The first half of 2022 was a challenging period for investors. With inflation hitting multi-decade highs, central banks raising interest rates aggressively, China reintroducing Covid lockdowns, and the Russia-Ukraine crisis creating new supply chain issues, sentiment towards stocks deteriorated. As a result, major stock market indexes such as the S&P 500, the Nasdaq 100, and the STOXX Europe 50 ended the term in negative territory.

There were some areas of the market that generated positive returns in the first half of the year, however. Energy was one such area. Despite a pullback in June, this sector delivered strong returns for investors on the back of high oil and gas prices. Chevron and Shell, for example, rose more than 20% over the period. Defence stocks also did well, boosted by the high levels of geopolitical risk. Northrop Grumman and Lockheed Martin, for instance, delivered double-digit positive returns for investors.

Meanwhile, plenty of dividend stocks generated healthy returns as well. Pharmaceutical giant AstraZeneca, beverages company Coca-Cola, and tobacco group British American Tobacco are some good examples here. All of these companies outperformed the broader market by a wide margin in H1.

Opportunities for investors in Q3

Looking ahead to Q3, we may see further volatility across the worlds stock markets in the near term. Given the elevated level of economic uncertainty, we are likely to see a U-shaped market recovery and not a V-shaped recovery like we saw in early 2020.

However, as was the case in the first half of 2022, there are likely to be plenty of opportunities for stock pickers. The key will be to get the investment style right. In this kind of market environment, it could be value and defensive stocks that generate the best returns.

One market that certainly looks interesting right now is the UK. Despite challenging economic conditions and inflation hitting 9%, the UK stock market has been resilient in 2022. This year, the large cap FTSE 100 has fallen the least of the major global equity indexes. This outperformance can be attributed to its mix of commodity and traditional defensive sectors, alongside inexpensive valuations versus history and a high dividend yield. Going forward, the UK market could offer investors some interesting opportunities.

5 top stocks to consider for Q3 2022

In this guide, we are going to highlight five top stocks for investors to consider for the third quarter of 2022.

The five stocks are:

- Consumer goods company Reckitt

- Gold and silver miner Fresnillo

- Energy services firm Petrofac

- Healthcare giant GlaxoSmithKline

- Financial services company NatWest

All of these companies look well placed to handle the economic uncertainty were facing right now, and have growth drivers that could potentially push their share prices higher in the future.

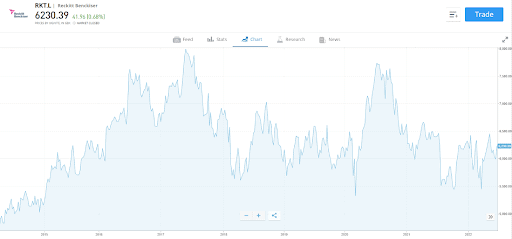

Reckitt (RKT.L)

Past performance is not an indication of future results.

- Reckitt is a leading consumer goods company that operates in the areas of health, hygiene, and nutrition. The company, which sells its products in over 200 countries worldwide, owns many well-known brands including Dettol, Nurofen, Durex, and Strepsils.

- Reckitt is a classic defensive stock. No matter whats happening in the global economy, people always fall ill. This means that demand for its health products (Nurofen painkillers, Strepsils lozenges, Mucinex cough medication, etc.) tends to remain fairly stable. Given that many financial experts are predicting a recession in the near future, RKT could potentially play a valuable role in investor portfolios right now.

- Reckitt could also offer some protection against inflation due to the fact that it has strong brands and pricing power. In the first quarter of 2022, it was able to raise its prices by 5.3%. This helped to offset higher raw material prices.

- For Q1, Reckitt delivered like-for-like (LFL) sales growth of 5.6%. On the back of this performance, management advised that it now expects full-year LFL net revenue growth towards the upper end of its guidance of 1-4%.

- One driver of growth at the moment is high demand for Reckitts baby formula products (Enfamil). Recently, the largest supplier of infant formula in the US, Abbott Laboratories, was forced to recall its products over contamination fears. The product recall has compounded a supply shortage that started during the coronavirus pandemic.

- This appears to have presented a rare opportunity for Reckitt to gain ground against its major rival. Since the crisis began, Reckitt has boosted formula production by 30% in order to capture market share. And this has paid off it now accounts for more than 50% of total baby formula supply in the US, up from around a third before the shortage.

- Next earnings release: H1 results, 27 July 2022

- 5-year share price return: -22% (as of 23 June 2022)

Buy Now With 0% Commission

Your capital is at risk. Other fees apply.

Fresnillo (FRES.L)

Past performance is not an indication of future results.

- Fresnillo is a Mexican company that is the worlds largest silver ore miner, and a major gold producer. Its flagship mine, which is based in Zacatecas, Mexico, has been in operation for almost 500 years.

- Fresnillo looks attractive right now due to its exposure to precious metals, and in particular, gold. Gold tends to do well during periods of economic uncertainty as its considered to be a safe-haven asset. Gold has also often performed well during periods of high inflation in the past. If gold prices rise from here, Fresnillos revenues are likely to get a boost. In the first quarter of 2022, the company produced 8,480 ounces of the yellow metal.

- Another thing to like about Fresnillo is that it is a reliable dividend payer. Last year, the company paid out dividends of 33.9 cents per share. At the current share price and exchange rate, that equates to a trailing dividend yield of about 3.5%.

- In its 2021 results, Fresnillo advised that its long-term growth pipeline remains strong. It added that it continues to invest heavily in its exploration efforts and that its making steady progress with its next development projects at Rodeo and Orisyvo. These mines are likely to contribute to gold production in the years ahead.

- In May, analysts at RBC raised their target price for Fresnillo to 1,225p from 1,175p. That price target is more than 50% above the current share price.

- Next earnings release: H1 results, 2 August 2022

- 5-year share price return: -51% (as of 23 June 2022)

Buy Now With 0% Commission

Your capital is at risk. Other fees apply.

Petrofac (PFC.L)

Past performance is not an indication of future results.

- Petrofac is an international energy services company that designs, builds, manages, and maintains infrastructure for the energy industry. Since it was founded in the early 1980s, it has completed over 200 infrastructure projects across the oil, gas, refining, petrochemicals, and clean energy markets.

- Petrofacs share price took a big hit in early 2021 after an employee of a subsidiary pleaded guilty to charges related to bribery. However, the company now appears to have put this scandal behind it. It paid a ?77 million fine to the UKs Serious Fraud Office (SFO) in October last year, and now has the potential to rebuild its reputation.

- In April, Petrofac was awarded a major decommissioning contract by the Australian Government, potentially worth up to USD $236 million. Meanwhile, in May, the company secured a $200 million decommissioning contract in the Gulf of Mexico as well as a new contract to provide offshore operations services for a BP project in Mauritania and Senegal. These kinds of deals should support revenue and earnings.

- Petrofac is expanding beyond its traditional oil and gas markets to support the worlds drive for renewable energy solutions, and has set up a dedicated New Energy team to grow this side of the business. This team has already secured early-stage positions in a number of exciting projects that are currently in proof of concept or design. Looking ahead, this division is well positioned for long-term growth, as the clean energy market is still in its infancy.

- In a recent trading update, Petrofacs management advised that the outlook for new awards in the groups Engineering & Construction (E&C) division is robust, supported by high energy prices and increased focus on energy security. It added that it expects the second half of 2022 to mark an inflexion point for a sustained period of growth in the E&C backlog.

- Looking further out, management said that in the medium term, it aims to achieve group revenue of USD $4-5 billion (versus $3.1 billion in 2021) including revenue of roughly $1 billion from New Energy, with a sector-leading operating profit margin of 6-8%. It believes that delivery of these medium-term objectives will create significant value for shareholders.

- Next earnings release: H1 results, 26 October 2022

- 5-year share price return: -67% (as of 23 June 2022)

Buy Now With 0% Commission

Your capital is at risk. Other fees apply.

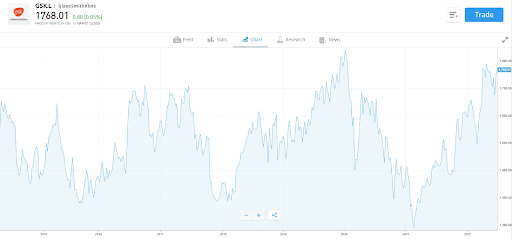

GlaxoSmithKline (GSK.L)

Past performance is not an indication of future results.

- GlaxoSmithKline, or GSK for short, is a global healthcare company that is headquartered in the UK. The company, which employs over 90,000 people across more than 90 countries, operates in three main areas pharmaceuticals, vaccines, and consumer healthcare.

- GSK is another defensive stock, as demand for its healthcare products tends to remain quite stable throughout the economic cycle. This is reflected in its share price performance this year. While the UKs FTSE 100 index has fallen, GSKs share price has risen.

- Glaxos recent Q1 results were encouraging, with strong sales growth in all divisions. For the period, Biopharma sales were up 40% year on year to ?7.1 billion with vaccine sales up 36% year on year to ?1.7 billion. Consumer healthcare sales were up 14% to ?2.6 billion.

- Looking ahead, the company said that it expects to generate sales growth of between 5% and 7% at constant exchange rates this year. It also expects growth in adjusted operating profit of between 12% to 14% at constant exchange rates for the full year.

- On 18 July, GSK will spin off its consumer health division (a joint venture with Pfizer), which owns a number of well-known brands including Sensodyne, Voltaren, and Advil. This company, called Haleon, will be listed on the London Stock Exchange and potentially on the New York Stock Exchange in the near future. The demerger will give GSK a one-off windfall of ?7 billion, which could help the company develop its drugs pipeline.

- This spin-off could help unlock value. Its worth noting that in January, GSK rejected a ?50 billion pound bid from Unilever for Haleon on the grounds that the offer undervalued the business.

- Next earnings release: H1 results, 27 July 2022

- 5-year share price return: 0% (as of 23 June 2022)

Buy Now With 0% Commission

Your capital is at risk. Other fees apply.

NatWest (NWG.L)

Past performance is not an indication of future results.

- NatWest is the smallest of the UKs big four commercial banks. It offers retail banking, private banking, and commercial banking services. Currently, the group serves nearly 20 million people, families, and businesses across the UK and Ireland.

- NatWest looks well placed to benefit from rising interest rates. When interest rates are higher, banks can earn a larger spread between their lending and borrowing rates. This typically leads to higher profits.

- In the UK, the Bank of England (BoE) has raised interest rates five times since December 2021. Many financial experts expect to see further rate hikes in 2022. Analysts at Jefferies believe current earnings estimates for NatWest fail to appreciate the benefit of rising rates.

- NatWest offers a high dividend yield right now. In 2021, the bank paid out 10.5p per share in dividends, which equates to a trailing yield of 4.7% at the current share price. For 2022, analysts expect the group to pay out 12.6p per share in dividends. That translates to a yield of nearly 6%.

- On top of this, the company is buying back its own shares, further boosting shareholder returns. In February, management announced a ?750 million buyback for the first half of 2022 and said that it will consider further repurchases as part of its capital distribution approach.

- NatWest shares look cheap at present. With analysts forecasting earnings per share of 25.6p for 2022, the stocks forward-looking price-to-earnings (P/E) ratio is under nine.

- Next earnings release: H1 results, 29 July 2022

- 5-year share price return: -9% (as of 23 June 2022)

BUY NOW WITH 0% COMMISSION

Your capital is at risk. Other fees apply.

Charts sourced from TBanque platform 28/06/2022.

Zero-commission means that no broker fee will be charged when opening or closing the position and does not apply to derivative, short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, visit etoro.com/trading/fees/.

TBanque Service ARSN 637 489 466 promoted by TBanque AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS. Zero commission does not apply to short or leveraged positions. Zero commission means that no broker fee has been charged when opening or closing the position. Limited stock exchanges only.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipients investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.