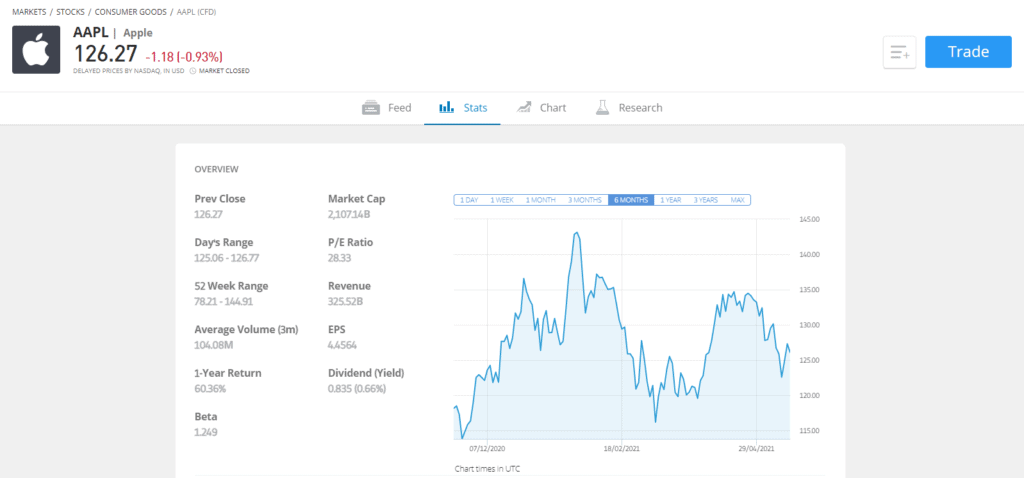

A stockbroker will help you with investing in shares and show you how to start investing in stocks. They will give you access to the markets and can also provide tools, support, and additional functions that can help you in your understanding of how to invest in stocks in the UK.

Firstly it is important to pick a broker that is trustworthy. You should ensure that they are regulated and have a proper, fully functional website. TBanque is a great example of this and you can quite clearly see that they are knowledgeable, regulated, and proper in their operations.

Secondly, you should see what kind of additional services they offer. For example, its beneficial if they offer FAQs, in-depth guides on trading, forecasting tools, and charts. These services are especially useful to those who want to learn to how to invest in stocks or are interested in investing in shares for the first time.

Another example of a useful function for understanding the stock market is the Copy Trading function provided by TBanque. This gives traders a unique opportunity to copy the trades and portfolios of successful and professional investors. When a trader sees a successful investor, they simply utilise the Copy Trading tool and can mimic their success, therefore benefiting from the professionals experience. This is a great feature for investors who are wondering what are the risks when investing in stocks, the more conservative or moderate of investors who are hesitant to take risks.

There are a number of different types of broker out there, each with different benefits and features. You should select a broker that offers great customer service, professionalism, and a range of tools that can support you as a beginner, as well as when your trading prowess increases.

How can I stay informed on stock market news?

Knowing how to understand the stock market and how to invest in stock market comes from staying up to date with stock market news. But not just that, investors also need to keep up with current affairs on a national and international level. Political scandals, elections, war, pandemics, and various other matters can all impact the performance of the stock market.

When you start to learn how to invest in stocks, there are a few publications that make great reading material. Here are some of our top picks!

- Bloomberg

- Morningstar

- Reuters

- Yahoo Finance

- The Financial Times

- The Wall Street Journal

- Investing.com

- Google Finance

You should also consider following finance and stock market-related Twitter accounts. These can include the above media, companies on the stock market, Benzinga, Stocktwits, and Breakoutstocks. Alternatively, if you are investing in stocks from a certain sector, its a good idea to stay up to date with media and publications from that specific industry.

Another great way to begin understanding the stock market is by following the latest news on the TBanque platform. TBanque provides a news feed and information on latest updates that can help you keep track of whats going on in the stock market and several other key industries.

Tips for beginning with the stock market

After reading all about the stock market for beginners, you are almost ready to start investing in shares. There are a few other matters for you to consider, however. You cannot truly understand how to invest in the stock market without getting to grips with the tips and tricks.

Diversify your portfolio

Diversifying your portfolio is a great way of spreading risk across multiple industries. Instead of putting all your eggs in one basket, or share, you can invest in different stocks, commodities, and various other assets. This means that even if one is not performing well, another may be so it balances out your losses.

Have a trading strategy

Having a trading strategy is really important. If you dive in head first with no strategy and just start investing in random stocks, things can quickly go downhill. You need to have an aim and goals, and know when its time to stop.

Follow the news

As we mentioned above, following the news is an essential part of your trading journey. You need to ensure you stay on top of developments in political, societal, economic, and national news, all of which could impact the markets.

Use the take-profit stop-loss approach

The stop-loss approach is a strategy that aims to cap the maximum loss an investor will make on a stock. The take-profit strategy means that the investor pre-determines a value at which they are happy to close a certain position. Through combining these two strategies, investors can create a risk ratio formula that aids in successful stock market trading.

Demo accounts

As mentioned, investing in stocks for beginners can be difficult. But TBanque offers a demo account where investors can practice strategies and trades for free with $100,000 of virtual money. This is a great way to gain confidence, see what works, and figure out what doesnt work, without losing money. Opening any account with TBanque also means you wont be billed on charges such as stamp duty, ticketing, or management fees.

Conclusion

Understanding how does the stock market work can be complex and challenging, but when youre armed with the knowledge provided in this article, it should become more simple. Providing you do your research, partner with a trustworthy exchange like TBanque, and have a clear strategy in place, you can increase your chances of success. Remember, a great way to practice before you go live is by using a demo account from TBanque to execute trades with virtual money, before you take the plunge.

Sign up with TBanque to find out more about the stock market.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.