Getting to grips with the terms Bull Market and Bear Market can positively impact your investing, as both can be associated with dramatic price moves. The phrases were introduced into the financial markets to help investors understand and react to certain situations. After all, time is money, particularly if asset prices are fluctuating heavily so it is important to know what is meant by these phrases.

Table of Contents

Strategies for Trading a Bull Market

Strategies for Trading a Bear Market

Things to Consider When Trading in Bull and Bear Markets

What Is a Bull Market?

A bull market is when the financial markets go up in value for a prolonged period. Two good indications of a bull market are:

- Prices rise by 20% from the previous low.

- Prices register an all-time high.

There can be bumps and dips along the way, but if the price chart goes from the bottom left to the top right, then it is likely a bull market. The term can apply to any asset, including commodities, currencies, cryptos and bonds, but the term is most commonly used in connection with equity markets.

A bull market is often the default position for stock markets. Price charts tend to show equity markets making measured and gradual gains, interrupted by dramatic, but shorter-lived price crashes. The investing community has latched onto this, with many investors analysing markets to find signs of a bull market forming, often sharing their ideas on how long it might run for.

Between 2009 and 2020, the Nasdaq 100 index experienced a bull market where it increased in value by 747%. It was finally ended by the COVID-19 inspired price crash which lowered the index value by 31.7% in the space of one month.

How To Spot a Bull Market

Bull markets are often reflective of the general market mood. A bull market begins when the previous bear market has reached its lowest point. The end of a bull run is the last peak prior to a bear market being confirmed. The chart below shows that there were troughs and peaks throughout the Nasdaqs bull run, but these did not signal the end of the bull market. Instead, the bull market ended after the price slumped more than 20% in March 2020.

Nasdaq 100 Bull Market 2009 2020 with 20% correction

Breakout

Bull markets can run for years, so it is possible for investors to make returns even if they are not involved from the start. However, being able to spot a bull market breakout is always useful.

Nasdaq 100 2016 2021 Breakout

Using the strictest definition of a bull market, the 202021 Nasdaq bull run was confirmed when it reached and passed the price level of 9738 in June 2020. The price had risen from the low point in March by more than 20%, equalling the price level of the previous peak in February 2020.

Strategies for Trading a Bull Market

Buy and Hold

A buy and hold strategy can be very good for those who want to build up their portfolios over time. There are records of investments that first lost money but, by holding their position, investors later received very good returns.

For example, imagine you bought a position in the Nasdaq 100 on January 1st every year since 2016. Some positions may have reported a loss at times, but would eventually give a good return.

There are various approaches to buy and hold strategies, and many of the Popular Investors on the TBanque site share the methods they use to enhance their returns.

Momentum Strategies

Momentum strategies are best explained by the phrase: join the party late and leave it early. Momentum investors buy stocks that have recently grown rapidly, and then sell instruments that have fallen in price. There are different time frames among investors that are used when applying a momentum strategy. They look at how a stock has performed in:

- The last 16 months, or

- A wider range of 312 months

Momentum investors assume that instruments that have grown in the medium term will tend to continue their gains in the near term. Investors will then sell their instruments when there is a reversal in the trend.

Trend Strategies

Trend strategies are favoured by fans of Technical Analysis. Investors analyse price charts and previous price data to find patterns that confirm trends. Once they see enough signs, they take a position in the market.

Growth Stocks

Growth stocks are those that are expected to have future earnings greater than the market average. Some companies will grow faster than average, giving investors better long-term gains. There is a greater risk with this strategy, but if the stocks are noticed early enough, the returns are significantly increased.

What Is a Bear Market?

A bear market is used to describe a fall in prices. A market may only be considered a true bear market if it experiences more than a 20% fall in price from the recent market high.

If a market falls more than 5% in one day, but has not yet hit the 20% mark, the phrase bearish may be used, as it reflects a panicked market and widespread selling.

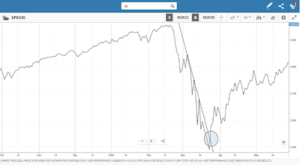

In March 2020, the crash in equity prices saw the S&P 500 equity index lose more than 30% in value. However, the sudden rebound in prices made it the shortest bear market in history. Within a matter of months, the S&P 500 had posted a new record high.

S&P 500 Bear Market 2020

Some bear markets can last for years. The Wall Street crash of 1929 was the key event in a drawn-out bear market that lasted almost three years, slicing 83.4% off the value of the S&P 500.

How To Spot a Bear Market

Bear markets often signify a loss of investor confidence. Catalysts for the shift can include interest rate rises, geopolitical events, or sometimes just a bull market overextending itself.

The measuring tools that come with price charts allow you to calculate the percentage change in price, to locate decreases greater than 20%.

It can be hard to spot the bottom of a bear market, where it reaches its lowest point. Even so, the temptation to trade into long positions purchasing an asset with the expectation that it will increase in value and pick the bottom of the market can be hard to resist.

The situation can be exacerbated if the event is linked to a liquidity crisis. Retail and institutional investors who invest using borrowed money referred to as leveraging to scale up their trading positions, dominate the markets. As prices fall, they become forced sellers and look to off-load some of their assets and convert them into cash collateral. This is done to avoid the need for investors to sell out of all of their positions, but does tend to trigger a downward spiral. Selling triggers lower prices, which triggers further selling, and so on.

Breakout

Bear markets are generally associated with sudden price crashes and equally fast recoveries. As a result, some strategies try to pinpoint when market sentiment and price change direction. Breakouts indicate the potential for the price to start trending in the other direction. For example, if the price intersects a downward trend line, and breaks out to the upside, this might suggest that the bear market is ending.

S&P 500 Bear Market 2020 Trendline breakout

At TBanque, investors are provided with a range of indicators that measure market price moves, including RSI (Relative Strength Indicator) and moving averages. Emotions can run high during a bear market, and sometimes the simplest indicators will provide a buy signal. The bounce in the S&P 500 in March 2020 was marked by a breakout to the upside, through the downward trend line.

Strategies for Trading a Bear Market

Momentum Strategies

Bear markets are often split into different stages. First, there is profit-taking by those who rode the bull market, but now consider prices to have overextended. They sell their positions before prices fall too far to avoid potential losses. Secondly, there is continued downward pressure as selling continues, potentially triggered by economic forecasts and negative news events.

Once downward momentum builds to a sufficient level, more speculative short selling comes into play. Investors may sell an asset, hoping to buy it back at a lower price in the future. Momentum strategies work on the basis that once the market sell-off starts, it will take some time to stop.

Trend Strategies

The indicators and price data that analysts use to spot market trends work as effectively in bear markets as they do in bullish ones. In bear markets, entering into naked short positions occurs when a sufficient number of technical indicators point to further downward price moves.

Scaling Out of Positions To Buy Back in Later

Most investors enter the market as a long position. In a bear market, they may scale back on some of their long positions to buy back in at lower prices this is one way to enhance trading returns. This does not require actively selling short.

Things To Consider When Trading in Bull and Bear Markets

There are a variety of things that need to be considered when trading in bull and bear markets. While bull markets are generally associated with steady gains, bear markets are usually shorter term in nature. In either case, price moves can be considerable, often generating headlines that intensify the situation.

Profiting from short-selling can be riskier than buying a long position. A long position can make a 100% loss, but can only trade to zero, for example, if a firm goes bust and their shares become worthless.

If you short-sell a market that you believe is overvalued, the potential losses are unlimited as the price can theoretically rise an infinite amount. Market situations known as short squeezes, where short-sellers get caught on the wrong side of a trade, can leave them unable to close out their positions, leading to considerable losses.

Risk Management

Platforms like TBanque offer a range of user-friendly risk-management tools. Two of the most commonly used are Stop-Losses and Take Profits. They are used to automatically sell your position if it makes too much of a loss or meets your profit target.

These tools are particularly useful for beginners. TBanque provides a Demo Account for new investors to see how all these tools work before investing.

These tools may not be suitable for some bull market strategies. If you are following a buy and hold strategy, for example, you would not want to lose your position because of a short price crash, as you want to remain there for the long haul. Therefore, stop-losses may not be a tool you want to use. To avoid being kicked out of trades, it is important to double-check that your trade instruction reflects your intention.

Stock Picking

Stock picking is a strategy where the investor chooses which stocks they individually wish to invest in, but this carries a higher risk. Diversifying your portfolio using Exchange-Traded Funds (ETFs) is one way to avoid single stock risk, lowering the potential of backing an underperforming company.

Instruments To Use & Holding Period

At TBanque, investors are offered different types of instruments for investing in equity markets.

Contracts for Difference (CFDs) allow investors to sell short and increase their risk-return. They can be used to buy or sell a variety of asset types, including stocks, ETFs and indices. They do not involve trading the actual asset, but are independent of the market, as it is an agreement between the investor and a CFD broker. This allows newer investors to access more of the market as CFDs can be used with less capital and expertise than necessary in traditional trading. CFDs can incur financing charges as the broker offers additional services, so do look into these before using this tool.

Alternatively, investors can buy the stock outright, for example, using $5k of funds to invest in $5k of stock.

This is called buying the underlying asset, or buying outright, and does not incur the commission fees associated with CFDs. This is thought to be the most cost-effective instrument for medium- and long-term investment strategies. Making sure you buy what you actually want to buy is simply a case of checking the details on your trade instruction.

Copy trading is a popular approach among investors. It allows investors to link their portfolio to other leading investors and replicate their actions. TBanque is a market leader in copy trading, with the CopyTrader feature allowing you to view what real investors are doing and copy their trading automatically. It is fully automated and commission-free.

TBanques CopyTrader feature helps to make TBanque unique, offering:

- No additional fees or commissions for copy trading

- No lock-ins. You can stop copying someone else at any time you want.

- 100% control of your funds. The platform only replicates the trading decisions of the Popular Investor and does not have any access to your account.

- Low minimums. You can spread your investments across a range of up to 100 Popular Investors.

Final Thoughts

The technical definitions of bull and bear markets can help improve general understanding, but the terms, in their broader sense, are often used as a simple way to capture the mood of the market.

- The terms bull and bear market are widely used because they effectively describe market conditions.

- Bull markets occur when there is more than a 20% price rise from a previous low and typically last for years. Bull markets offer opportunities for buy and hold investors.

- Bear markets occur when there is a more than a 20% price fall from a previous high and typically last for months rather than years. Because of the shorter time frame, price moves can be more volatile, requiring more consideration to be given to risk management.

Bull and bear markets both offer the opportunity to put on the trade of a lifetime, but extra risks need to be considered. Being cautious and not risking more money than you can afford to lose may improve returns. Sometimes the trick is to invest amounts small enough to allow you to ignore the price peaks and troughs and ultimately reach your long-term investment goals.

Explore bull and bear markets here on TBanque.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. TBanque makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.