Indices trading is highly popular among members of the financial community and for good reason. Not only do indices enable traders and investors to gain exposure to an entire economy through a single trade, but they can also be traded in both directions, meaning its possible to profit from both upward and downward price movements.

Interested in learning more about indices trading? This guide to indices trading is a great place to start. In this guide, well walk you through the basics of stock indices and explain how you can trade them through TBanque.

Contents

What are the best indices to trade?

Alternative ways of trading indices

What is a stock index?

A stock index is an index that measures the performance of a particular group of stocks over time.

The aim of stock indices is to provide an accurate and efficient way for investors to reliably compare current stock market prices with past stock market prices. Indices can be used to measure overall stock market performance, and can also be used to benchmark an investors performance.

Examples of stock indices include:

- The S&P 500 index, which tracks the performance of 500 large-cap companies listed in the US and is generally seen as a broad representation of the US stock market.

- The FTSE 100 index which tracks the performance of 100 large-cap stocks listed in the UK and is the most widely-used UK stock market indicator.

- The Nikkei 225 index, which tracks the performance of 225 top companies listed in Japan and is the most recognised Japanese stock market index.

You cant invest in indices directly. However, you can capitalise on their price movements by trading financial products that reflect their performance such as Contracts For Difference (CFDs).

At TBanque, trading indices is straightforward.

TBanques platform is easy to use and offers traders and investors the opportunity to trade a wide range of major stock indices.

Why trade indices?

Indices trading is popular for a number of reasons.

Some of the main advantages of indices trading include:

- Plenty of trading opportunities: stock indices are constantly moving up and down during market hours which means there are always plenty of opportunities for traders and investors to capitalise on.

- The ability to trade in both directions: when you trade indices with CFDs, you have the ability to trade in both directions. You can go long (buy) an index in order to profit from upward price movements, or you can go short (sell) an index, in order to profit from downward price movements.

- You only need a small amount of capital to start trading: a key advantage of CFDs is that they enable you to use leverage to control a larger amount of money than you have deposited for the trade. For example, with leverage of X2, you can control $2,000 with $1,000. This means that you can start trading indices with a relatively small amount of capital.

- Leverage can boost your gains: leverage is a powerful tool that can potentially magnify your trading profits. However, leverage can also increase your losses, so its important to be aware of the risks. TBanque currently offers leverage of up to X20 on selected stock indices.

- Less hassle than trading individual stocks: with indices trading, you dont need to worry about studying individual companies reports or analysing their financials before you trade. This means that trading indices can be less time-consuming than trading individual stocks.

- Less risky than trading individual stocks: trading indices is also generally less risky than trading individual stocks because youre effectively trading a whole basket of stocks. This means that youre less exposed to individual company risks.

- Indices can be used to reduce portfolio risk: trading indices can be an effective way to hedge portfolio risk. For example, if you own a portfolio of stocks but are concerned that the stock market could fall temporarily in the short term, you could open a short index trade in order to profit if the market falls. If the market does fall, the short index trade will increase in value, offsetting the losses on your stocks.

Types of stock indices

There are a number of different types of stock indices today.

Some of the main types include:

- Country-focused indices: these are designed to represent the stock markets of specific countries. Examples include the S&P 500 which is generally seen as a broad representation of the US stock market, and the DAX 30 which is generally considered a barometer of the German economy.

- Exchange-based indices: these are designed to track stocks listed on a particular stock exchange. An example is the NASDAQ 100 index which tracks non-financial stocks listed on the NASDAQ exchange.

- Regional stock indices: these are designed to represent specific geographic regions. Examples include the FTSE Developed Asia Pacific Index, which tracks the performance of stocks listed in developed countries within Asia, and the EURO STOXX 50 index, which tracks stocks in the Eurozone.

- Sector-based indices: these are designed to track particular sectors of the stock market such as healthcare stocks or financial stocks.

Stock indices can also be categorised as market-cap weighted indices or price-weighted indices. With market-cap weighted indices, companies with larger market capitalisations (the total value of a companys shares) have a larger weight in the index. Examples of market-cap weighted indices include the FTSE 100 and the DAX30. With price-weighted indices, companies with higher share prices have a bigger impact on the index. An example of a price-weighted index is the Dow Jones Industrial Average.

What are the best indices to trade?

There is a wide range of stock indices available to trade today.

Some of the most popular indices among traders include:

- The Dow Jones Industrial Average (DJ30): launched in 1885, the Dow Jones is one of the oldest stock indices in the world. It comprises 30 large publicly-owned companies in the US. Stocks in the index include the likes of Microsoft, Walmart, and Johnson & Johnson.

- The S&P 500 index (SPX500): the S&P 500 is a broad index that tracks the performance of 500 large-cap companies listed in the US. A widely followed index, it is generally seen as a broad representation of the US stock market. Stocks in the index include the likes of Apple, Mastercard, Walt Disney, and PepsiCo.

- The NASDAQ 100 (NSDQ100): this is a technology-focused index that tracks the 100 largest non-financial companies listed on the NASDAQ exchange. Well-known companies in this index include Amazon, Facebook, Alphabet (Google), and Netflix.

- The FTSE 100 index (UK100): the FTSE 100 is a collection of 100 large-cap stocks listed on the London Stock Exchange. Constituents include Royal Dutch Shell, HSBC Holdings, Unilever, and GlaxoSmithKline. While the FTSE 100 is generally seen as the UKs main stock index, its worth noting that the majority of companies within the index are multinationals that generate revenues outside the UK. This means that the index does not really represent the UK economy.

- The DAX 30 (GER30): this index tracks 30 major German companies trading on the Frankfurt Stock Exchange. It is generally considered to be a barometer of the German economy. Constituents include Siemens, Adidas, and Volkswagen.

- The Nikkei 225 (JPN225): the Nikkei 225 is Japans premier stock market index. It contains 225 companies listed on the Tokyo Stock Exchange. Companies within the index include prominent Japanese brands such as Sony, Toyota, and Panasonic.

- The ASX 200 (AUS200): the ASX200 is Australias blue-chip stock index. It tracks 200 companies, which combined, represent about 80% of Australias total stock market capitalisation. Companies in the ASX200 include the likes of National Australia Bank, Qantas Airways, and Rio Tinto.

What drives index prices?

Indices are calculated from the share prices of the stocks within the index. If the share prices of the stocks in the index rise, the index will rise. If the share prices of the stocks in the index fall, the index will fall.

Share prices can be influenced by many different factors. Some of the main drivers of share prices include:

- Economic news: the stock market and the economy are closely linked so any economic news such as news in relation to GDP figures, unemployment rates, or interest rates can impact share prices. Strong economic data, or better-than-expected economic data, tends to push share prices and indices up. Weak economic data, or worse-than-expected economic data, tends to push share prices and indices down.

- Political instability / geopolitical events: investors hate uncertainty so any geopolitical events that increase uncertainty, such as conflicts between countries, terrorist attacks, trade wars, or social unrest tend to have a negative impact on share prices and stock indices. A good example here is the FTSE 100 index immediately after the Brexit vote. Due to the increased uncertainty associated with the Brexit vote result, the FTSE 100 crashed.

- Company announcements: company announcements can have a big impact on share prices. For example, if a company announces that its full-year profits are much higher than the market was expecting, its share price is likely to rise. If a company has a large weighting within an index, its share price movements can have a significant impact on the indexs price. For example, when Apple which has a dominant position in the NASDAQ 100 rises, the NASDAQ 100 often rises too.

- Currency movements: currency swings can impact share prices and therefore also affect index prices. The FTSE 100 is a good example of an index that is highly sensitive to currency movements. Many of its constituents generate revenues internationally, so currency movements can affect the value of those revenues. When the pound weakens, FTSE 100 share prices tend to rise (because those international revenues are worth more in GBP terms), pushing the index up.

- Investor sentiment: human emotions play a dominant role in the stock market. When stock prices are rising, investors tend to get greedy. This can result in more buyers than sellers, pushing share prices and stock indices higher. Conversely, when share prices are falling, investors tend to be fearful. This can result in more sellers than buyers, which pushes share prices and indices down.

Developing a trading strategy

Indices trading strategies are generally based on two main forms of analysis.

The first type is fundamental analysis. In this type of analysis, traders base their trading decisions on economic developments and other factors that might impact indices. Fundamental analysis traders keep a close eye on the economic calendar and closely monitor data releases that may affect index prices.

Economic data that fundamental analysis traders tend to keep a close eye on include:

- Gross Domestic Product (GDP) figures

- Unemployment figures (e.g. nonfarm payroll data)

- Interest rate decisions

- Inflation data

- Consumer confidence reports

- Purchasing Managers Indices (PMIs)

The second type of analysis is called technical analysis. In this type of analysis, traders study index price charts and analyse price trends, patterns, and indicators in an effort to predict future index price movements. The idea behind technical analysis is that historical price information can be used to predict future price movements.

Three popular technical analysis strategies include:

- Trend trading: this strategy aims to generate profits by analysing an indexs trend. A trend occurs when an index moves in one direction for a long period of time. Once you have identified the trend, it may be possible to profit from it by trading in the same direction as the trend.

- Support and resistance trading: this strategy aims to generate profits by identifying an indexs support and resistance levels. Support is the level on the chart where the indexs price finds it difficult to fall below. Resistance is the level where the indexs price finds it difficult to go above. Once these areas have been identified, it may be possible to profit by placing trades at the area where the indexs price is likely to reverse.

- Breakout trading: this strategy aims to generate profits by identifying indices that have broken through established support or resistance levels. Breakouts can be strong signals, especially when confirmed by other technical analysis indicators.

Fundamental analysis and technical analysis both have their advantages and disadvantages. For this reason, many traders use a combination of both when trading indices.

Tip: Learning from TBanques Popular Investors can help you develop a robust indices trading strategy. Many Popular Investors have significant experience trading indices, and their advice can be invaluable.

How to trade indices

There are a number of ways to trade indices.

One of the easiest ways, however, is through Contracts For Difference (CFDs).

CFDs are financial instruments that offer traders and investors the opportunity to profit from the price movements of a security without actually owning the underlying security. When you trade a CFD, you are entering into an agreement with your broker to exchange the difference in the price of the security from the point at which the contract is started to the point when it is closed.

Trading indices through CFDs has a number of advantages:

- CFDs are easy to use. Its much easier to buy a CFD on an index than buy all the stocks that are in it. CFDs are also very accessible. All you need is a trading account with a broker or investment platform that offers CFDs and you can be trading indices within minutes.

- You can trade in both directions. The beauty of CFDs is that you can potentially profit from both upward price movements and downward price movements. If you believe that an index is going to rise, you buy a CFD (go long). If you believe that an index is going to fall, you sell a CFD (go short).

- With CFDs, you can use leverage to trade a larger amount of money than you have deposited for the trade. Leverage can work to your advantage by potentially increasing your trading profits. However, it can also magnify your trading losses, so its important to be aware of the risks.

- Typically, there are no transaction fees associated with CFD trades. The main form of fee that traders pay is the spread between the buy price and the sell price of the trade.*

Placing a trade on TBanque

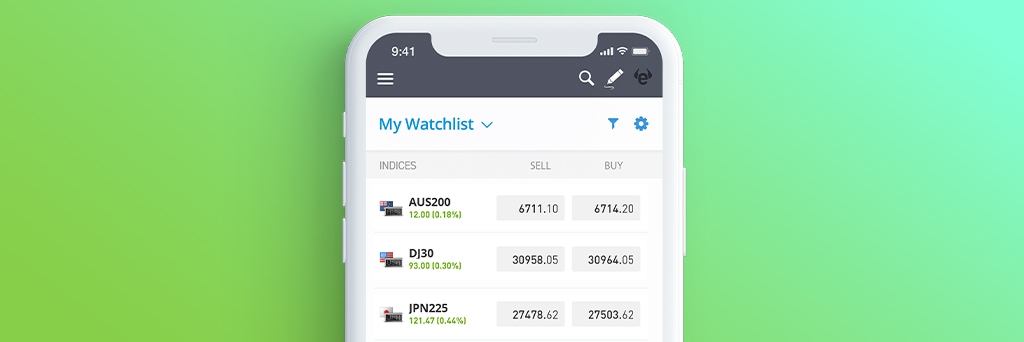

Placing an index trade on TBanque using CFDs is easy.

Heres how to do it:

- Login or create an account by going to https://www.etoro.com/accounts/sign-up

- Head to our Markets page, and then select Indices to access the full list of indices

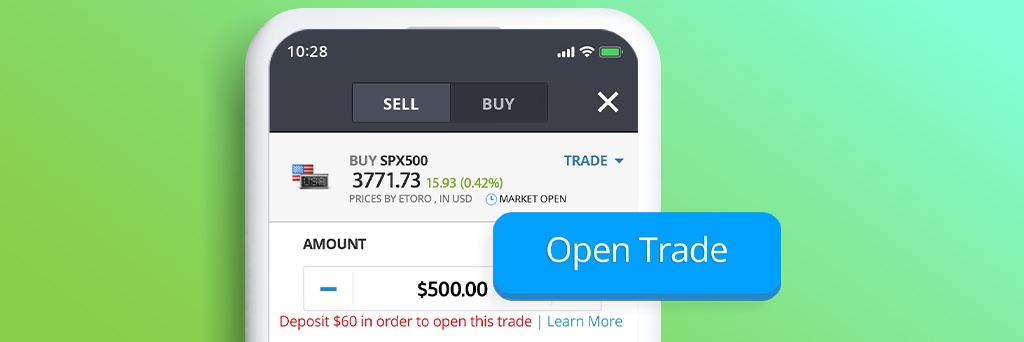

- Select the index that you wish to buy or sell, then select Trade

- Select BUY or SELL depending on the direction you wish to trade

- Enter the amount or number of units you wish to trade

- Set the stop loss, leverage, and take profit parametres

- Select Open Trade

Alternative ways of trading indices

While CFDs offer an easy way to trade indices, its worth pointing out that there are other ways to trade indices on TBanque.

One alternative to trading CFDs is trading exchange-traded funds (ETFs). ETFs are investment funds that are designed to track the performance of a particular index or asset. They are traded on the stock market just like regular stocks.

On TBanque, there are a number of ETFs that track major stock indices.

Examples include:

- The SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index

- The iShares FTSE 100 UCITS ETF (ISF.L), which tracks the FTSE 100 index

- The iShares MSCI ACWI ETF (ACWI), which tracks the MSCI All-Country World Index

On TBanque, you can invest in ETFs commission free.

Youll find more information on ETFs in our Beginners Guide to ETFs.

Risks of trading indices

Any form of investing or trading involves risks and indices trading is no different.

Two of the main risks to be aware of with indices trading are:

- Volatility risk: volatility risk refers to the risks associated with index price movements. Index prices can be volatile at times and while this volatility can create trading opportunities, it can also be a risk factor. Unfavourable price moves can result in significant losses for traders. If you do not have sufficient funds in your account to cover potential losses, your positions may be automatically closed.

- Leverage risk: while leverage is a powerful tool that can magnify trading gains, it can also work against you by magnifying trading losses. If a large amount of leverage is used to trade, even a relatively small price movement in the wrong direction can result in substantial losses. Its important to be aware that losses can exceed the amount invested.

Risk management strategies

You can never eliminate risk completely when trading indices, however, you can reduce it by focusing on risk management.

Four strategies that can help reduce risk include:

- Determining your optimal position size: before you start trading indices, you should determine your optimal position size for each trade. A good rule of thumb is to avoid risking more than 2% of your capital on any single trade. Trading more than 2% per trade could expose you to losses that are hard to recover from.

- Putting stop losses in place: stop losses are a fundamental component of a robust risk management strategy. Stop losses help minimise trading losses by closing out losing positions before large losses build up.

- Using leverage sensibly: leverage can magnify your trading losses so it should always be used sensibly.

- Keeping an eye on the economic calendar: an economic calendar can be an invaluable risk management tool as it will list events that could potentially impact stock indices. By keeping a close eye on economic releases related to the index you are trading, you can anticipate price moves in advance.

Summary

- A stock index is an index that measures the performance of a particular group of stocks over time.

- The aim of stock indices is to provide an accurate and efficient way for investors to reliably compare current stock market prices with past stock market prices. They can be used to measure overall stock market performance and can also be used to benchmark an investors performance.

- Indices trading is popular for a number of reasons. Not only do indices provide plenty of trading opportunities but you can also trade them in both directions using Contracts For Difference (CFDs).

- There are different types of stock indices including country-specific indices, exchange-based indices, regional indices, and sector-based indices.

- Some of the most popular indices to trade include the Dow Jones Industrial Average, the S&P 500, the FTSE 100, the DAX 30, and the Nikkei 225.

- Index prices can be affected by many different factors including economic and political developments, company news, currency movements, and investor sentiment.

- Index traders generally use two types of analysis fundamental analysis and technical analysis.

- There are a number of different ways to trade indices. CFDs are one of the easiest ways. ETFs are another way to trade indices.

- Risks associated with trading indices include volatility risk and leverage risk. Risks can be reduced by focusing on risk management.

- Trading indices on TBanque is straightforward.

- TBanques platform is easy to use and offers traders and investors the opportunity to trade a wide range of major stock indices.

Glossary

- CFD contract for difference. A financial instrument that enables you to profit from the price movements of securities without actually owning the underlying security

- DIVERSIFICATION spreading your money out over many different investments to lower portfolio risk

- ETF exchange-traded fund. A type of investment fund that aims to track the performance of a specific stock market index or asset.

- FUNDAMENTAL ANALYSIS a form of analysis that focuses on information such as economic developments and data

- GOING LONG buying a security

- GOING SHORT selling a security

- INDICES the plural form of index

- INVESTOR SENTIMENT the general mood of investors

- LEVERAGE using capital borrowed from a broker when opening a position to increase the potential return of an investment

- MARKET CAPITALISATION the total value of a companys shares

- MARKET RISK the risk that the underlying index or asset falls in value.

- MUTUAL FUND an investment fund that pools money together from many individual investors to purchase securities

- RISK the amount of capital exposed on any single trade

- RISK MANAGEMENT focusing on risk when trading in order to minimise losses

- SPREAD the difference between the buy and the sell price. This is also the cost of placing the trade

- STOCK INDEX an index that measures the performance of a particular group of stocks over time

- TECHNICAL ANALYSIS a form of analysis that focuses on price charts, trends, and patterns

- VOLATILITY up and down movements in the price of a security

Get started on TBanque to learn more about indicies.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.